Global Soundbar Market Overview

- The Global Soundbar Market is valued at USD 4.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for high-quality audio solutions in home entertainment systems, the proliferation of smart TVs, and the rising popularity of streaming services, which heighten the need for superior sound quality. The market has seen a surge in consumer interest as soundbars offer a compact, efficient, and aesthetically pleasing alternative to traditional home theater systems, with features such as wireless connectivity and integration with smart home devices further boosting adoption .

- Key players in this market include the United States, Germany, and Japan, which dominate due to their advanced technology infrastructure, high consumer spending on electronics, and the presence of major soundbar manufacturers. These countries benefit from robust retail networks and a tech-savvy consumer base that prioritizes audio quality, smart home integration, and the latest advancements in sound technology .

- In 2023, the European Union implemented Commission Regulation (EU) 2019/2021, issued by the European Commission, which sets ecodesign requirements for electronic displays and related equipment, including soundbars. This regulation mandates that all soundbars sold within the EU must meet specific energy consumption criteria and display energy efficiency ratings, thereby promoting sustainability and reducing environmental impact. Manufacturers are required to ensure compliance with these standards and provide clear labeling to enable consumers to make informed choices .

Global Soundbar Market Segmentation

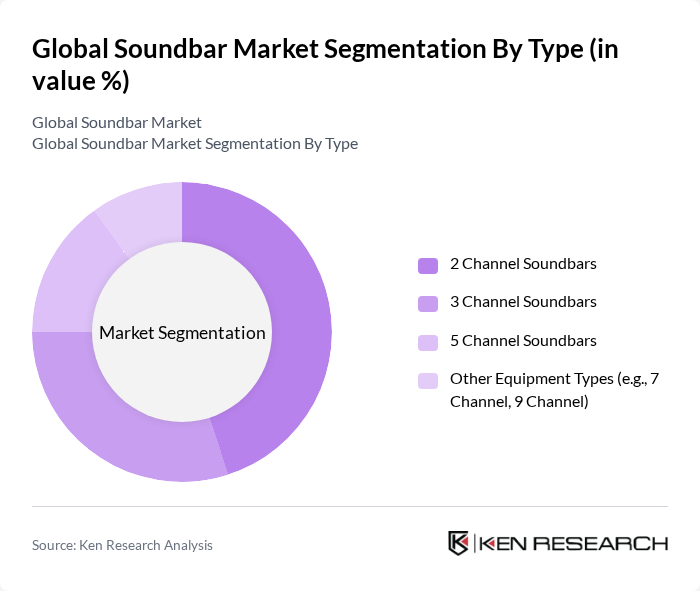

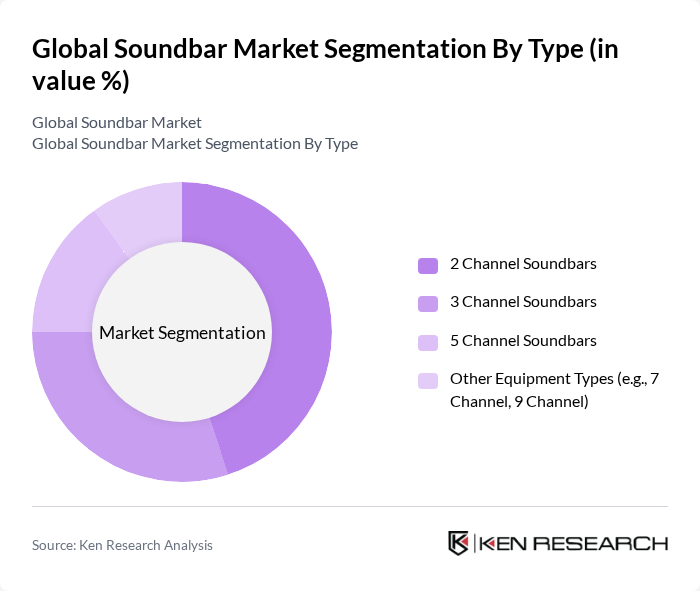

By Type:The soundbar market is segmented into various types, including 2 Channel Soundbars, 3 Channel Soundbars, 5 Channel Soundbars, and Other Equipment Types (e.g., 7 Channel, 9 Channel). Among these, 2 Channel Soundbars are currently leading the market due to their affordability, ease of use, and suitability for smaller living spaces, making them a popular choice for consumers seeking to enhance their audio experience without significant investment. The demand for 3 Channel and 5 Channel Soundbars is also growing, driven by consumers seeking more immersive sound experiences for home theaters and gaming applications .

