Global Smart Building Market Overview

- The Global Smart Building Market is valued at USD 110 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for energy-efficient solutions, rapid advancements in IoT, AI, and cloud computing, and the rising need for enhanced security and occupant comfort. The integration of smart technologies in building management systems has significantly contributed to operational efficiency, sustainability, and cost savings, with AI-driven analytics enabling predictive maintenance and personalized environments .

- Key players in this market include the United States, Germany, and China, which dominate due to robust technological infrastructure, significant investments in smart city initiatives, and a strong focus on sustainability. These countries have established themselves as leaders in the adoption of smart building technologies, propelled by government policies, public and private investment, and high consumer demand for innovative, energy-efficient solutions .

- The Energy Performance of Buildings Directive (EPBD), revised in 2023 by the European Union and issued by the European Parliament and the Council, mandates that all new buildings in member states must be nearly zero-energy buildings (NZEB) and requires the deployment of smart readiness indicators, energy performance standards, and digital building logbooks. This regulation aims to enhance energy efficiency, reduce greenhouse gas emissions, and accelerate the adoption of smart building technologies across the EU .

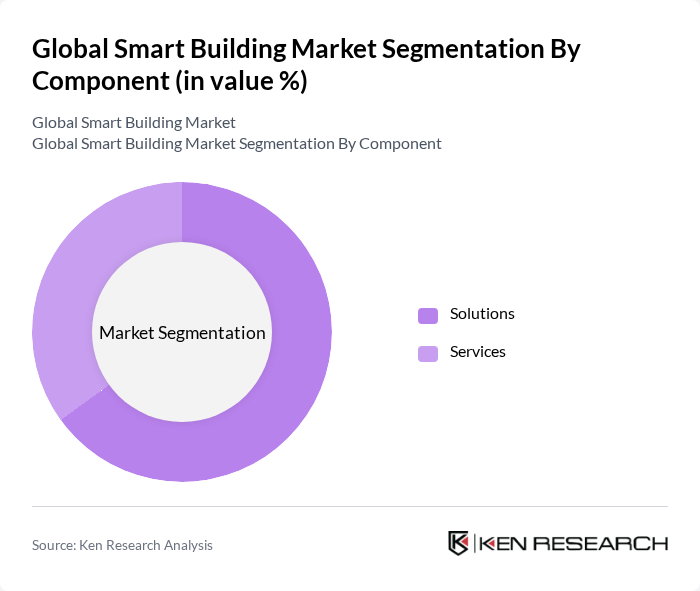

Global Smart Building Market Segmentation

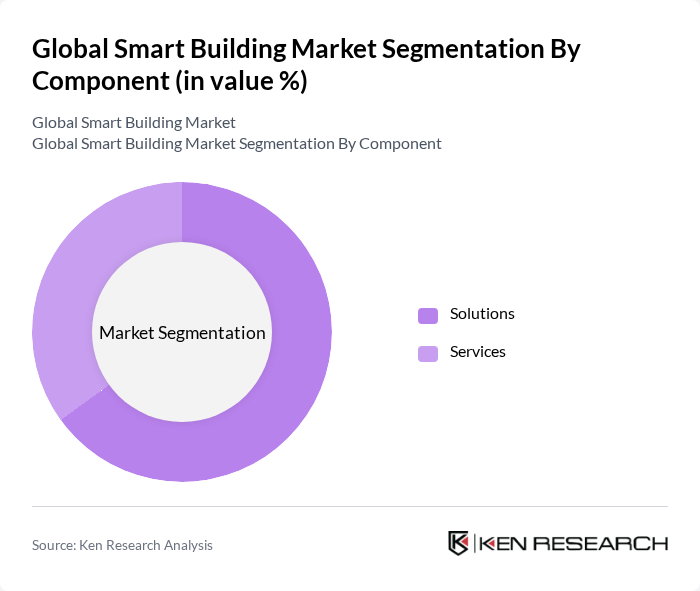

By Component:The market is segmented into Solutions and Services. Solutions comprise technologies and software such as building automation, energy management, and security systems that enhance building management, while Services encompass consulting, integration, support, and maintenance required for these systems. The Solutions segment leads the market, driven by the increasing adoption of advanced automation, AI-powered analytics, and IoT platforms that improve energy efficiency, occupant experience, and operational performance .

