Region:Asia

Author(s):Shubham

Product Code:KRAA8480

Pages:98

Published On:November 2025

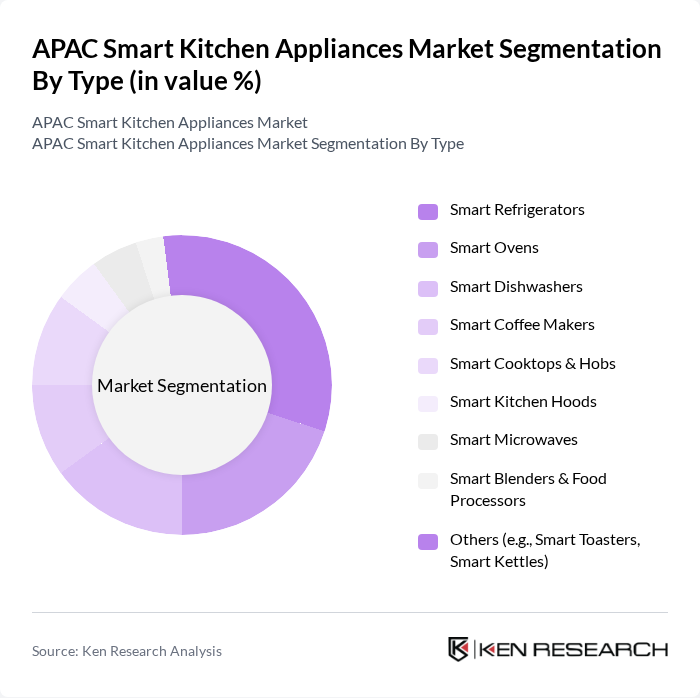

By Type:The market is segmented into various types of smart kitchen appliances, including Smart Refrigerators, Smart Ovens, Smart Dishwashers, Smart Coffee Makers, Smart Cooktops & Hobs, Smart Kitchen Hoods, Smart Microwaves, Smart Blenders & Food Processors, and Others (e.g., Smart Toasters, Smart Kettles). Among these, Smart Refrigerators are leading the market due to their advanced features such as inventory management, energy efficiency, and connectivity with other smart home devices. The growing trend of smart homes, the integration of voice assistants, and the increasing focus on energy conservation are driving the demand for these appliances.

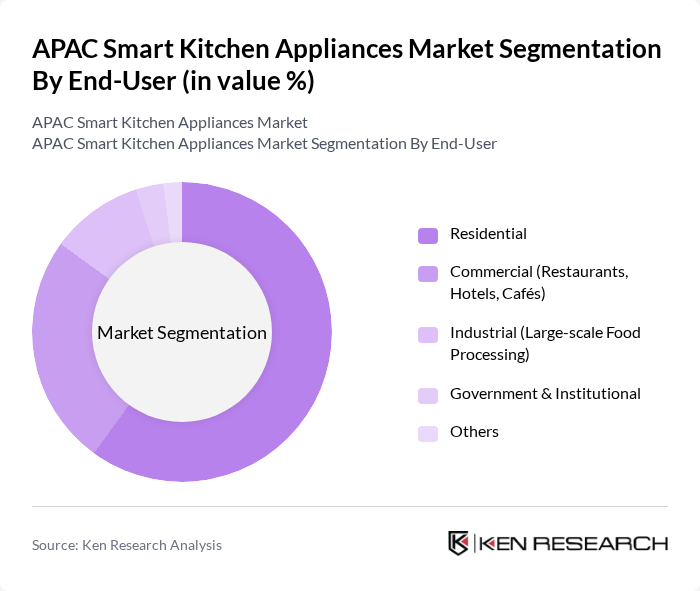

By End-User:The market is segmented by end-user into Residential, Commercial (Restaurants, Hotels, Cafés), Industrial (Large-scale Food Processing), Government & Institutional, and Others. The Residential segment dominates the market, driven by the increasing trend of smart homes, growing consumer preference for convenience and energy-efficient appliances, and the proliferation of direct-to-consumer e-commerce platforms. The rise in disposable income and changing lifestyles are also contributing to the growth of smart kitchen appliances in residential settings.

The APAC Smart Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Panasonic Holdings Corporation, Koninklijke Philips N.V., Haier Smart Home Co., Ltd., BSH Hausgeräte GmbH (Bosch), Electrolux AB, Miele & Cie. KG, GE Appliances (a Haier company), Sharp Corporation, Xiaomi Corporation, Breville Group Limited, KitchenAid (a Whirlpool brand), Groupe SEB (Tefal), Midea Group Co., Ltd., Morphy Richards, Hitachi, Ltd., Toshiba Corporation, Smeg S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC smart kitchen appliances market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As sustainability becomes a priority, manufacturers are likely to focus on developing eco-friendly products that meet energy efficiency standards. Furthermore, the integration of AI and machine learning into kitchen appliances will enhance user experience, making them more intuitive and responsive. This shift will likely attract a broader consumer base, particularly among tech-savvy millennials and environmentally conscious buyers, fostering robust market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Refrigerators Smart Ovens Smart Dishwashers Smart Coffee Makers Smart Cooktops & Hobs Smart Kitchen Hoods Smart Microwaves Smart Blenders & Food Processors Others (e.g., Smart Toasters, Smart Kettles) |

| By End-User | Residential Commercial (Restaurants, Hotels, Cafés) Industrial (Large-scale Food Processing) Government & Institutional Others |

| By Region | China India Japan South Korea Southeast Asia (e.g., Indonesia, Vietnam, Thailand, Malaysia) Australia & New Zealand Rest of APAC |

| By Technology | Wi-Fi Enabled Appliances Bluetooth Enabled Appliances Voice-Controlled Appliances App-Controlled Appliances AI-Integrated Appliances Others |

| By Application | Cooking Food Preservation Cleaning Beverage Preparation Others |

| By Distribution Channel | Online Offline (Retail, Specialty Stores, Hypermarkets) Others |

| By Price Range | Premium Mid-range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Refrigerator Market | 120 | Product Managers, Retail Buyers |

| Smart Oven Adoption | 95 | Home Appliance Retailers, Kitchen Designers |

| Consumer Preferences in Smart Dishwashers | 75 | End Users, Homeowners |

| Market Trends in Smart Kitchen Gadgets | 65 | Tech Enthusiasts, Early Adopters |

| Impact of Smart Appliances on Energy Consumption | 85 | Energy Analysts, Sustainability Experts |

The APAC Smart Kitchen Appliances Market is valued at approximately USD 7.5 billion, driven by consumer demand for convenience, energy efficiency, and technological advancements in kitchen appliances.