Region:Asia

Author(s):Geetanshi

Product Code:KRAA0255

Pages:88

Published On:August 2025

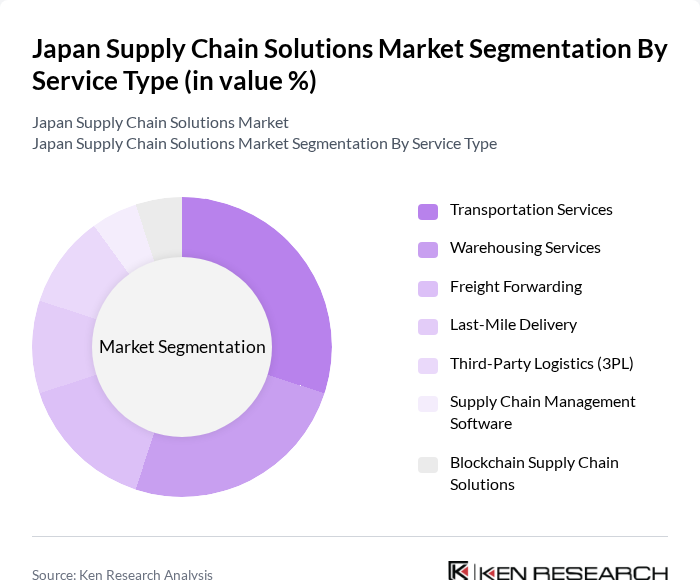

By Service Type:The service type segmentation includes various subsegments such as Transportation Services, Warehousing Services, Freight Forwarding, Last-Mile Delivery, Third-Party Logistics (3PL), Supply Chain Management Software, and Blockchain Supply Chain Solutions. Each of these subsegments plays a crucial role in the overall supply chain ecosystem, addressing diverse logistical requirements and supporting operational efficiencies through digitalization, automation, and real-time data analytics .

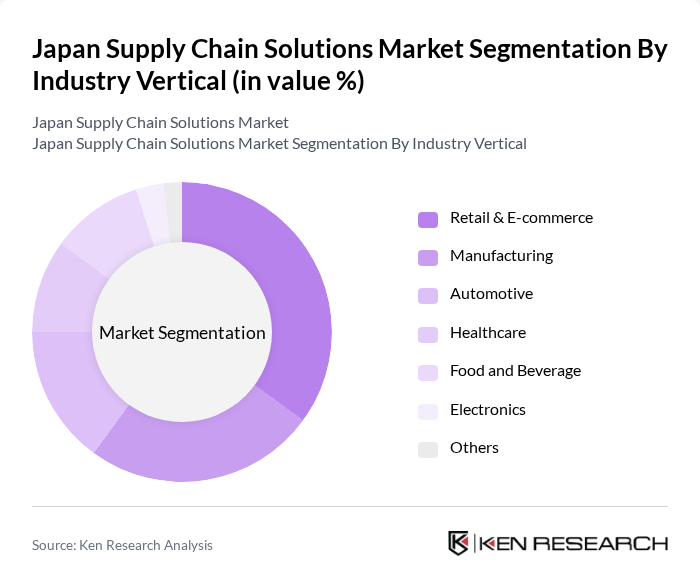

By Industry Vertical:The industry vertical segmentation encompasses Retail & E-commerce, Manufacturing, Automotive, Healthcare, Food and Beverage, Electronics, and Others. Each sector has unique supply chain requirements, influencing the demand for tailored solutions that enhance efficiency, traceability, and responsiveness to market changes .

The Japan Supply Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Holdings, Yamato Holdings Co., Ltd., Kintetsu World Express, Inc., Hitachi Transport System, Ltd. (now LOGISTEED, Ltd.), Sagawa Express Co., Ltd., Seino Holdings Co., Ltd., Mitsui-Soko Holdings Co., Ltd., Marubeni Corporation, Fujitsu Limited, Panasonic Connect Co., Ltd., Toyota Tsusho Corporation, DENSO Corporation, Asahi Logistics Co., Ltd., NTT Data Corporation, Rakuten Group, Inc., and SoftBank Group Corp. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan supply chain solutions market appears promising, driven by technological innovations and a growing emphasis on sustainability. As companies increasingly adopt digital solutions and automation, operational efficiencies are expected to improve significantly. Furthermore, the integration of IoT and real-time data analytics will enhance supply chain visibility and responsiveness. These trends indicate a shift towards more agile and resilient supply chains, positioning businesses to better navigate future challenges and capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Services Warehousing Services Freight Forwarding Last-Mile Delivery Third-Party Logistics (3PL) Supply Chain Management Software Blockchain Supply Chain Solutions |

| By Industry Vertical | Retail & E-commerce Manufacturing Automotive Healthcare Food and Beverage Electronics Others |

| By Region | Kanto (Tokyo, etc.) Kansai/Kinki (Osaka, etc.) Chubu (Nagoya, etc.) Kyushu-Okinawa Tohoku Chugoku Hokkaido Shikoku |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Technology | Cloud-Based Solutions On-Premise Solutions IoT-Enabled Solutions AI and Automation Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Solutions | 100 | Supply Chain Managers, Operations Directors |

| Retail Logistics Optimization | 60 | Logistics Coordinators, Inventory Managers |

| Technology Integration in Supply Chains | 50 | IT Managers, Digital Transformation Leads |

| Cold Chain Logistics for Food Products | 40 | Quality Assurance Managers, Supply Chain Analysts |

| Last-Mile Delivery Solutions | 50 | Delivery Operations Managers, Customer Experience Leads |

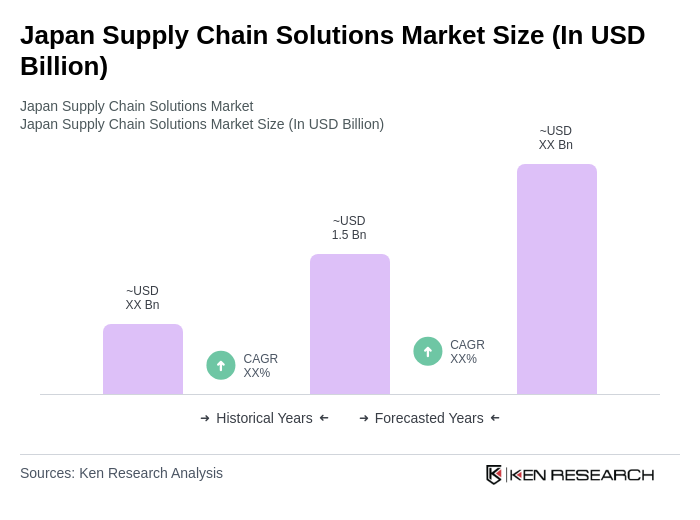

The Japan Supply Chain Solutions Market is valued at approximately USD 1.5 billion, driven by the increasing demand for efficient logistics and supply chain management solutions, particularly due to the rise of e-commerce and advanced digital technologies.