Region:Asia

Author(s):Geetanshi

Product Code:KRAB4501

Pages:81

Published On:October 2025

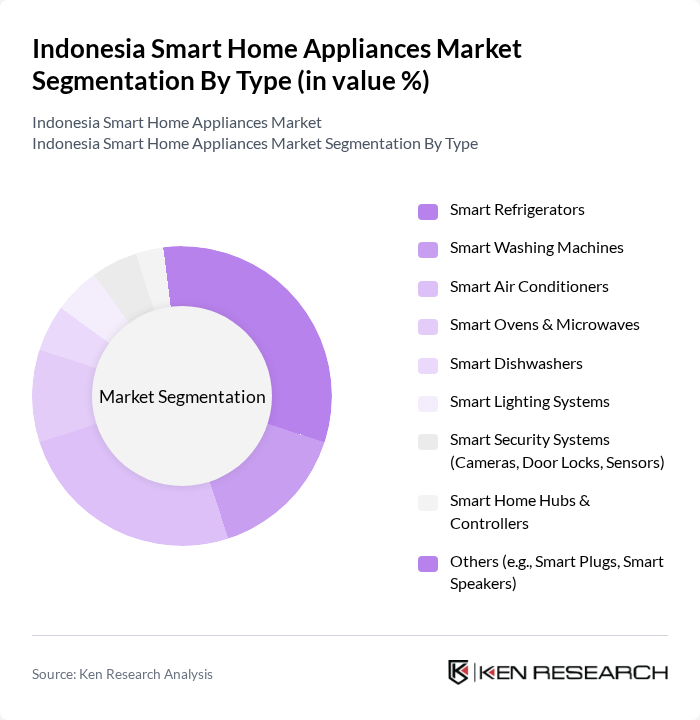

By Type:The market is segmented into various types of smart home appliances, including smart refrigerators, smart washing machines, smart air conditioners, smart ovens & microwaves, smart dishwashers, smart lighting systems, smart security systems, smart home hubs & controllers, and others such as smart plugs and smart speakers. Among these, smart refrigerators and smart air conditioners are leading the market due to their essential roles in daily household activities and the growing consumer preference for energy-efficient solutions. The smart appliances segment, which includes these categories, holds the largest market share, reflecting strong demand for connected devices that offer convenience and remote control.

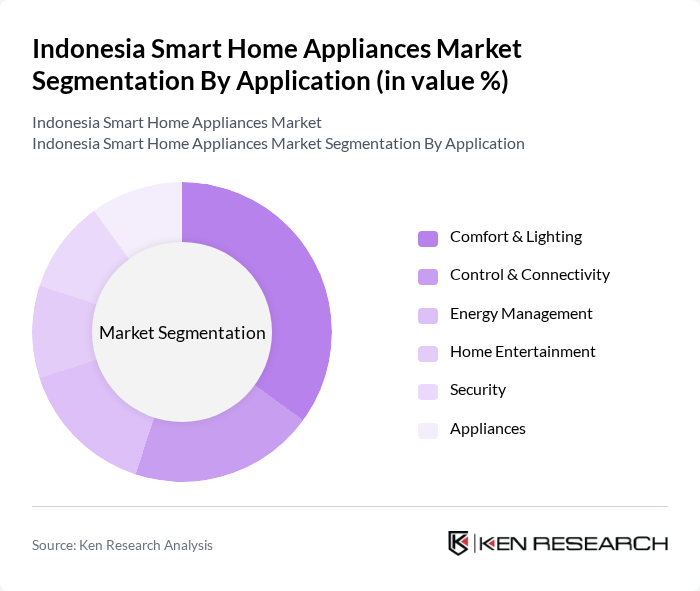

By Application:The applications of smart home appliances include comfort & lighting, control & connectivity, energy management, home entertainment, security, and appliances. The comfort & lighting segment is currently dominating the market, driven by consumer demand for enhanced living experiences and the integration of smart technologies that allow for seamless control of home environments. Smart appliances are increasingly integrated with IoT and AI, enabling personalized automation and energy savings.

The Indonesia Smart Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Indonesia, LG Electronics Indonesia, Philips Indonesia, Panasonic Gobel Indonesia, Sharp Electronics Indonesia, Xiaomi Indonesia, Haier Indonesia, Electrolux Indonesia, Midea Indonesia, Ariston Thermo Indonesia, Toshiba Lifestyle Products and Services Corporation Indonesia, Beko Appliances Indonesia, Hisense Indonesia, Gree Electric Appliances Indonesia, TCL Indonesia, Daikin Industries Indonesia, BSH Home Appliances Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

As Indonesia continues to urbanize and its middle class expands, the demand for smart home appliances is expected to rise significantly. The integration of smart technologies into everyday life will likely become more prevalent, driven by consumer preferences for convenience and energy efficiency. Additionally, advancements in IoT and increased government support for smart technologies will further stimulate market growth. Companies that innovate and adapt to consumer needs will be well-positioned to capitalize on these emerging trends in the smart home sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Refrigerators Smart Washing Machines Smart Air Conditioners Smart Ovens & Microwaves Smart Dishwashers Smart Lighting Systems Smart Security Systems (Cameras, Door Locks, Sensors) Smart Home Hubs & Controllers Others (e.g., Smart Plugs, Smart Speakers) |

| By Application | Comfort & Lighting Control & Connectivity Energy Management Home Entertainment Security Appliances |

| By End-User | Residential Commercial Hospitality Government & Utilities |

| By Sales Channel | Online Retail Offline Retail (Modern Trade, Electronics Stores) Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Emerging Brands |

| By Functionality | Basic Functionality (Remote Control, Scheduling) Advanced Functionality (AI, Voice Control, Automation) Integrated Functionality (Ecosystem Integration) |

| By Distribution Mode | Direct Distribution Indirect Distribution Hybrid Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Smart Lighting | 100 | Homeowners, Renters, Interior Designers |

| Smart Security Systems Usage | 90 | Homeowners, Security Consultants, Property Managers |

| Home Automation Device Preferences | 80 | Tech Enthusiasts, Early Adopters, Home Automation Installers |

| Market Trends in Smart Appliances | 60 | Retail Managers, Product Developers, Market Analysts |

| Consumer Feedback on Smart Home Integration | 50 | Homeowners, IT Professionals, Smart Home Consultants |

The Indonesia Smart Home Appliances Market is valued at approximately USD 340 million, driven by urbanization, rising disposable incomes, and a growing preference for energy-efficient and automated home solutions.