Region:North America

Author(s):Rebecca

Product Code:KRAA9386

Pages:82

Published On:November 2025

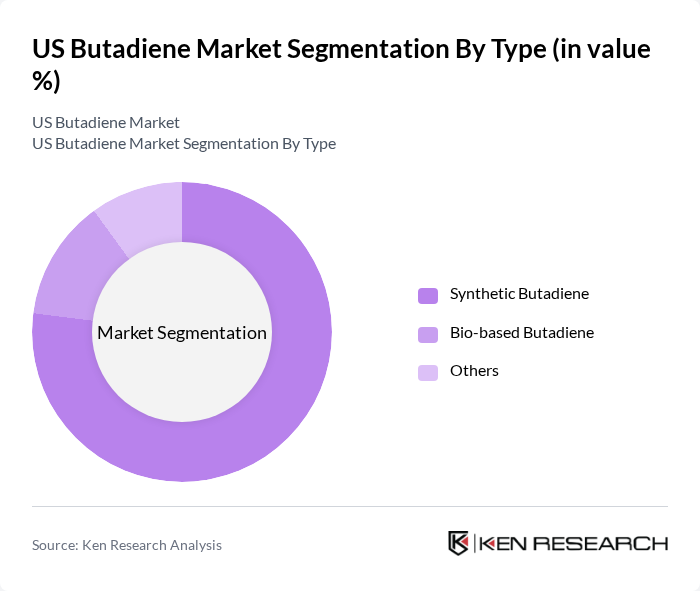

By Type:The butadiene market is segmented into three main types: Synthetic Butadiene, Bio-based Butadiene, and Others. Synthetic Butadiene remains the most widely used type due to its cost-effectiveness and high demand in the production of synthetic rubber and plastics. Bio-based Butadiene is gaining traction as companies seek sustainable alternatives, while the 'Others' category includes various niche products that cater to specific applications .

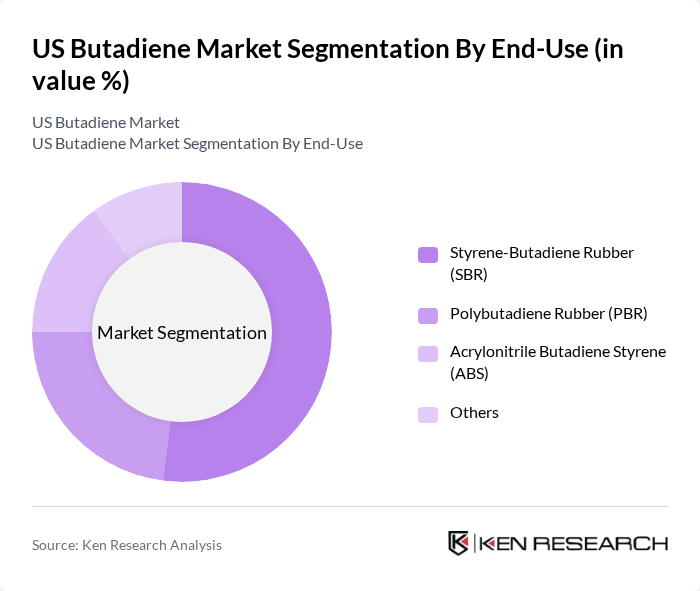

By End-Use:The end-use segment of the butadiene market includes Styrene-Butadiene Rubber (SBR), Polybutadiene Rubber (PBR), Acrylonitrile Butadiene Styrene (ABS), and Others. SBR is the leading end-use segment, primarily due to its extensive application in tire manufacturing. PBR is significant for its use in various rubber products, while ABS is favored in the automotive and consumer goods sectors. The 'Others' category encompasses diverse applications such as adhesives, coatings, and specialty polymers .

The US Butadiene Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical, LyondellBasell Industries, Shell Chemical Company, TPC Group, Braskem, INEOS Group, BASF Corporation, Eastman Chemical Company, Chevron Phillips Chemical Company, SABIC, Formosa Plastics Corporation, U.S.A., Versalis S.p.A., LG Chem Ltd., Mitsubishi Chemical Group Corporation, Reliance Industries Limited contribute to innovation, geographic expansion, and service delivery in this space.

The US butadiene market is poised for significant transformation as it adapts to evolving consumer preferences and regulatory landscapes. The shift towards sustainable production methods is expected to gain momentum, driven by both consumer demand and government initiatives. Additionally, advancements in digital manufacturing technologies will enhance operational efficiencies. As companies increasingly focus on integrating circular economy principles, the market will likely witness innovative applications of butadiene in high-performance materials, further solidifying its relevance in various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Butadiene Bio-based Butadiene Others |

| By End-Use | Styrene-Butadiene Rubber (SBR) Polybutadiene Rubber (PBR) Acrylonitrile Butadiene Styrene (ABS) Others |

| By Application | Tire Manufacturing Plastics & Polymers Adhesives and Sealants Others |

| By Distribution Channel | Direct Sales Indirect Sales Online Sales Others |

| By Geography | Northeast Midwest South West Southwest Southeast |

| By Production Process | Steam Cracking Catalytic Dehydrogenation Others |

| By Market Structure | Oligopoly Monopoly Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 120 | Product Managers, R&D Directors |

| Rubber Manufacturing Sector | 90 | Procurement Managers, Operations Heads |

| Plastics and Polymers Market | 70 | Supply Chain Managers, Technical Sales Representatives |

| Chemical Processing Facilities | 60 | Plant Managers, Process Engineers |

| Research Institutions and Academia | 50 | Research Scientists, Academic Professors |

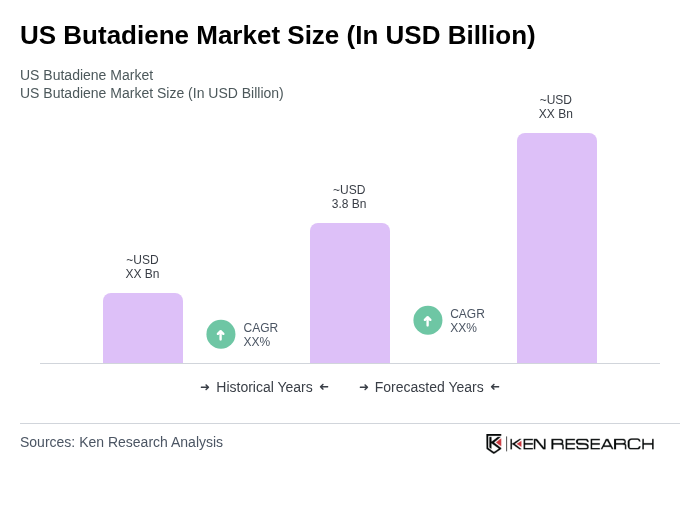

The US Butadiene Market is valued at approximately USD 3.8 billion, driven by the increasing demand for synthetic rubber in automotive and tire manufacturing, as well as the rising production of plastics and polymers.