Region:Middle East

Author(s):Rebecca

Product Code:KRAD7378

Pages:100

Published On:December 2025

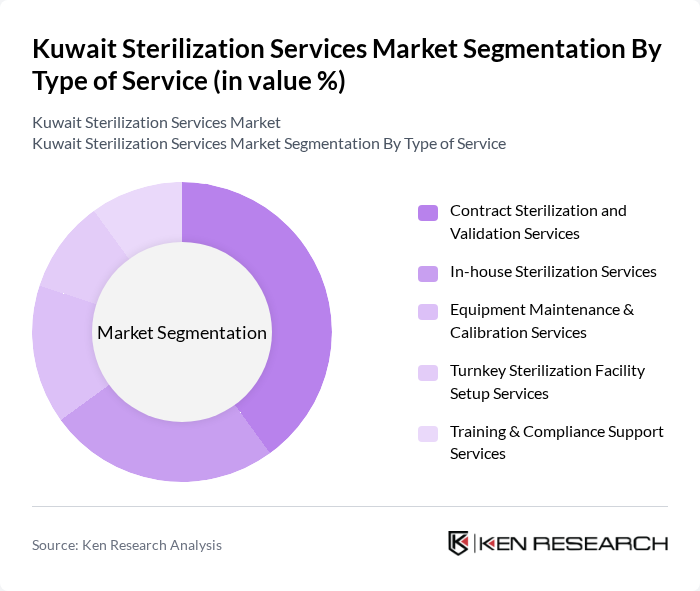

By Type of Service:The market is segmented into various types of services, including contract sterilization and validation services, in-house sterilization services, equipment maintenance and calibration services, turnkey sterilization facility setup services, and training and compliance support services. Among these, contract sterilization and validation services are leading due to their cost-effectiveness and the ability to meet regulatory compliance efficiently. The trend towards outsourcing sterilization processes is also gaining traction, as it allows healthcare facilities to focus on core operations while ensuring high standards of sterilization.

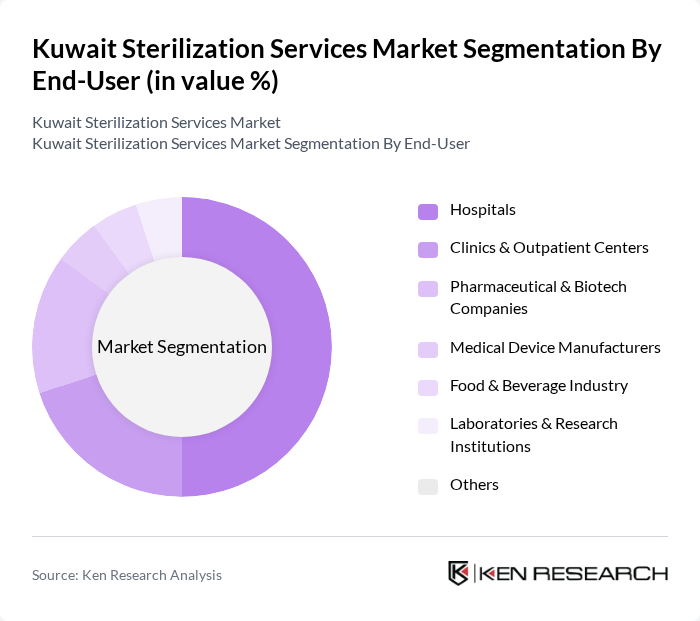

By End-User:The end-user segmentation includes hospitals, clinics and outpatient centers, pharmaceutical and biotech companies, medical device manufacturers, food and beverage industry, laboratories and research institutions, and others. Hospitals are the leading end-users, driven by the increasing number of surgical procedures and the need for stringent sterilization protocols to prevent infections. The growing emphasis on patient safety and regulatory compliance in healthcare settings further propels the demand for sterilization services.

