Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8376

Pages:81

Published On:November 2025

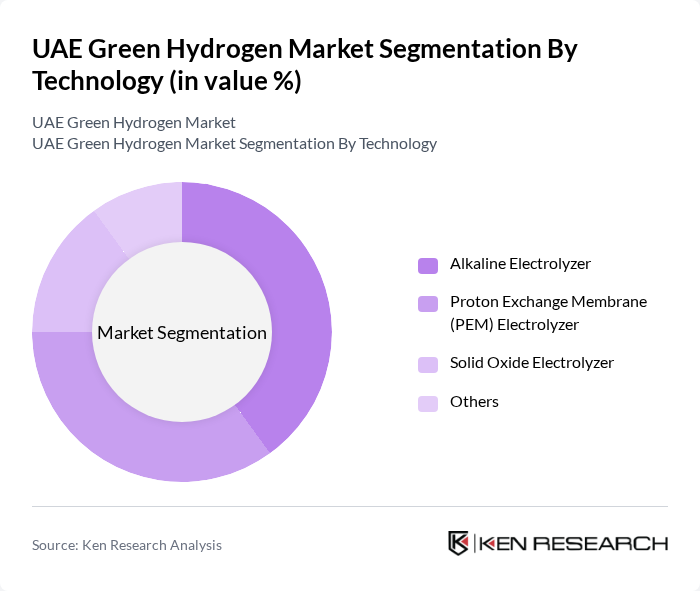

By Technology:The market is segmented into various technologies used for hydrogen production, including Alkaline Electrolyzer, Proton Exchange Membrane (PEM) Electrolyzer, Solid Oxide Electrolyzer, and Others. Each technology has its unique advantages and applications, influencing market dynamics and consumer preferences.

TheAlkaline Electrolyzersegment is currently dominating the market due to its cost-effectiveness and reliability in large-scale hydrogen production. This technology is widely adopted in various industrial applications, making it a preferred choice for companies looking to invest in green hydrogen. TheProton Exchange Membrane (PEM) Electrolyzeris also gaining traction, particularly in applications requiring high purity hydrogen, but its higher costs limit its widespread adoption compared to alkaline systems.

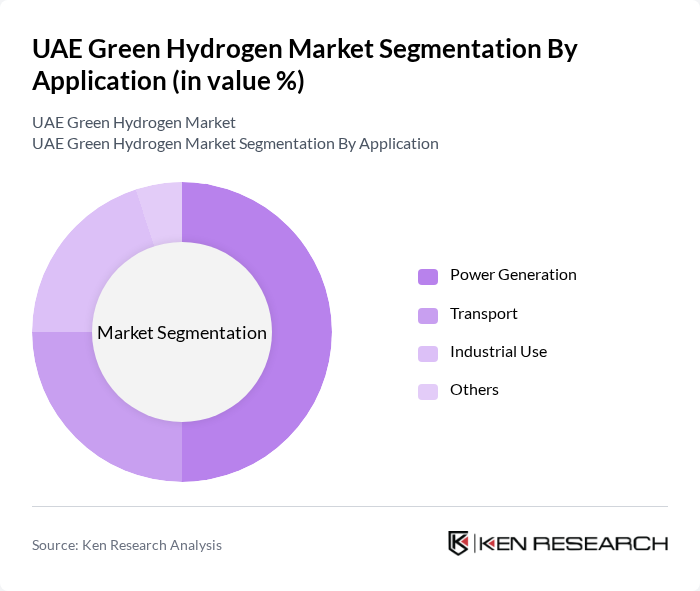

By Application:The market is segmented based on applications, including Power Generation, Transport, Industrial Use, and Others. Each application area presents unique opportunities and challenges, influencing the overall market landscape.

ThePower Generationapplication is leading the market, driven by the increasing demand for renewable energy sources and the integration of hydrogen into existing energy systems. This segment benefits from government initiatives aimed at enhancing energy security and reducing carbon footprints. TheTransportsector is also emerging as a significant application area, particularly with the rise of hydrogen fuel cell vehicles, although it currently lags behind power generation in terms of market share.

The UAE Green Hydrogen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Oil Company (ADNOC), Masdar, Siemens Energy, Air Products and Chemicals, Inc., Linde plc, Engie, TotalEnergies, Shell, Enel Green Power, Thyssenkrupp AG, Nel ASA, Ballard Power Systems, ITM Power, Green Hydrogen Systems, Hydrogenics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE green hydrogen market appears promising, driven by increasing investments in research and development, particularly in hydrogen production technologies. The integration of hydrogen into transportation and industrial processes is expected to gain momentum, aligning with global sustainability goals. Furthermore, the UAE's strategic location offers significant potential for exporting hydrogen to international markets, enhancing its role as a key player in the global energy transition and fostering economic diversification.

| Segment | Sub-Segments |

|---|---|

| By Technology (Alkaline Electrolyzer, Proton Exchange Membrane Electrolyzer, Solid Oxide Electrolyzer, Others) | Alkaline Electrolyzer Proton Exchange Membrane (PEM) Electrolyzer Solid Oxide Electrolyzer Others |

| By Application (Power Generation, Transport, Industrial Use, Others) | Power Generation Transport Industrial Use Others |

| By End-User (Utilities, Industrial, Commercial, Government, Others) | Utilities Industrial Commercial Government Others |

| By Region (Abu Dhabi, Dubai, Sharjah, Others) | Abu Dhabi Dubai Sharjah Others |

| By Distribution Channel (Pipeline, Cargo, Others) | Pipeline Cargo Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes, Others) | Domestic FDI PPP Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, Renewable Energy Certificates (RECs), Others) | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Hydrogen Production Facilities | 60 | Plant Managers, Operations Directors |

| Government Regulatory Bodies | 40 | Policy Makers, Energy Regulators |

| End-Users in Transportation Sector | 50 | Fleet Managers, Sustainability Officers |

| Research Institutions and Universities | 40 | Researchers, Academic Professors |

| Investors and Financial Analysts | 40 | Investment Managers, Financial Advisors |

The UAE Green Hydrogen Market is currently valued at approximately USD 8 million, reflecting a growing commitment to diversifying energy sources and reducing carbon emissions through significant investments in renewable energy infrastructure.