Region:Global

Author(s):Geetanshi

Product Code:KRAA2754

Pages:96

Published On:August 2025

Market.png)

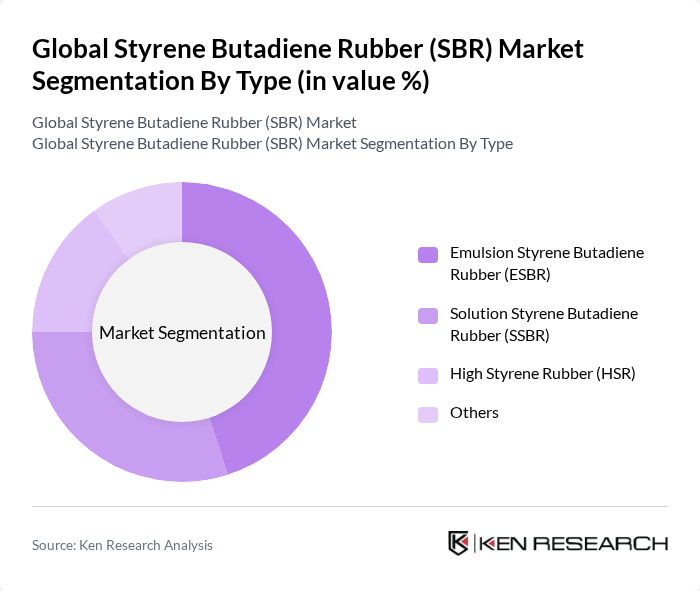

By Type:The SBR market is segmented into four main types:Emulsion Styrene Butadiene Rubber (ESBR),Solution Styrene Butadiene Rubber (SSBR),High Styrene Rubber (HSR), andOthers. Among these, ESBR is the most widely used due to its superior performance in tire manufacturing, providing excellent abrasion resistance and aging stability. SSBR is gaining traction in high-performance tires, offering improved wet grip and lower rolling resistance. HSR is utilized in specialized applications requiring high styrene content, while the "Others" category includes niche products for specific industrial needs.

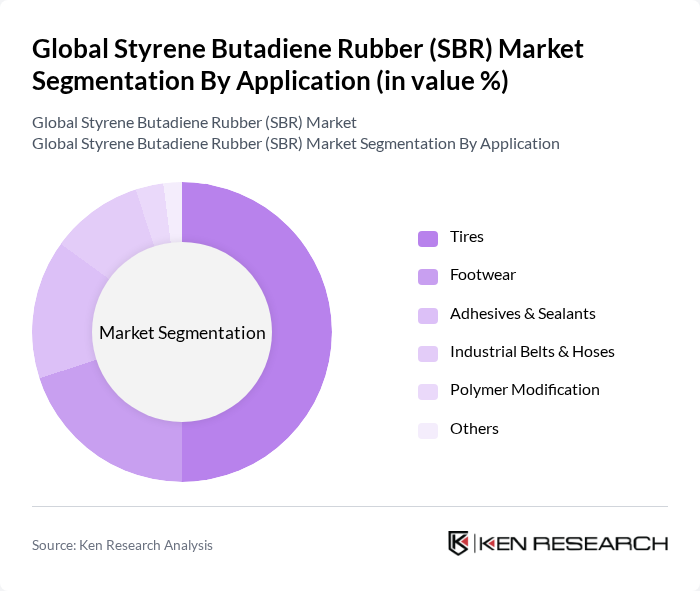

By Application:The applications of SBR are diverse, includingTires,Footwear,Adhesives & Sealants,Industrial Belts & Hoses,Polymer Modification, andOthers. The tire segment dominates the market, accounting for more than half of global SBR consumption, due to the increasing production of vehicles and the demand for high-performance tires. Footwear applications are significant, driven by the expanding fashion and sportswear industries. Adhesives and sealants are gaining popularity in construction and automotive sectors, while industrial belts and hoses are essential for various manufacturing processes. Polymer modification and other niche applications continue to grow as SBR’s versatility is recognized across industries.

The Global Styrene Butadiene Rubber (SBR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bridgestone Corporation, Michelin SCA, The Goodyear Tire & Rubber Company, Continental AG, Lanxess AG, Kraton Corporation, Asahi Kasei Corporation, LG Chem Ltd., China Petroleum & Chemical Corporation (Sinopec), TSRC Corporation, Kumho Petrochemical Co., Ltd., Repsol S.A., ExxonMobil Chemical Company, Dow Chemical Company, Chevron Phillips Chemical Company LLC, Reliance Industries Limited, Arlanxeo, Zeon Corporation, JSR Corporation, Versalis S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SBR market appears promising, driven by technological advancements and increasing applications across various industries. The shift towards sustainable practices is likely to encourage innovation in eco-friendly SBR formulations, enhancing market appeal. Additionally, the expansion of e-commerce platforms is expected to facilitate greater accessibility to SBR products, allowing manufacturers to reach a broader customer base. As industries adapt to changing consumer preferences, the SBR market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Emulsion Styrene Butadiene Rubber (ESBR) Solution Styrene Butadiene Rubber (SSBR) High Styrene Rubber (HSR) Others |

| By Application | Tires Footwear Adhesives & Sealants Industrial Belts & Hoses Polymer Modification Others |

| By End-User | Automotive Construction & Infrastructure Consumer Goods Industrial Manufacturing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Product Form | Granules Sheets Liquid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Tire Manufacturers | 120 | Production Managers, R&D Heads |

| Footwear Industry Suppliers | 90 | Product Development Managers, Procurement Officers |

| Adhesives and Sealants Producers | 60 | Technical Directors, Quality Assurance Managers |

| Industrial Rubber Product Manufacturers | 50 | Operations Managers, Supply Chain Analysts |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Analysts |

The Global Styrene Butadiene Rubber (SBR) Market is valued at approximately USD 15 billion, driven by increasing demand in the automotive industry and advancements in manufacturing technologies that enhance product performance and sustainability.