Region:Global

Author(s):Geetanshi

Product Code:KRAD0072

Pages:98

Published On:August 2025

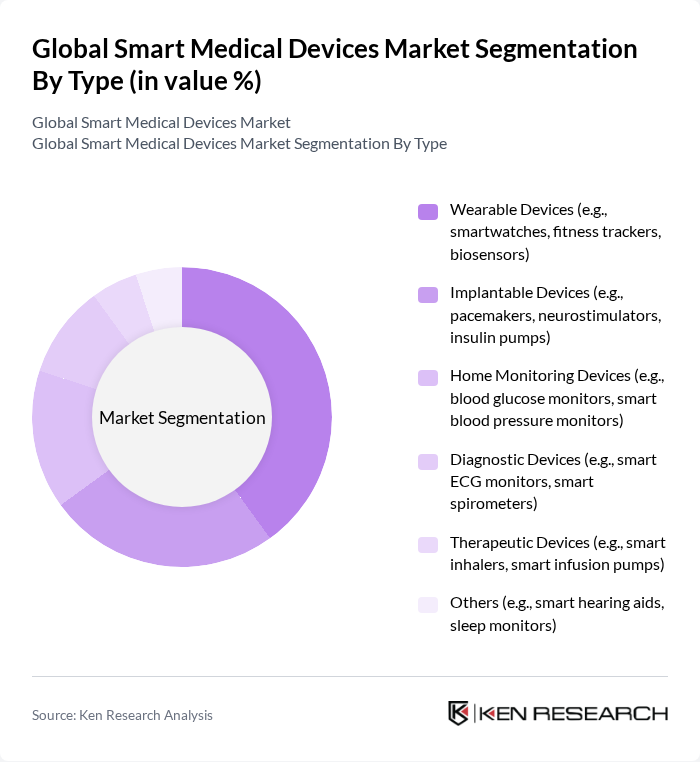

By Type:The market is segmented into various types of smart medical devices, including wearable devices, implantable devices, home monitoring devices, diagnostic devices, therapeutic devices, and others. Among these, wearable devices have gained significant traction due to their convenience, ability to provide real-time health data, and integration with mobile health platforms. The increasing focus on preventive healthcare, fitness tracking, and personalized medicine has further propelled demand for these devices .

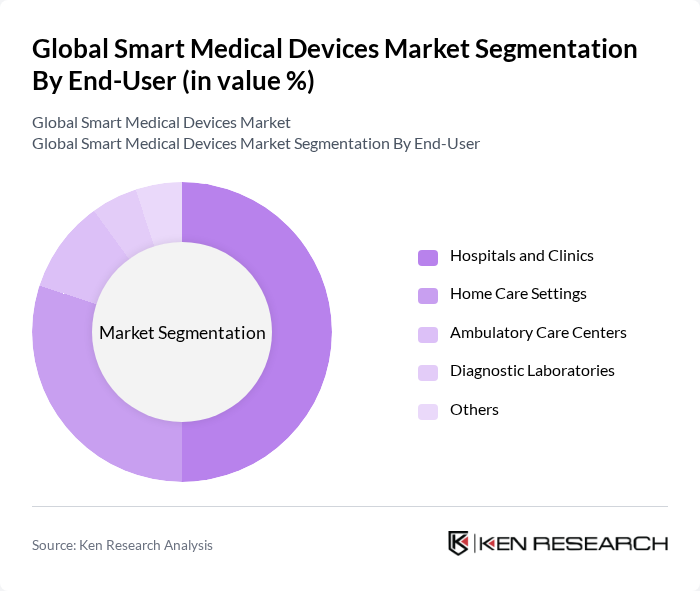

By End-User:The end-user segmentation includes hospitals and clinics, home care settings, ambulatory care centers, diagnostic laboratories, and others. Hospitals and clinics dominate the market due to their need for advanced monitoring and diagnostic tools to enhance patient care. The shift towards home care settings is notable, driven by the increasing preference for at-home health management, the aging population, and the rise of telemedicine and remote patient monitoring solutions .

The Global Smart Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic PLC, Abbott Laboratories, Koninklijke Philips N.V. (Philips Healthcare), Siemens Healthineers AG, GE Healthcare, Johnson & Johnson (including J&J MedTech), Boston Scientific Corporation, Stryker Corporation, Becton, Dickinson and Company (BD), Omron Healthcare Co., Ltd., Fitbit LLC (Google LLC), Apple Inc., Samsung Electronics Co., Ltd., Honeywell International Inc., Canon Medical Systems Corporation, Sonova Holding AG, NeuroMetrix, Inc., Sotera Wireless, Inc., VitalConnect, Inc., Enable Injections, Inc., Debiotech SA, Activinsights Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of smart medical devices in Nigeria is poised for significant growth, driven by technological advancements and increasing consumer demand for personalized healthcare solutions. As telehealth services gain traction, healthcare providers are expected to adopt smart devices to enhance patient engagement and improve outcomes. Additionally, the integration of AI and machine learning will further optimize device functionality, leading to more efficient healthcare delivery and better patient management strategies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable Devices (e.g., smartwatches, fitness trackers, biosensors) Implantable Devices (e.g., pacemakers, neurostimulators, insulin pumps) Home Monitoring Devices (e.g., blood glucose monitors, smart blood pressure monitors) Diagnostic Devices (e.g., smart ECG monitors, smart spirometers) Therapeutic Devices (e.g., smart inhalers, smart infusion pumps) Others (e.g., smart hearing aids, sleep monitors) |

| By End-User | Hospitals and Clinics Home Care Settings Ambulatory Care Centers Diagnostic Laboratories Others |

| By Application | Chronic Disease Management (e.g., diabetes, cardiovascular, respiratory) Fitness and Wellness Monitoring Remote Patient Monitoring Emergency Care Others |

| By Distribution Channel | Online Retail (e.g., e-commerce platforms, company websites) Pharmacies Direct Sales Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Bluetooth Technology Wi-Fi Technology Cellular Technology Others (e.g., NFC, Zigbee) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chronic Disease Management Devices | 100 | Healthcare Providers, Patients, Device Manufacturers |

| Wearable Health Monitoring Devices | 80 | Fitness Trainers, Health Coaches, Technology Developers |

| Telehealth Solutions | 90 | Telemedicine Practitioners, IT Managers, Healthcare Administrators |

| Smart Surgical Instruments | 60 | Surgeons, Operating Room Managers, Biomedical Engineers |

| Remote Patient Monitoring Systems | 70 | Nurses, Care Coordinators, Health IT Specialists |

The Global Smart Medical Devices Market is valued at approximately USD 90 billion, driven by technological advancements, the increasing prevalence of chronic diseases, and a growing demand for remote monitoring solutions.