Global Smart Irrigation Market Overview

- The Global Smart Irrigation Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing need for efficient water management in agriculture, heightened awareness of sustainable farming practices, and rapid advancements in irrigation technologies. The integration of IoT and AI in irrigation systems has further accelerated market expansion, enabling farmers to optimize water usage, reduce operational costs, and improve crop yields. Recent trends include the adoption of cloud-based irrigation management, solar-powered smart irrigation systems, and the use of real-time data analytics for precision agriculture .

- The United States, China, and India are the leading markets for smart irrigation, attributed to their extensive agricultural sectors and substantial investments in advanced irrigation technologies. The United States leads in technological innovation and adoption rates, while China and India benefit from robust government initiatives focused on improving agricultural productivity and water conservation. Rapid urbanization in these countries is also increasing the demand for efficient irrigation solutions in both agricultural and landscaping applications .

- The Water Infrastructure Improvements for the Nation (WIIN) Act, 2016, issued by the United States Congress, provides federal funding for the development and modernization of irrigation systems, including smart irrigation technologies. This legislation mandates compliance with water conservation standards, supports infrastructure upgrades, and encourages the adoption of advanced irrigation solutions to enhance agricultural efficiency and sustainability across the country .

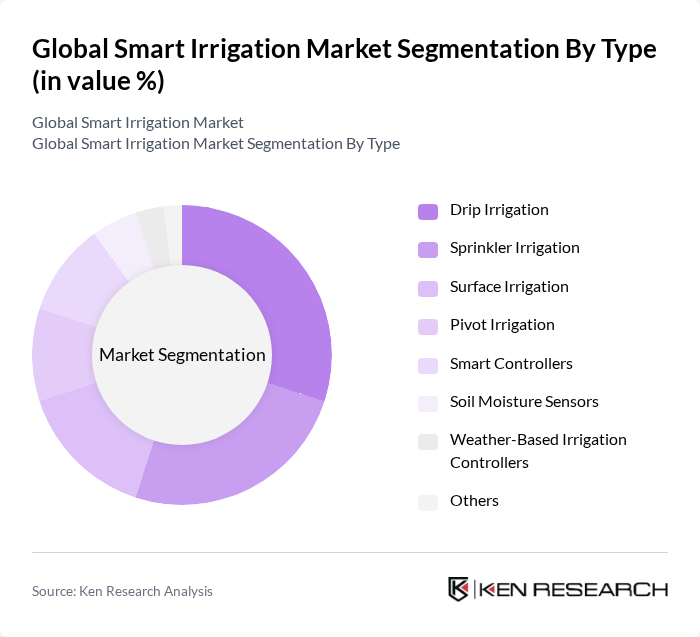

Global Smart Irrigation Market Segmentation

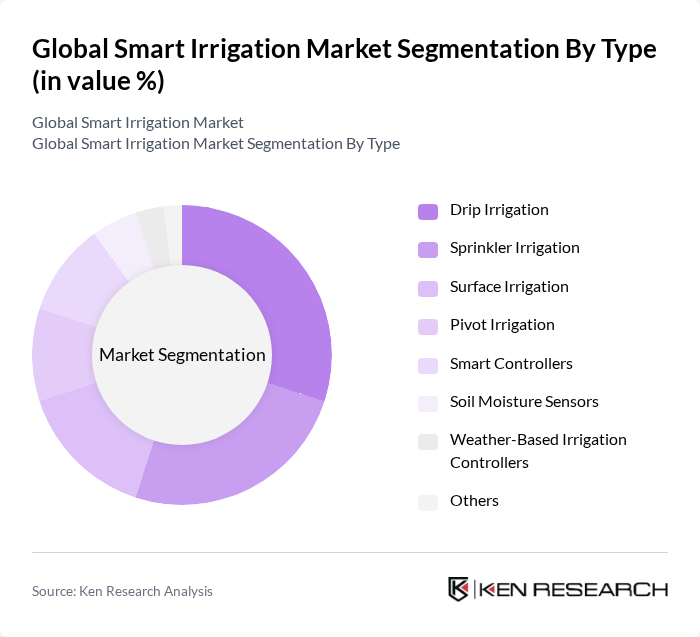

By Type:The smart irrigation market is segmented into Drip Irrigation, Sprinkler Irrigation, Surface Irrigation, Pivot Irrigation, Smart Controllers, Soil Moisture Sensors, Weather-Based Irrigation Controllers, and Others. Drip Irrigation remains the leading sub-segment due to its superior water-use efficiency and ability to deliver water directly to plant roots, significantly reducing evaporation and runoff. The growing adoption of precision agriculture and the need for resource optimization are further fueling demand for drip irrigation systems. Smart controllers and sensor-based solutions are also gaining traction, driven by advancements in automation and data-driven irrigation management .