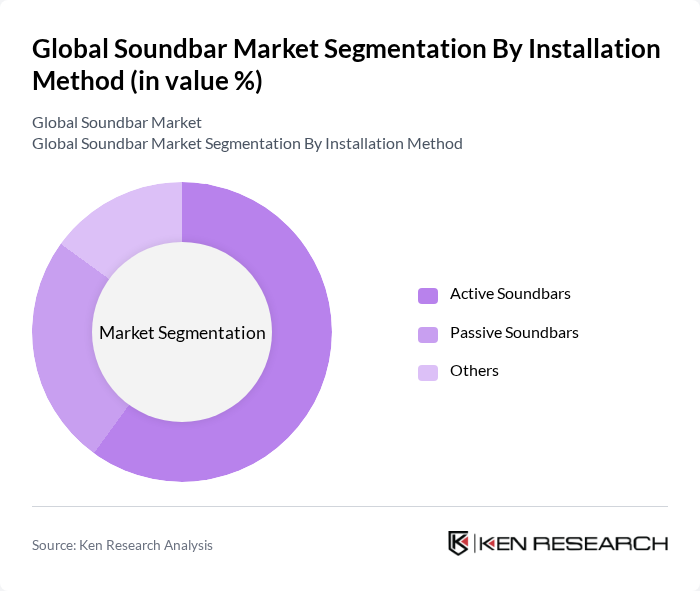

By Installation Method:The market is also segmented based on installation methods, which include Active Soundbars, Passive Soundbars, and Others. Active Soundbars dominate the market due to their built-in amplifiers, wireless connectivity, and ease of setup, appealing to consumers who prefer a plug-and-play solution. Passive Soundbars, while offering superior sound customization, require additional components such as external amplifiers, which can deter some buyers. The trend toward simplicity, convenience, and integration with smart home systems has solidified the position of Active Soundbars as the preferred choice among consumers .

Global Soundbar Market Competitive Landscape

The Global Soundbar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Group Corporation, Bose Corporation, Vizio, Inc., JBL (Harman International Industries, Incorporated), Sonos, Inc., Yamaha Corporation, Polk Audio (Sound United LLC), Klipsch Group, Inc. (VOXX International Corporation), Denon (Sound United LLC), Koninklijke Philips N.V., Sharp Corporation, Creative Technology Ltd., Anker Innovations Limited contribute to innovation, geographic expansion, and service delivery in this space.

Global Soundbar Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Home Entertainment Systems:The global home entertainment market is projected to reach $1,500 billion by 2025, driven by a surge in consumer interest in immersive audio experiences. In future, approximately 70% of households in Viet Nam reported owning a soundbar, reflecting a growing preference for high-quality audio solutions. This trend is further supported by the rise in disposable income, with an average increase of 6.2% in household income in Viet Nam, enabling consumers to invest in premium audio equipment.

- Rising Adoption of Smart Home Technologies:The smart home market in Viet Nam is expected to grow to $200 billion by 2025, with soundbars increasingly integrated into these ecosystems. In future, around 55% of soundbar sales were attributed to smart models featuring voice control and connectivity with other smart devices. This integration enhances user experience and convenience, driving demand as consumers seek seamless connectivity and automation in their home entertainment systems.

- Growth in Streaming Services and Digital Content Consumption:The number of streaming service subscriptions in Viet Nam reached 90 million in future, a 25% increase from the previous year. This surge in digital content consumption has led to a corresponding rise in demand for soundbars, as consumers seek to enhance their viewing experience. With an average of 4.2 streaming services per household, the need for superior audio quality has become paramount, further propelling soundbar sales in the region.

Market Challenges

- Intense Competition Among Manufacturers:The soundbar market in Viet Nam is characterized by fierce competition, with over 70 brands vying for market share. This saturation has led to aggressive pricing strategies, with some manufacturers reducing prices by up to 20% in future to attract consumers. Such competition can erode profit margins, making it challenging for companies to maintain sustainable growth while investing in innovation and marketing.

- Price Sensitivity Among Consumers:In Viet Nam, approximately 80% of consumers consider price as a primary factor when purchasing soundbars. With the average price of soundbars ranging from $200 to $600, many consumers are opting for budget-friendly options. This price sensitivity is exacerbated by economic uncertainties, leading to a cautious approach in consumer spending, which poses a challenge for premium soundbar manufacturers aiming to capture higher-end market segments.

Global Soundbar Market Future Outlook

The future of the soundbar market in Viet Nam appears promising, driven by technological advancements and evolving consumer preferences. As manufacturers increasingly focus on integrating advanced features such as voice assistants and multi-room audio systems, the demand for innovative sound solutions is expected to rise. Additionally, the shift towards eco-friendly products will likely influence purchasing decisions, prompting brands to adopt sustainable practices and materials in their offerings, thereby enhancing their market appeal.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets in Viet Nam present significant growth opportunities, with a projected increase in soundbar adoption rates by 40% by 2025. As urbanization accelerates and disposable incomes rise, manufacturers can tap into these markets by offering affordable yet high-quality soundbar options tailored to local preferences.

- Development of Wireless and Portable Soundbars:The demand for wireless and portable soundbars is on the rise, with sales expected to increase by 30% in Viet Nam in future. This trend is driven by consumer preferences for convenience and flexibility, creating opportunities for manufacturers to innovate and capture a larger share of the market by introducing versatile audio solutions.