The Kuwait Sterilization Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Kuwait Danish Dairy Company (KDD), Kuwait Hospital Sterile Services Departments (SSDs) – Ministry of Health Network, Mubarak Al-Kabeer Hospital Central Sterile Services Department, Jaber Al-Ahmad Hospital Central Sterile Services Department, New Mowasat Hospital – Infection Control & Sterilization Services, Dar Al Shifa Hospital – Central Sterilization Unit, Al Salam International Hospital – Sterilization & Infection Control Services, Royale Hayat Hospital – Sterile Processing Department, Kuwait Cancer Control Center – Sterilization & Central Services, Advanced Technology Company K.S.C. (ATC) – Sterilization Solutions & Services, Gulf Cryo – Medical Gas & Related Sterilization Support Services, Bader Sultan & Brothers Co. W.L.L. – Infection Control & Sterilization Solutions, United Medical Services Company (UMS) – Healthcare Facility Management & Sterile Services, Kuwait Life Sciences Company (KLSC) – Medical Technologies & Sterilization Support contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait sterilization services market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the government continues to prioritize public health initiatives, the demand for efficient sterilization solutions is expected to rise. Furthermore, the integration of automated systems and eco-friendly practices will likely shape the market landscape, enhancing operational efficiency and sustainability. These trends indicate a robust growth trajectory for the sterilization services sector in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type of Service | Contract Sterilization and Validation Services In-house Sterilization Services Equipment Maintenance & Calibration Services Turnkey Sterilization Facility Setup Services Training & Compliance Support Services |

| By End-User | Hospitals Clinics & Outpatient Centers Pharmaceutical & Biotech Companies Medical Device Manufacturers Food & Beverage Industry Laboratories & Research Institutions Others |

| By Application | Surgical Instruments Medical Devices & Disposables Pharmaceutical & Biologic Products Laboratory Equipment & Glassware Food Packaging & Contact Materials Others |

| By Sterilization Method | Ethylene Oxide (EtO) Sterilization Services Steam (Autoclave) Sterilization Services Low-Temperature Hydrogen Peroxide / Plasma Sterilization Services Radiation (Gamma / E-beam) Sterilization Services Chemical / Ozone / Other Advanced Sterilization Services |

| By Mode of Delivery | Off-site / Centralized Sterilization Services On-site Sterilization Services (within customer facilities) Hybrid / Managed Sterile Services |

| By Regulatory Compliance | Facilities compliant with Kuwait MOH & Municipal Regulations Facilities certified to ISO 13485 / ISO 11135 / ISO 14937 Facilities serving CE-marked / EU-regulated products Facilities serving US FDA-regulated products Others |

| By Customer Profile | Large Integrated Healthcare Systems Standalone Hospitals & Clinics Small and Medium Enterprises (Pharma, Device, Food) Government & Military Institutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Sterilization Services | 120 | Hospital Administrators, Infection Control Officers |

| Outpatient Clinic Sterilization | 90 | Clinic Managers, Medical Directors |

| Laboratory Sterilization Practices | 70 | Lab Managers, Quality Assurance Officers |

| Dental Clinic Sterilization | 60 | Dentists, Dental Hygienists |

| Veterinary Sterilization Services | 50 | Veterinarians, Veterinary Clinic Managers |

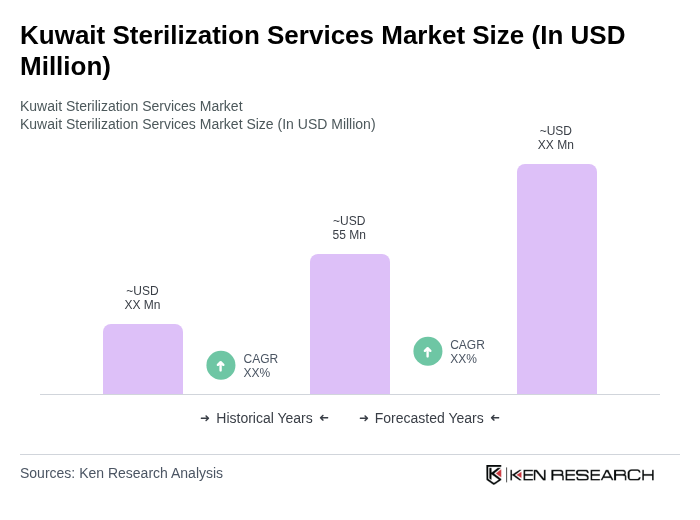

The Kuwait Sterilization Services Market is valued at approximately USD 55 million, reflecting a five-year historical analysis. This growth is driven by increasing demand in healthcare, pharmaceuticals, and food processing sectors, alongside heightened awareness of infection control.