Region:Global

Author(s):Geetanshi

Product Code:KRAB0125

Pages:86

Published On:August 2025

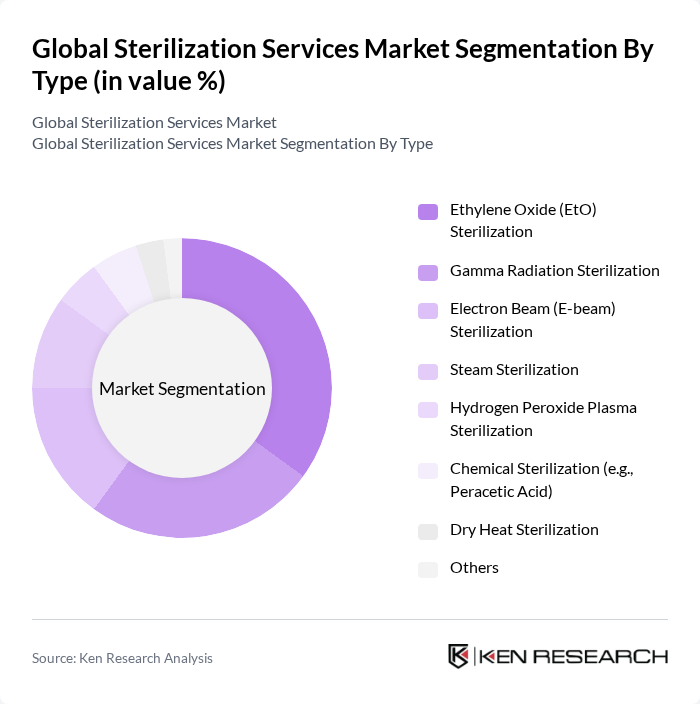

By Type:The sterilization services market is segmented into various types, including Ethylene Oxide (EtO) Sterilization, Gamma Radiation Sterilization, Electron Beam (E-beam) Sterilization, Steam Sterilization, Hydrogen Peroxide Plasma Sterilization, Chemical Sterilization (e.g., Peracetic Acid), Dry Heat Sterilization, and Others. Among these, Ethylene Oxide (EtO) Sterilization remains the most widely used method due to its effectiveness in sterilizing heat- and moisture-sensitive medical devices and instruments. The growing demand for this method is driven by its ability to penetrate complex geometries and provide a high level of sterility assurance .

By End-User:The end-user segmentation includes Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Medical Device Manufacturers, Research & Academic Laboratories, Food & Beverage Industry, Contract Sterilization Service Providers, and Others. Hospitals & Clinics represent the largest segment due to the increasing number of surgical procedures and the rising focus on infection control. The demand for sterilization services in this sector is driven by the need to ensure patient safety and comply with regulatory standards .

The Global Sterilization Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sterigenics International LLC, STERIS plc, E-BEAM Services, Inc., Medistri SA, North American Science Associates, Inc. (NAMSA), Cantel Medical LLC (a STERIS company), 3M Company, Johnson & Johnson (Advanced Sterilization Products), Becton, Dickinson and Company (BD), Getinge AB, Aesculap, Inc. (a B. Braun company), Advanced Sterilization Products (ASP, a Fortive company), Stryker Corporation, Thermo Fisher Scientific Inc., Hu-Friedy Mfg. Co., LLC (a Cantel Medical company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sterilization services market appears promising, driven by ongoing advancements in technology and a growing emphasis on infection control. As healthcare facilities increasingly adopt automated sterilization processes and integrate IoT for monitoring, operational efficiencies are expected to improve. Additionally, the expansion of sterilization services into emerging markets will likely create new revenue streams, while the focus on sustainability will drive the development of eco-friendly sterilization technologies, further enhancing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethylene Oxide (EtO) Sterilization Gamma Radiation Sterilization Electron Beam (E-beam) Sterilization Steam Sterilization Hydrogen Peroxide Plasma Sterilization Chemical Sterilization (e.g., Peracetic Acid) Dry Heat Sterilization Others |

| By End-User | Hospitals & Clinics Pharmaceutical & Biotechnology Companies Medical Device Manufacturers Research & Academic Laboratories Food & Beverage Industry Contract Sterilization Service Providers Others |

| By Application | Surgical Instruments Medical Devices & Implants Laboratory Equipment & Consumables Pharmaceuticals & Biologics Food Packaging & Products Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Service Type | Contract Sterilization Services In-House Sterilization Services Validation & Testing Services Consulting & Regulatory Compliance Services Others |

| By Technology | Conventional Sterilization Technologies Advanced Sterilization Technologies (e.g., Low-Temperature, Plasma, Ozone) Automated Sterilization Systems Others |

| By Pricing Model | Pay-Per-Use Subscription-Based Project-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Sterilization Services | 100 | Hospital Administrators, Infection Control Officers |

| Medical Device Sterilization | 80 | Manufacturing Managers, Quality Assurance Specialists |

| Outsourced Sterilization Providers | 60 | Operations Managers, Business Development Executives |

| Regulatory Compliance in Sterilization | 50 | Regulatory Affairs Managers, Compliance Officers |

| Emerging Technologies in Sterilization | 40 | Research Scientists, Technology Development Managers |

The Global Sterilization Services Market is valued at approximately USD 5.98 billion, reflecting significant growth driven by increased demand for sterilization in healthcare settings, rising surgical procedures, and advancements in sterilization technologies.