Region:Global

Author(s):Shubham

Product Code:KRAA0850

Pages:82

Published On:August 2025

By Type:The market is segmented into various types, including Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Inventory & Order Management, Supply Chain Planning & Analytics, Procurement & Sourcing Solutions, Manufacturing Execution Systems (MES), and Others (e.g., Supplier Management, Demand Forecasting). Among these, Transportation Management Systems (TMS) is the leading subsegment, driven by the increasing need for efficient transportation logistics, real-time tracking, and route optimization. Businesses are increasingly adopting TMS solutions to reduce shipping costs, improve delivery reliability, and enhance customer satisfaction. Warehouse Management Systems (WMS) are also experiencing strong adoption, supported by the growth of e-commerce and the need for automation and real-time inventory visibility .

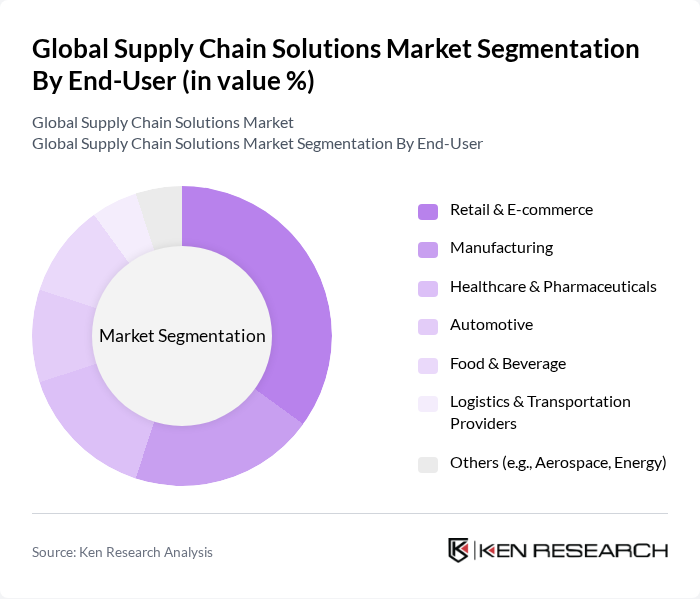

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, Logistics & Transportation Providers, and Others (e.g., Aerospace, Energy). The Retail & E-commerce sector is the dominant end-user, fueled by the rapid growth of online shopping, omnichannel distribution, and the need for agile supply chain solutions to manage inventory and fulfill orders promptly. Manufacturing is also a significant segment, with increasing adoption of digital supply chain platforms to enhance visibility, reduce costs, and improve supplier collaboration. Healthcare & Pharmaceuticals are rapidly adopting supply chain solutions to ensure regulatory compliance, product traceability, and timely delivery .

The Global Supply Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Blue Yonder (formerly JDA Software), Manhattan Associates, Kinaxis Inc., Infor, Descartes Systems Group, Coupa Software, E2open, C.H. Robinson Worldwide, Inc., XPO Logistics, Inc., DHL Supply Chain, Kuehne + Nagel International AG, Ryder System, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the supply chain solutions market in None is poised for transformative growth, driven by digital transformation and sustainability initiatives. As companies increasingly adopt AI and automation, operational efficiencies will improve, enabling faster response times and reduced costs. Additionally, the focus on sustainable practices will shape supply chain strategies, with businesses prioritizing eco-friendly logistics solutions. These trends will not only enhance competitiveness but also align with evolving consumer expectations for responsible sourcing and delivery practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Inventory & Order Management Supply Chain Planning & Analytics Procurement & Sourcing Solutions Manufacturing Execution Systems (MES) Others (e.g., Supplier Management, Demand Forecasting) |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Logistics & Transportation Providers Others (e.g., Aerospace, Energy) |

| By Component | Software Hardware (e.g., RFID, IoT Devices, Robotics) Services (Consulting, Implementation, Managed Services) |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales/Cloud Marketplaces |

| By Deployment Mode | On-premise Cloud-based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Solutions | 100 | Supply Chain Managers, Logistics Coordinators |

| Manufacturing Process Optimization | 90 | Operations Directors, Production Managers |

| Healthcare Logistics Management | 80 | Pharmaceutical Supply Chain Leads, Hospital Logistics Managers |

| Technology Integration in Supply Chains | 70 | IT Managers, Digital Transformation Officers |

| Global Freight Forwarding Trends | 60 | Freight Managers, International Trade Specialists |

The Global Supply Chain Solutions Market is valued at approximately USD 25 billion, driven by the increasing demand for efficient logistics and supply chain management solutions, particularly in sectors like retail, manufacturing, and healthcare.