Region:Global

Author(s):Rebecca

Product Code:KRAA2166

Pages:84

Published On:August 2025

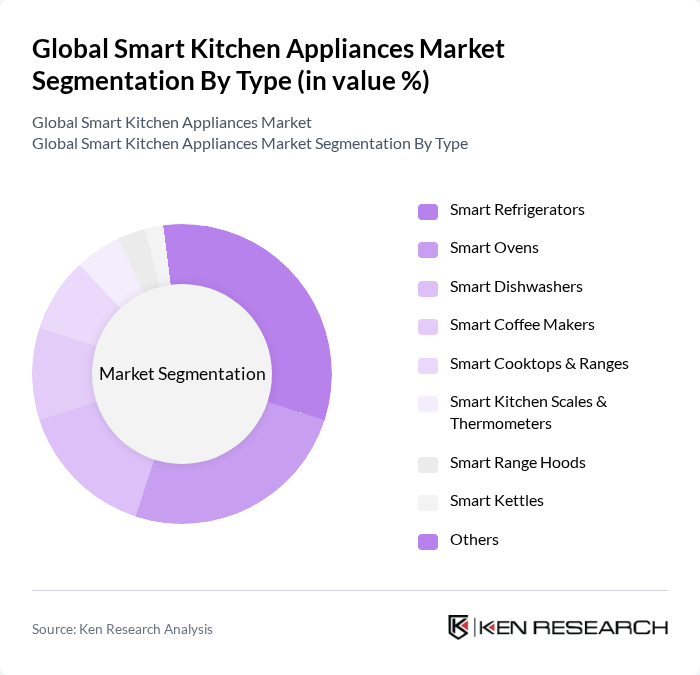

By Type:The market is segmented into various types of smart kitchen appliances, including Smart Refrigerators, Smart Ovens, Smart Dishwashers, Smart Coffee Makers, Smart Cooktops & Ranges, Smart Kitchen Scales & Thermometers, Smart Range Hoods, Smart Kettles, and Others. Each of these segments caters to different consumer needs and preferences, with specific features that enhance cooking efficiency and convenience. The adoption of smart refrigerators and ovens remains highest, driven by demand for connectivity, remote monitoring, and integration with home automation systems. Smart dishwashers and coffee makers are also seeing significant uptake, particularly among urban consumers seeking convenience and energy savings .

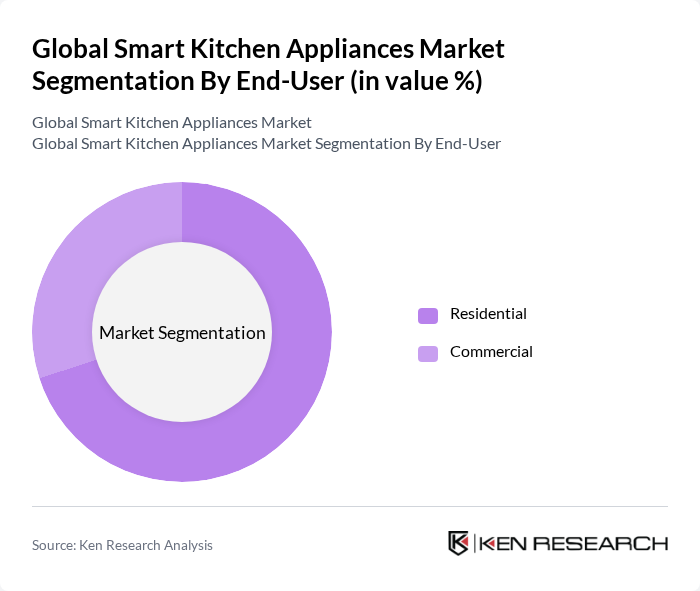

By End-User:The market is divided into Residential and Commercial segments. The residential segment is primarily driven by the increasing number of smart homes and the growing trend of home automation. Consumers are increasingly investing in smart kitchen appliances to enhance their cooking experience and improve energy efficiency. The commercial segment, on the other hand, is driven by the need for efficiency and productivity in restaurants and catering services. The residential segment accounts for the majority share, reflecting strong consumer adoption in developed and urban markets .

The Global Smart Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Koninklijke Philips N.V., Panasonic Corporation, BSH Hausgeräte GmbH (Bosch Home Appliances), Electrolux AB, GE Appliances (a Haier company), Haier Group Corporation, Miele & Cie. KG, KitchenAid (Whirlpool Corporation), Breville Group Limited, Instant Brands Inc., Sharp Corporation, Frigidaire (Electrolux AB), Xiaomi Corporation, SMEG S.p.A., Sub-Zero Group, Inc., Robam Appliances Co., Ltd., Arçelik A.?. contribute to innovation, geographic expansion, and service delivery in this space. These companies are investing in R&D to introduce AI-powered appliances, voice-controlled features, and enhanced connectivity, aligning with evolving consumer expectations for smart, sustainable, and user-friendly kitchen solutions .

The future of the smart kitchen appliances market appears promising, driven by technological innovations and changing consumer preferences. As more households embrace smart home ecosystems, the integration of kitchen appliances with other smart devices will enhance user experience. Additionally, the focus on sustainability will likely lead to the development of energy-efficient appliances, aligning with global environmental goals. Companies that prioritize user-friendly designs and robust security measures will be well-positioned to capture market share in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Refrigerators Smart Ovens Smart Dishwashers Smart Coffee Makers Smart Cooktops & Ranges Smart Kitchen Scales & Thermometers Smart Range Hoods Smart Kettles Others |

| By End-User | Residential Commercial |

| By Distribution Channel | Online Retail Multi-brand Stores Exclusive Stores Direct Sales Wholesale |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Feature | Energy Efficiency Smart Connectivity (Wi-Fi, Bluetooth, NFC, Thread/Matter) Voice Control Integration User-Friendly Interfaces Health & Nutrition Monitoring |

| By Application | Home Cooking Meal Preparation Food Preservation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Refrigerator Users | 100 | Homeowners, Tech Enthusiasts |

| Smart Oven Users | 80 | Professional Chefs, Home Cooks |

| Smart Dishwasher Users | 70 | Families, Eco-conscious Consumers |

| Smart Kitchen Gadget Users | 60 | Millennials, Gadget Lovers |

| General Kitchen Appliance Users | 90 | Homeowners, Renovators |

The Global Smart Kitchen Appliances Market is valued at approximately USD 25 billion, reflecting significant growth driven by the adoption of smart home technologies and consumer demand for convenience and energy-efficient appliances.