Region:Global

Author(s):Rebecca

Product Code:KRAD0241

Pages:88

Published On:August 2025

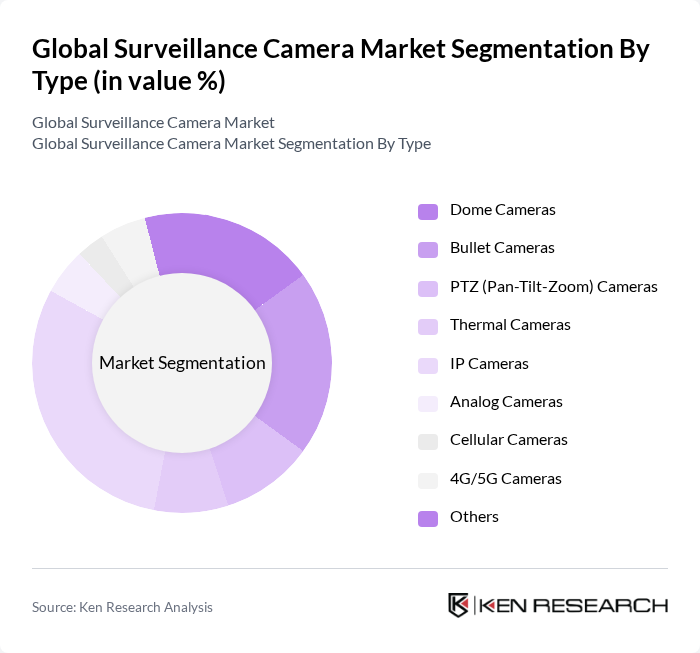

By Type:The market is segmented into Dome Cameras, Bullet Cameras, PTZ (Pan-Tilt-Zoom) Cameras, Thermal Cameras, IP Cameras, Analog Cameras, Cellular Cameras, 4G/5G Cameras, and Others. Among these, IP Cameras dominate the market, driven by high-resolution imaging, ease of installation, and seamless integration with cloud-based and AI-powered systems. The growing adoption of smart home and business solutions, along with features such as remote access, real-time monitoring, and advanced analytics, continues to propel the demand for IP Cameras .

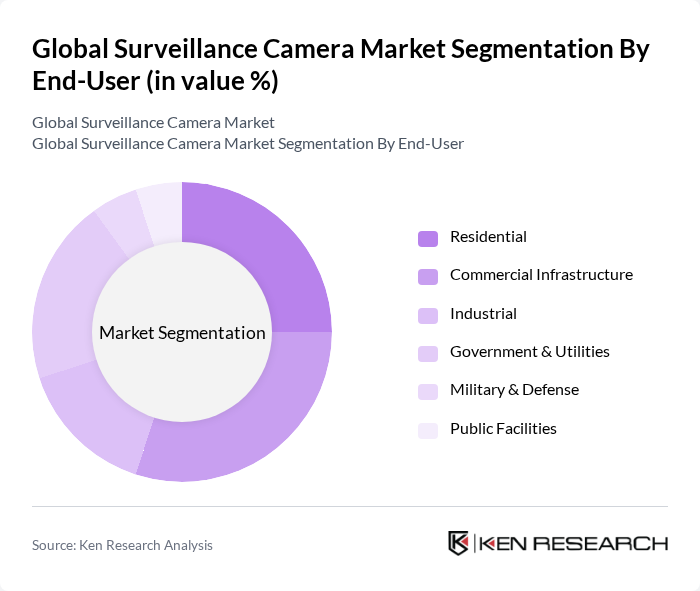

By End-User:The market is segmented by end-users, including Residential, Commercial Infrastructure, Industrial, Government & Utilities, Military & Defense, and Public Facilities. The Residential segment is experiencing robust growth, fueled by heightened consumer awareness of home security, the proliferation of smart home technologies, and the increasing popularity of DIY security solutions. Commercial infrastructure remains the largest segment, driven by the need for advanced security in offices, retail, and public venues. Industrial, government, and utility sectors are also adopting surveillance solutions to enhance safety and compliance .

The Global Surveillance Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems (Robert Bosch GmbH), Hanwha Vision Co., Ltd. (formerly Hanwha Techwin), Teledyne FLIR LLC (formerly FLIR Systems, Inc.), Panasonic Holdings Corporation, Sony Group Corporation, Avigilon Corporation (Motorola Solutions), Johnson Controls International plc (Tyco), Genetec Inc., Honeywell International Inc., Motorola Solutions, Inc., ADT Inc., Vicon Industries, Inc., Canon Inc., Schneider Electric SE, Costar Technologies, Inc., JVCKENWOOD Corporation, and Xiaomi Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surveillance camera market appears promising, driven by technological advancements and increasing urbanization. As cities continue to evolve into smart environments, the integration of AI and IoT technologies will enhance surveillance capabilities, making systems more efficient and user-friendly. Furthermore, the growing emphasis on cybersecurity will lead to the development of more secure surveillance solutions, ensuring data integrity and privacy, which are critical for consumer trust and market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Dome Cameras Bullet Cameras PTZ (Pan-Tilt-Zoom) Cameras Thermal Cameras IP Cameras Analog Cameras Cellular Cameras G/5G Cameras Others |

| By End-User | Residential Commercial Infrastructure Industrial Government & Utilities Military & Defense Public Facilities |

| By Application | Retail Security Traffic Monitoring Public Safety Home Security Corporate Surveillance Critical Infrastructure Protection Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC) Latin America (Brazil, Rest of LATAM) Middle East & Africa (KSA, UAE, South Africa, Rest of MEA) |

| By Price Range | Low-End Cameras Mid-Range Cameras High-End Cameras |

| By Technology | Wired Surveillance Systems Wireless Surveillance Systems Cloud-Based Surveillance Systems AI-Enabled Surveillance Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Sector Surveillance | 100 | Facility Managers, Security Directors |

| Residential Security Solutions | 60 | Homeowners, Property Managers |

| Public Safety Applications | 50 | Law Enforcement Officials, City Planners |

| Transportation Security Systems | 40 | Transport Managers, Safety Officers |

| Retail Surveillance Strategies | 50 | Loss Prevention Managers, Store Owners |

The Global Surveillance Camera Market is valued at approximately USD 54 billion, driven by increasing security concerns, technological advancements, and the demand for smart surveillance solutions across various sectors, including residential, commercial, and government.