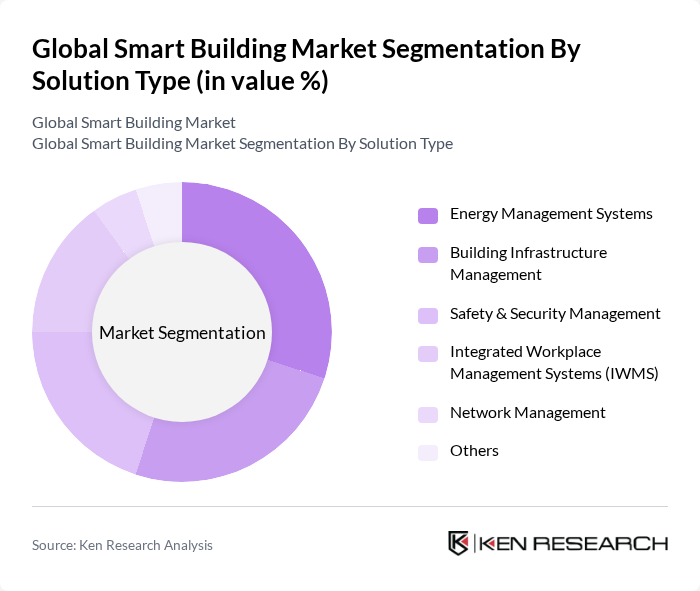

By Solution Type:The market is further divided into Energy Management Systems, Building Infrastructure Management, Safety & Security Management, Integrated Workplace Management Systems (IWMS), Network Management, and Others. Energy Management Systems remain the most dominant sub-segment, driven by the growing emphasis on energy conservation, sustainability, and regulatory compliance in building operations. Building Infrastructure Management and Safety & Security Management are also witnessing strong adoption due to the need for integrated, automated control and enhanced occupant safety .

Global Smart Building Market Competitive Landscape

The Global Smart Building Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Controls International plc, Siemens AG, Honeywell International Inc., Schneider Electric SE, ABB Ltd., Cisco Systems, Inc., IBM Corporation, Legrand S.A., Trane Technologies plc, Signify N.V. (formerly Philips Lighting), BuildingIQ, Inc., Lutron Electronics Co., Inc., Delta Electronics, Inc., Enel X S.r.l., View, Inc., Microsoft Corporation, Hitachi, Ltd., Huawei Technologies Co., Ltd., Advantech Co., Ltd., Robert Bosch GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Global Smart Building Market Industry Analysis

Growth Drivers

- Increased Demand for Energy Efficiency:The global push for energy efficiency is evident, with the International Energy Agency reporting that energy-efficient buildings can reduce energy consumption by up to 30%. In future, energy costs are projected to reach $6 trillion globally, prompting businesses and governments to invest in smart building technologies that optimize energy use. This trend is further supported by the anticipated reduction of carbon emissions by 1.5 gigatons through energy-efficient practices, driving demand for smart solutions.

- Technological Advancements in IoT:The Internet of Things (IoT) is revolutionizing smart buildings, with an estimated over 15 billion connected devices expected in future. In future, the global IoT market is projected to reach $1.1 trillion, facilitating real-time data collection and analysis. This technological evolution enables enhanced building management systems, improving operational efficiency and occupant comfort. As IoT adoption increases, smart building solutions are becoming more accessible and effective, further driving market growth.

- Rising Urbanization and Smart City Initiatives:In future, urban populations are expected to exceed 5 billion, leading to increased demand for smart infrastructure. Governments are investing heavily in smart city initiatives, with global spending projected to reach $1.5 trillion in future. These initiatives focus on integrating smart technologies into urban planning, enhancing sustainability, and improving quality of life. The growing urbanization trend is a significant driver for the smart building market, as cities seek innovative solutions to manage resources efficiently.

Market Challenges

- High Initial Investment Costs:The transition to smart buildings often requires substantial upfront investments, with costs averaging around $150 to $200 per square foot for smart technologies. In future, many businesses may struggle to allocate budgets for these technologies, especially in regions with limited financial resources. This financial barrier can hinder the adoption of smart building solutions, slowing market growth despite the long-term savings they offer through energy efficiency and operational optimization.

- Data Security and Privacy Concerns:As smart buildings become increasingly interconnected, data security and privacy issues are paramount. In future, cyberattacks targeting IoT devices are expected to rise significantly, raising concerns among stakeholders. The potential for data breaches can deter investment in smart technologies, as companies fear the repercussions of compromised sensitive information. Addressing these security challenges is crucial for fostering trust and encouraging broader adoption of smart building solutions.

Global Smart Building Market Future Outlook

The future of the smart building market appears promising, driven by technological advancements and increasing urbanization. As cities evolve, the integration of AI and machine learning into building management systems will enhance operational efficiency and user experience. Additionally, the growing emphasis on sustainability will likely lead to more stringent energy efficiency regulations, pushing stakeholders to adopt smart technologies. Overall, the market is poised for significant growth as innovations continue to reshape the landscape of urban living and building management.

Market Opportunities

- Integration of AI and Machine Learning:The incorporation of AI and machine learning into smart building systems presents a significant opportunity. In future, AI-driven analytics can optimize energy consumption, predict maintenance needs, and enhance occupant comfort, potentially reducing operational costs by 20%. This technological integration will not only improve efficiency but also attract investments from tech-savvy stakeholders looking for innovative solutions.

- Expansion in Emerging Markets:Emerging markets are increasingly recognizing the benefits of smart building technologies. In future, countries in Asia and Africa are expected to invest over $500 billion in smart infrastructure projects. This expansion presents a lucrative opportunity for companies to enter new markets, providing tailored solutions that address local challenges while capitalizing on the growing demand for sustainable and efficient building practices.