Region:Middle East

Author(s):Dev

Product Code:KRAA9589

Pages:83

Published On:November 2025

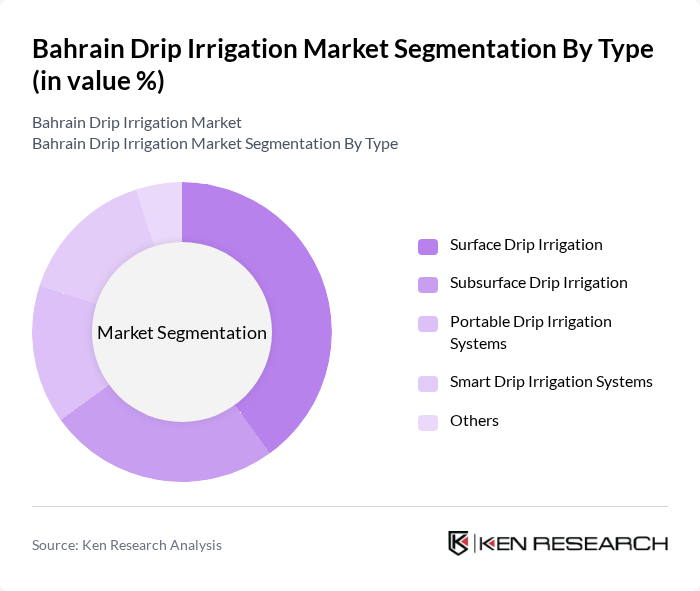

By Type:The market is segmented into various types of drip irrigation systems, including Surface Drip Irrigation, Subsurface Drip Irrigation, Portable Drip Irrigation Systems, Smart Drip Irrigation Systems, and Others. Among these, Surface Drip Irrigation is the most widely used due to its cost-effectiveness, ease of installation, and suitability for a wide range of crops. Subsurface systems are gaining traction for their superior water-use efficiency and reduced evaporation losses, while Smart Drip Irrigation Systems are increasingly adopted due to advancements in IoT integration, automation, and real-time monitoring, enabling precise water delivery and improved crop management .

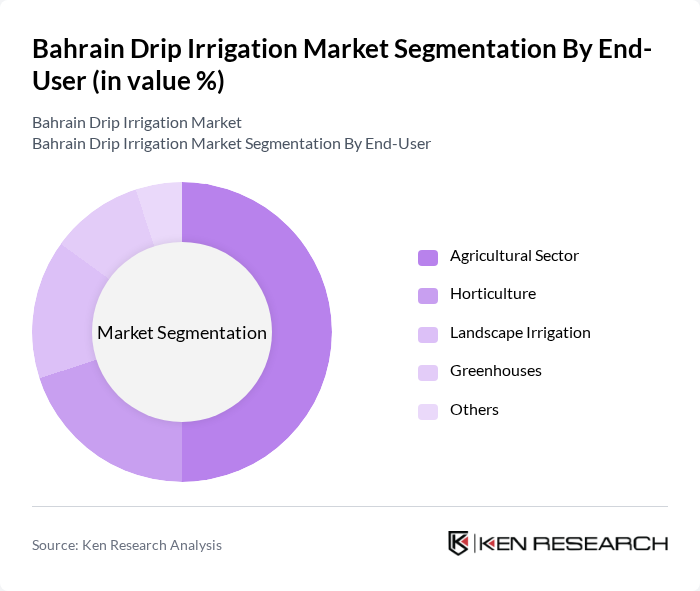

By End-User:The end-user segmentation includes the Agricultural Sector, Horticulture, Landscape Irrigation, Greenhouses, and Others. The Agricultural Sector is the leading end-user, driven by the need for efficient water usage in crop production and government incentives supporting modern irrigation. Horticulture and Greenhouses are also significant contributors, as they require precise water management to ensure optimal growth conditions. The increasing emphasis on sustainable practices and resource optimization in these sectors is further boosting the adoption of drip irrigation systems .

The Bahrain Drip Irrigation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netafim, Jain Irrigation Systems Ltd., Rain Bird Corporation, Hunter Industries, The Toro Company, Irritec S.p.A., Rivulis Irrigation, Elgo Irrigation Ltd., Agri-Inject, Inc., Aqualine Water Technology, Plastro Irrigation Systems, A.M.A. Horticulture Inc., Metzerplas Cooperative Agricultural Organization Ltd., Bowsmith Inc., Dura-Line Corporation, Gulf Irrigation Group (Bahrain), Bahrain Agricultural Company (BACO), Al Fateh Agricultural & Irrigation Systems contribute to innovation, geographic expansion, and service delivery in this space.

As Bahrain continues to grapple with water scarcity, the demand for efficient irrigation solutions is expected to intensify. The government's commitment to sustainable agriculture and the integration of advanced technologies will likely drive innovation in the drip irrigation sector. Additionally, as awareness among farmers increases, more will adopt these systems, leading to improved agricultural productivity. The focus on water conservation and sustainable practices will shape the future landscape of the irrigation market in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Type | Surface Drip Irrigation Subsurface Drip Irrigation Portable Drip Irrigation Systems Smart Drip Irrigation Systems Others |

| By End-User | Agricultural Sector Horticulture Landscape Irrigation Greenhouses Others |

| By Crop Type | Fruits and Vegetables Field Crops Ornamental Plants Nuts Others |

| By System Component | Emitters/Drippers Drip Tubes/Drip Lines Filters & Fertilizer Injectors Pressure Pumps Valves Fittings & Accessories Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Dealers Agricultural Cooperatives Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Sustainable Practices Technical Training Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Crop Farmers | 100 | Farm Owners, Agricultural Managers |

| Drip Irrigation Equipment Suppliers | 60 | Sales Representatives, Product Managers |

| Agricultural Consultants | 40 | Agronomists, Irrigation Specialists |

| Government Agricultural Officials | 40 | Policy Makers, Extension Officers |

| Research Institutions | 20 | Researchers, Academics in Agricultural Sciences |

The Bahrain Drip Irrigation Market is valued at approximately USD 41 million, reflecting a growing demand for efficient water management solutions in agriculture, particularly in arid regions like Bahrain.