Region:Global

Author(s):Shubham

Product Code:KRAA3175

Pages:92

Published On:August 2025

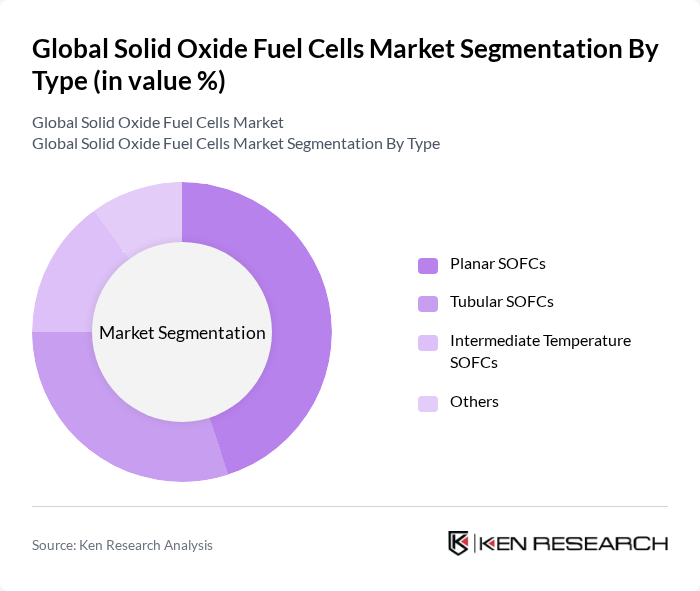

By Type:The market is segmented into various types of solid oxide fuel cells, including Planar SOFCs, Tubular SOFCs, Intermediate Temperature SOFCs, and Others. Among these, Planar SOFCs are currently leading the market due to their compact design, high power density, and efficiency, making them suitable for a wide range of stationary and distributed power applications. Tubular SOFCs also hold a significant share, particularly in industrial and large-scale power generation applications, due to their robustness, scalability, and ability to operate at high temperatures .

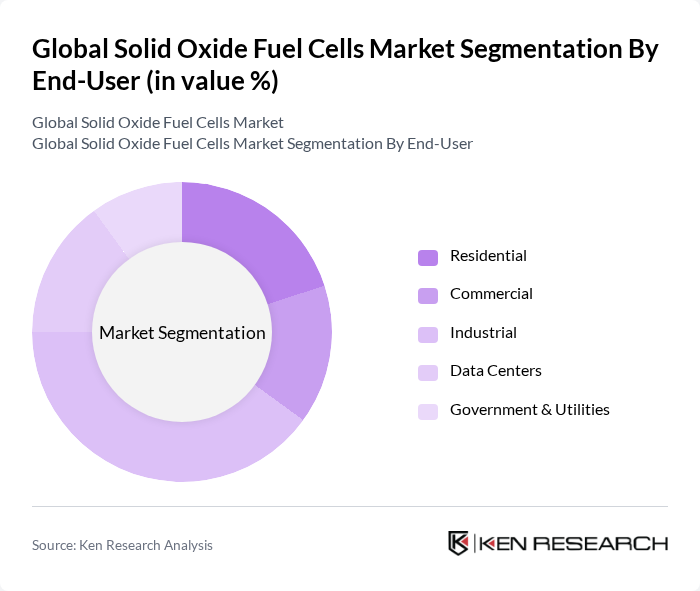

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Data Centers, and Government & Utilities. The Industrial segment is the dominant force in the market, driven by the increasing need for reliable and efficient power sources in manufacturing processes and the adoption of combined heat and power (CHP) systems. The growing trend toward energy independence, grid resilience, and sustainability in industrial operations further propels the demand for solid oxide fuel cells. Data Centers are also emerging as a significant segment, leveraging SOFCs for clean, decentralized backup power .

The Global Solid Oxide Fuel Cells Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bloom Energy Corporation, FuelCell Energy, Inc., Siemens Energy AG, Mitsubishi Power, Ltd., Ceres Power Holdings plc, Sunfire GmbH, Doosan Fuel Cell Co., Ltd., Aisin Corporation, Kyocera Corporation, Toshiba Energy Systems & Solutions Corporation, Convion Ltd., SolidPower S.p.A., Hexis AG, Elcogen AS, Ballard Power Systems Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solid oxide fuel cell market appears promising, driven by increasing investments in clean energy technologies and a growing emphasis on sustainability. As governments and industries prioritize carbon neutrality, the demand for efficient energy solutions will likely rise. Additionally, advancements in hydrogen production and storage technologies will enhance the feasibility of SOFCs, making them more attractive for various applications. The market is expected to evolve with innovative designs and materials, further boosting efficiency and reducing costs.

| Segment | Sub-Segments |

|---|---|

| By Type | Planar SOFCs Tubular SOFCs Intermediate Temperature SOFCs Others |

| By End-User | Residential Commercial Industrial Data Centers Government & Utilities |

| By Application | Power Generation Combined Heat and Power (CHP) Backup Power Systems Auxiliary Power Units (APU) Others |

| By Component | Fuel Processors Power Conditioning Units Balance of Plant Stack Module Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Sector Fuel Cells | 100 | Fleet Managers, Automotive Engineers |

| Stationary Power Applications | 80 | Facility Managers, Energy Directors |

| Portable Power Solutions | 60 | Product Managers, Technology Developers |

| Research Institutions and Academia | 50 | Research Scientists, Professors in Energy Studies |

| Government and Regulatory Bodies | 40 | Policy Makers, Energy Analysts |

The Global Solid Oxide Fuel Cells Market is valued at approximately USD 1.0 billion, reflecting a growing demand for clean and efficient energy solutions, supported by advancements in fuel cell technology and increasing investments in sustainable power generation.