Region:Global

Author(s):Rebecca

Product Code:KRAC0326

Pages:80

Published On:August 2025

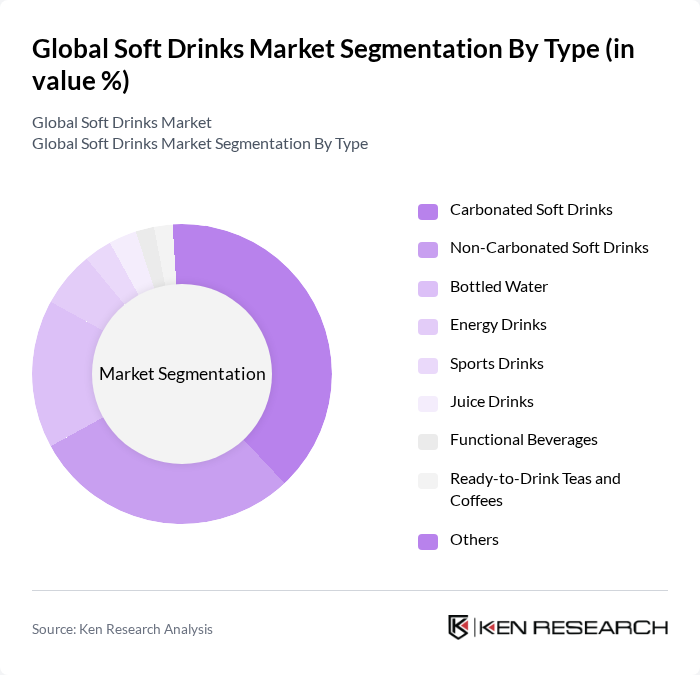

By Type:The soft drinks market is segmented into various types, including carbonated and non-carbonated beverages. Carbonated soft drinks remain a dominant segment due to their long-standing popularity and extensive marketing efforts. However, non-carbonated drinks, such as bottled water and functional beverages, are gaining traction as consumers shift towards healthier options. The energy drinks segment is also witnessing significant growth, driven by the increasing demand for functional beverages that provide energy and hydration. There is also a notable rise in ready-to-drink teas and coffees, as well as premium and craft beverages targeting niche consumer segments .

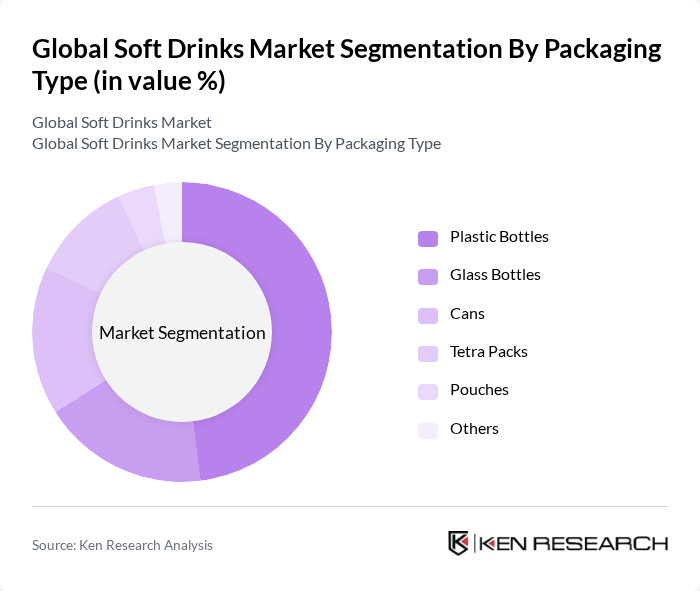

By Packaging Type:The packaging type for soft drinks includes various formats such as plastic bottles, glass bottles, cans, and tetra packs. Plastic bottles continue to dominate the market due to their lightweight nature and convenience, making them the preferred choice for consumers. Cans are also widely used, especially for energy drinks and carbonated beverages, as they offer portability and are easily recyclable. Glass bottles, while less common, are favored for premium and craft beverages, appealing to consumers seeking quality and sustainability. There is a growing trend towards eco-friendly and innovative packaging solutions, including recycled materials and biodegradable options, as brands respond to consumer demand for sustainability .

The Global Soft Drinks Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper Inc., Nestlé S.A., Red Bull GmbH, Monster Beverage Corporation, Suntory Beverage & Food Limited, Britvic plc, Coca-Cola HBC AG, A.G. Barr plc, National Beverage Corp., Refresco Group N.V., Pepsi Bottling Ventures LLC, Asahi Group Holdings, Ltd., Danone S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the soft drinks market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with functional beverages that offer health benefits. Additionally, the integration of digital marketing strategies will enhance consumer engagement, particularly among younger demographics. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in the dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Soft Drinks Non-Carbonated Soft Drinks Bottled Water Energy Drinks Sports Drinks Juice Drinks Functional Beverages Ready-to-Drink Teas and Coffees Others |

| By Packaging Type | Plastic Bottles Glass Bottles Cans Tetra Packs Pouches Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Vending Machines Foodservice (Cafés, Restaurants, QSRs) Others |

| By Consumer Demographics | Age Group (Children, Teens, Adults, Seniors) Gender Income Level |

| By Flavor Profile | Cola Citrus Berry Tropical Herbal/Botanical Others |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers Trend-Focused Consumers |

| By Health Consciousness | Health-Conscious Consumers Regular Consumers Indifferent Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Carbonated Soft Drinks Consumption | 120 | Retail Managers, Beverage Distributors |

| Juice and Non-Carbonated Beverages | 90 | Product Managers, Marketing Executives |

| Bottled Water Market Insights | 60 | Supply Chain Managers, Brand Strategists |

| Health-Conscious Beverage Trends | 50 | Nutritionists, Consumer Behavior Analysts |

| Emerging Markets Beverage Preferences | 70 | Market Researchers, Regional Sales Directors |

The Global Soft Drinks Market is valued at approximately USD 528 billion, reflecting a significant growth trend driven by consumer demand for convenience, innovative flavors, and health-conscious options.