Region:Global

Author(s):Shubham

Product Code:KRAA1746

Pages:91

Published On:August 2025

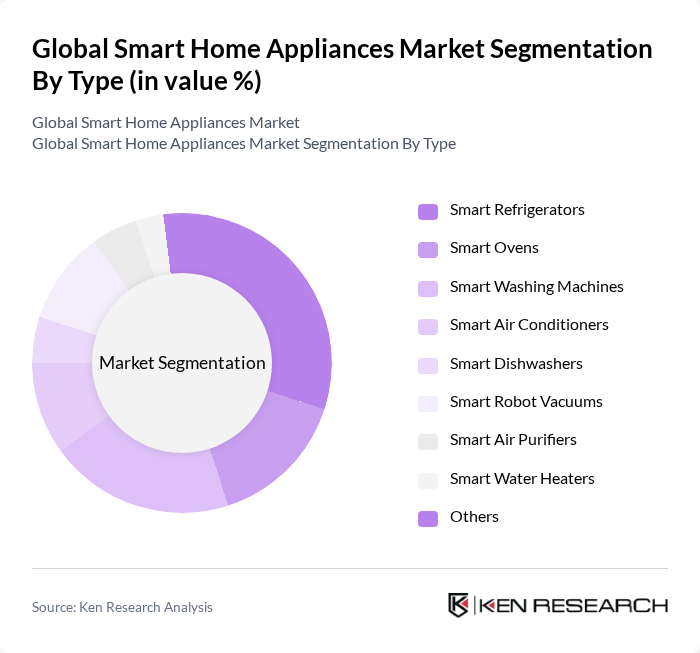

By Type:The market is segmented into various types of smart home appliances, including Smart Refrigerators, Smart Ovens, Smart Washing Machines, Smart Air Conditioners, Smart Dishwashers, Smart Robot Vacuums, Smart Air Purifiers, Smart Water Heaters, and Others. Smart Refrigerators and Smart Washing Machines are widely adopted due to advanced feature sets (remote diagnostics, energy optimization, cycle personalization), integration with home ecosystems, and measurable energy savings outcomes that align with consumer sustainability preferences.

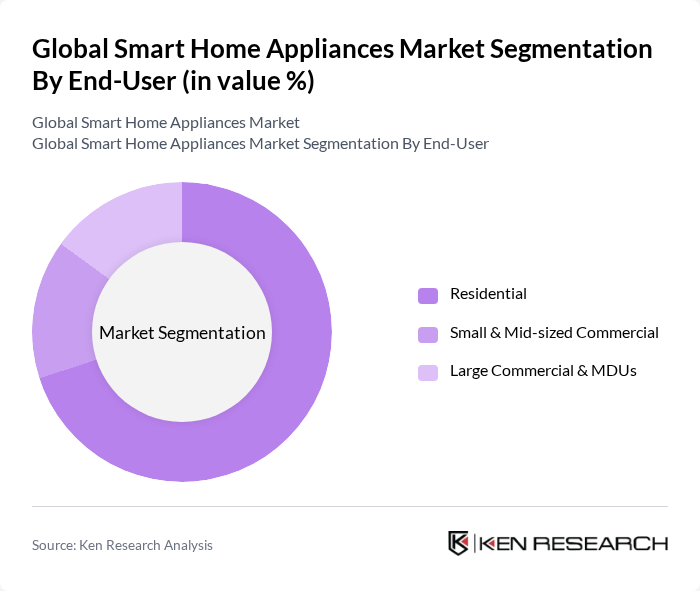

By End-User:The market is segmented into Residential, Small & Mid-sized Commercial (e.g., hospitality, offices), and Large Commercial & Multi-dwelling Units (MDUs). The Residential segment dominates as consumers integrate smart appliances alongside broader smart-home systems (networked thermostats, speakers, and security), prioritizing convenience, energy savings, and seamless control via mobile apps and voice assistants.

The Global Smart Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Koninklijke Philips N.V., Honeywell International Inc., BSH Hausgeräte GmbH (Bosch, Siemens), Panasonic Holdings Corporation, AB Electrolux, GE Appliances, a Haier company, Haier Smart Home Co., Ltd., Amazon.com, Inc. (Smart home devices), Google LLC (Nest), Apple Inc. (HomeKit ecosystem), Xiaomi Corporation, Arçelik A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart home appliances market appears promising, driven by technological advancements and evolving consumer preferences. As manufacturers increasingly focus on integrating artificial intelligence and machine learning, appliances will become more intuitive and user-friendly. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly products, aligning with consumer values. This convergence of technology and environmental consciousness is expected to create a dynamic market landscape, fostering innovation and enhancing user experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Refrigerators Smart Ovens Smart Washing Machines Smart Air Conditioners Smart Dishwashers Smart Robot Vacuums Smart Air Purifiers Smart Water Heaters Others |

| By End-User | Residential Small & Mid-sized Commercial (e.g., hospitality, offices) Large Commercial & Multi-dwelling Units (MDUs) |

| By Sales Channel | Online Retail (Brand D2C, E-commerce Marketplaces) Offline Retail (Specialty Stores, Supermarkets/Hypermarkets) Distributors/Value-Added Resellers |

| By Connectivity/Technology | Wi?Fi Bluetooth Zigbee/Z?Wave/Matter Cellular/Other |

| By Price Range | Premium Mid-Range Budget |

| By Brand/Ecosystem | Established Global Brands Emerging/Regional Brands Private Labels |

| By Product Features | Energy Efficiency Connectivity & App Control Voice Assistant & Smart Home Integration Home Safety/Health Monitoring |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Smart Lighting | 140 | Homeowners, Renters |

| Smart Security Systems Usage | 120 | Security Managers, Homeowners |

| HVAC Smart Controls Feedback | 100 | Facility Managers, Homeowners |

| Smart Kitchen Appliances Insights | 80 | Homeowners, Home Cooks |

| Consumer Preferences in Smart Home Ecosystems | 130 | Tech Enthusiasts, Early Adopters |

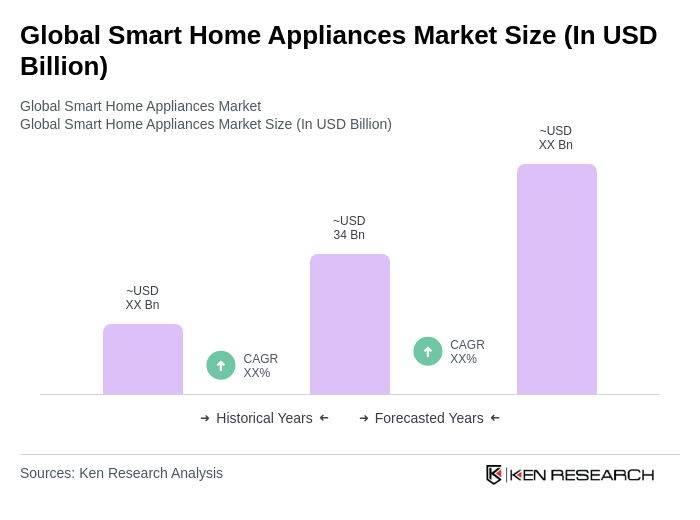

The Global Smart Home Appliances Market is valued at approximately USD 34 billion, based on a comprehensive analysis of industry sources and reported baselines over the past five years.