Region:Asia

Author(s):Dev

Product Code:KRAD1704

Pages:84

Published On:November 2025

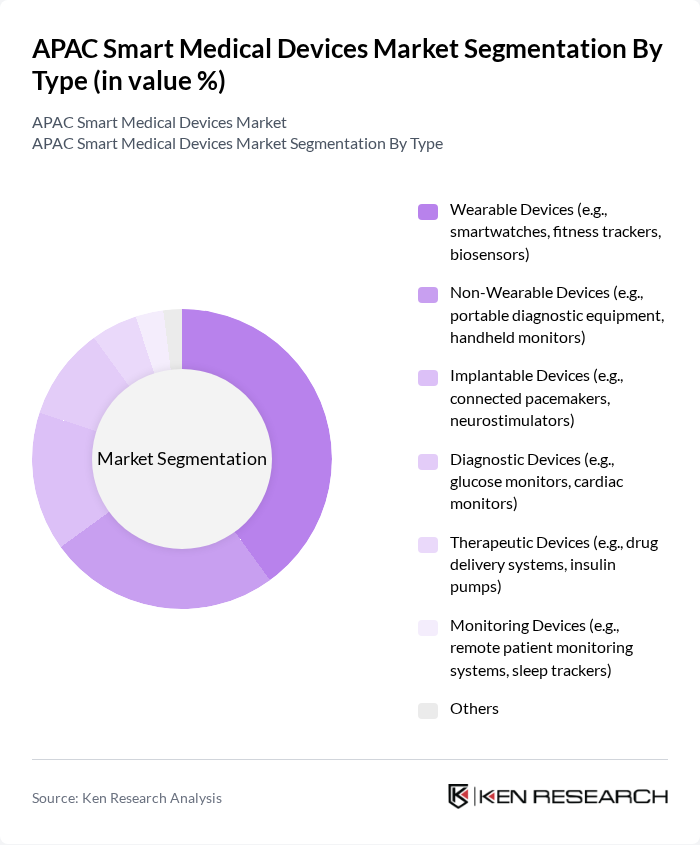

By Type:The market is segmented into wearable devices, non-wearable devices, implantable devices, diagnostic devices, therapeutic devices, monitoring devices, and others. Wearable devices, such as smartwatches, fitness trackers, and biosensors, are gaining significant traction due to their convenience and ability to provide real-time health monitoring. Non-wearable devices, including portable diagnostic equipment and handheld monitors, remain essential in clinical settings for diagnostics and patient management. The demand for implantable devices, such as connected pacemakers and neurostimulators, is driven by technological advancements and increasing patient acceptance. Diagnostic and monitoring devices are also seeing robust adoption, supported by the trend toward remote patient monitoring and point-of-care diagnostics .

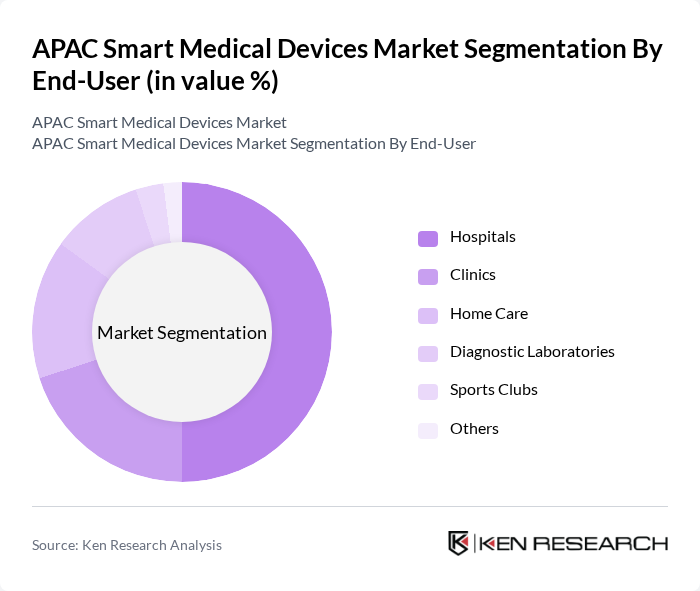

By End-User:The end-user segmentation includes hospitals, clinics, home care, diagnostic laboratories, sports clubs, and others. Hospitals are the largest end-users, reflecting their need for advanced medical technologies to improve patient care and operational efficiency. Clinics and home care settings are increasingly adopting smart medical devices for enhanced patient monitoring and treatment. The growing trend of telemedicine and remote patient monitoring is further accelerating demand in home care environments. Diagnostic laboratories and sports clubs are also expanding their use of smart devices for specialized applications, while other segments include rehabilitation centers and elderly care facilities .

The APAC Smart Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Medtronic, Abbott Laboratories, Johnson & Johnson, Boston Scientific, Stryker Corporation, B. Braun Melsungen AG, Canon Medical Systems Corporation, Hitachi Medical Corporation, Olympus Corporation, Roche Diagnostics, Fujifilm Holdings Corporation, Mindray Medical International Limited, Terumo Corporation, Nihon Kohden Corporation, HekaBio K.K., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Wuxi AppTec, MicroPort Scientific Corporation, Samsung Medison Co., Ltd., Omron Healthcare Co., Ltd., Yuwell-Jiangsu Yuyue Medical Equipment & Supply Co., Ltd., ResMed Asia Pacific contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC smart medical devices market is poised for transformative growth, driven by technological innovations and increasing healthcare demands. As telehealth services expand, more patients will engage with remote monitoring solutions, enhancing healthcare delivery. Additionally, the integration of AI and machine learning will revolutionize diagnostics and treatment personalization, making healthcare more efficient. The focus on preventive healthcare will further encourage the adoption of smart devices, ensuring better health outcomes across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable Devices (e.g., smartwatches, fitness trackers, biosensors) Non-Wearable Devices (e.g., portable diagnostic equipment, handheld monitors) Implantable Devices (e.g., connected pacemakers, neurostimulators) Diagnostic Devices (e.g., glucose monitors, cardiac monitors) Therapeutic Devices (e.g., drug delivery systems, insulin pumps) Monitoring Devices (e.g., remote patient monitoring systems, sleep trackers) Others |

| By End-User | Hospitals Clinics Home Care Diagnostic Laboratories Sports Clubs Others |

| By Region | China India Japan South Korea Southeast Asia Oceania |

| By Technology | Bluetooth Technology Wi-Fi Technology NFC Technology Cloud Computing AI & Machine Learning Integration Others |

| By Application | Diabetes Management Cardiovascular Disease Management Oncology Auto-Immune Disorders Infectious Diseases Sports and Fitness Sleep Disorders Remote Patient Monitoring Emergency Care Others |

| By Distribution Channel | Pharmacies Online Channel Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Wearable Devices | 100 | Healthcare Providers, Product Managers |

| Telehealth Solutions | 60 | Telemedicine Specialists, IT Managers |

| Remote Patient Monitoring Systems | 50 | Nurses, Home Care Coordinators |

| Smart Surgical Instruments | 40 | Surgeons, Operating Room Managers |

| Diagnostic Imaging Devices | 70 | Radiologists, Biomedical Engineers |

The APAC Smart Medical Devices Market is valued at approximately USD 25 billion, reflecting significant growth driven by increasing chronic disease prevalence, healthcare expenditure, and advancements in digital technologies that enhance patient care and monitoring.