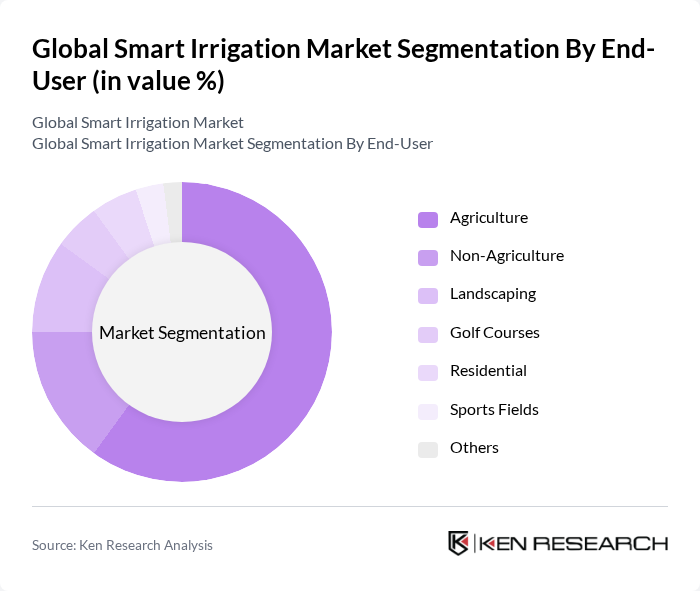

By End-User:The end-user segmentation covers Agriculture, Non-Agriculture, Landscaping, Golf Courses, Residential, Sports Fields, and Others. Agriculture is the dominant end-user segment, driven by the urgent need for efficient water management in farming operations. The adoption of smart irrigation solutions in agriculture is increasing due to the focus on maximizing crop yields, reducing water consumption, and meeting sustainability targets. Landscaping and non-agricultural applications are also expanding, supported by urban development and the proliferation of smart city initiatives .

Global Smart Irrigation Market Competitive Landscape

The Global Smart Irrigation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rain Bird Corporation, Hunter Industries, Netafim Ltd., The Toro Company, Jain Irrigation Systems Ltd., Lindsay Corporation, Valmont Industries, Inc., Irritrol Systems, AquaSpy, Inc., CropX Technologies, HydroPoint Data Systems, Inc., Ceres Imaging, GreenIQ Ltd., Rachio, Inc., Soil Scout Oy contribute to innovation, geographic expansion, and service delivery in this space.

Global Smart Irrigation Market Industry Analysis

Growth Drivers

- Increasing Water Scarcity:Water scarcity is a pressing issue, with the World Bank reporting that in the future, over 1.8 billion people will live in areas with absolute water scarcity. This situation drives the adoption of smart irrigation systems, which can reduce water usage by up to 50%. As agricultural demands rise, the need for efficient water management becomes critical, pushing farmers to invest in technologies that optimize water resources and enhance crop yields.

- Technological Advancements in Irrigation Systems:The integration of advanced technologies in irrigation systems is transforming agricultural practices. In the future, the global investment in smart irrigation technologies is projected to reach $1.5 billion, driven by innovations such as soil moisture sensors and automated irrigation controllers. These technologies not only improve water efficiency but also enable real-time monitoring, allowing farmers to make data-driven decisions that enhance productivity and sustainability.

- Rising Demand for Sustainable Agriculture:The global shift towards sustainable agriculture is a significant growth driver for smart irrigation. According to the Food and Agriculture Organization (FAO), sustainable practices can increase food production by 20% while conserving resources. In the future, the demand for sustainable agricultural practices is expected to rise, with smart irrigation playing a crucial role in reducing environmental impact and meeting the needs of a growing population, projected to reach 8.5 billion.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the adoption of smart irrigation systems is the high initial investment required. The average cost of implementing a smart irrigation system can range from $2,000 to $10,000 per acre, depending on the technology used. This financial barrier can deter many smallholder farmers, particularly in regions where agricultural income is limited, thus slowing the overall market growth in the None region.

- Lack of Awareness Among Farmers:A significant challenge in the smart irrigation market is the lack of awareness and understanding among farmers regarding the benefits of these systems. In the future, it is estimated that only 30% of farmers in developing regions are familiar with smart irrigation technologies. This knowledge gap hinders adoption rates, as many farmers remain reliant on traditional irrigation methods, which can be less efficient and more resource-intensive.

Global Smart Irrigation Market Future Outlook

The future of the smart irrigation market appears promising, driven by increasing awareness of water conservation and technological advancements. As farmers become more educated about the benefits of smart irrigation, adoption rates are expected to rise significantly. Additionally, the integration of IoT and AI technologies will enhance system efficiency, providing real-time data for better decision-making. This trend, coupled with government support for sustainable practices, will likely lead to a more robust market landscape in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant opportunities for smart irrigation systems. With a growing population and increasing agricultural demands, countries in Asia and Africa are investing in modern irrigation technologies. In the future, these regions are expected to see a 25% increase in smart irrigation adoption, driven by government initiatives and the need for efficient water management.

- Integration with IoT and AI Technologies:The integration of IoT and AI technologies into smart irrigation systems offers substantial market opportunities. In the future, the use of AI-driven analytics in irrigation management is projected to enhance water efficiency by up to 30%. This technological synergy not only improves operational efficiency but also provides farmers with actionable insights, fostering a more sustainable agricultural ecosystem.