Region:Asia

Author(s):Geetanshi

Product Code:KRAD0043

Pages:80

Published On:August 2025

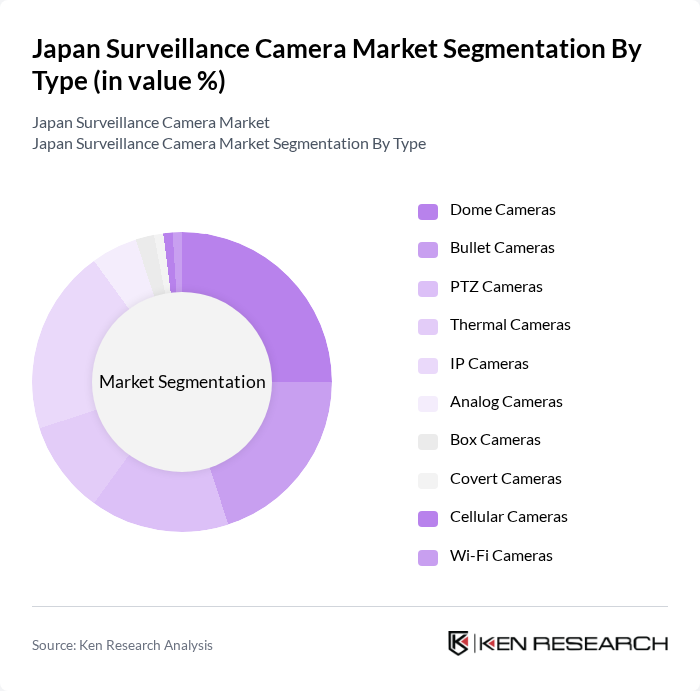

By Type:The market is segmented into various types of surveillance cameras, including Dome Cameras, Bullet Cameras, PTZ Cameras, Thermal Cameras, IP Cameras, Analog Cameras, Box Cameras, Covert Cameras, Cellular Cameras, and Wi-Fi Cameras. Each type serves different purposes and is preferred in various applications based on features such as resolution, connectivity (wired, wireless, cellular), and suitability for indoor or outdoor use. Dome and bullet cameras are widely used for general surveillance, PTZ cameras for large-area monitoring, thermal cameras for low-light or specialized environments, and IP cameras for networked, high-definition applications. Analog cameras are gradually being replaced by digital alternatives, while Wi-Fi and cellular cameras are gaining traction in residential and remote applications .

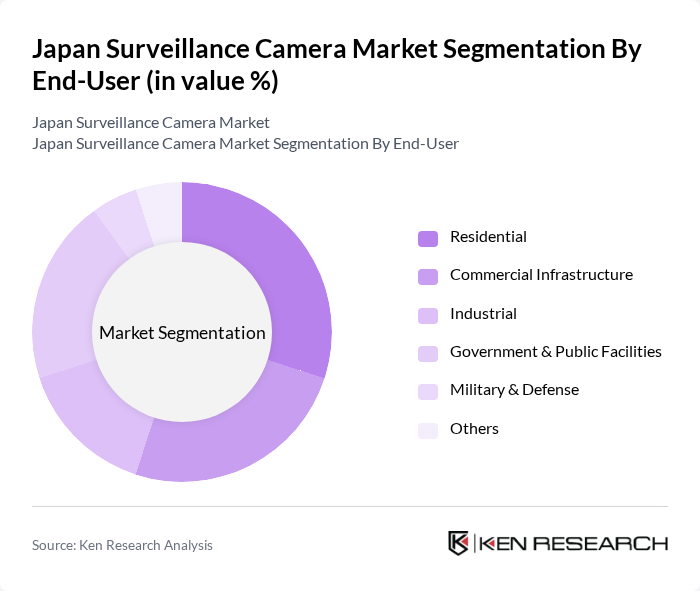

By End-User:The market is segmented by end-users, including Residential, Commercial Infrastructure, Industrial, Government & Public Facilities, Military & Defense, and Others. Residential users increasingly adopt smart, wireless, and cloud-connected cameras for home security. Commercial infrastructure—including retail, offices, and hospitality—demands integrated surveillance for asset protection and operational monitoring. Industrial users focus on perimeter security and process monitoring, while government and public facilities prioritize city-wide safety and crowd management. Military and defense applications require robust, high-security solutions, and the 'Others' category includes transportation and educational institutions .

The Japan Surveillance Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Inc., Sony Group Corporation, Panasonic Holdings Corporation, JVCKENWOOD Corporation, Hitachi, Ltd., NEC Corporation, Fujitsu Limited, Secom Co., Ltd., i-PRO Co., Ltd., Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems, Hanwha Vision Co., Ltd., Vivotek Inc., Avigilon Corporation, Pelco (Motorola Solutions, Inc.), FLIR Systems, Inc., QNAP Systems, Inc., Geutebrück GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The Japan surveillance camera market is poised for significant transformation, driven by technological advancements and increasing security demands. As smart city initiatives gain momentum, the integration of IoT devices will enhance surveillance capabilities, providing real-time data analytics. Furthermore, the shift towards AI-powered systems will improve efficiency and effectiveness in monitoring. With a growing emphasis on cybersecurity, companies will need to invest in secure surveillance solutions, ensuring data protection while meeting regulatory requirements, ultimately shaping the future landscape of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Dome Cameras Bullet Cameras PTZ Cameras Thermal Cameras IP Cameras Analog Cameras Box Cameras Covert Cameras Cellular Cameras Wi-Fi Cameras |

| By End-User | Residential Commercial Infrastructure Industrial Government & Public Facilities Military & Defense Others |

| By Application | Retail Security Traffic Monitoring Public Safety Home Security Corporate Surveillance Critical Infrastructure Protection Smart City Initiatives Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores |

| By Price Range | Low-End Cameras Mid-Range Cameras High-End Cameras |

| By Technology | Analog Technology Digital/IP Technology Wireless Technology G/5G Enabled Cameras |

| By Resolution | High Definition (HD ?2MP) Full High Definition (FHD 3–5MP) Ultra High Definition (UHD/4K ?8MP) |

| By Deployment | Indoor Outdoor |

| By Region | Kanto Kansai Chubu Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Sector Surveillance Initiatives | 100 | City Officials, Public Safety Directors |

| Retail Security Solutions | 60 | Store Managers, Loss Prevention Officers |

| Transportation Monitoring Systems | 50 | Transport Authority Officials, Infrastructure Managers |

| Private Security Firms | 40 | Security Managers, Technology Integrators |

| Residential Surveillance Adoption | 70 | Homeowners, Property Managers |

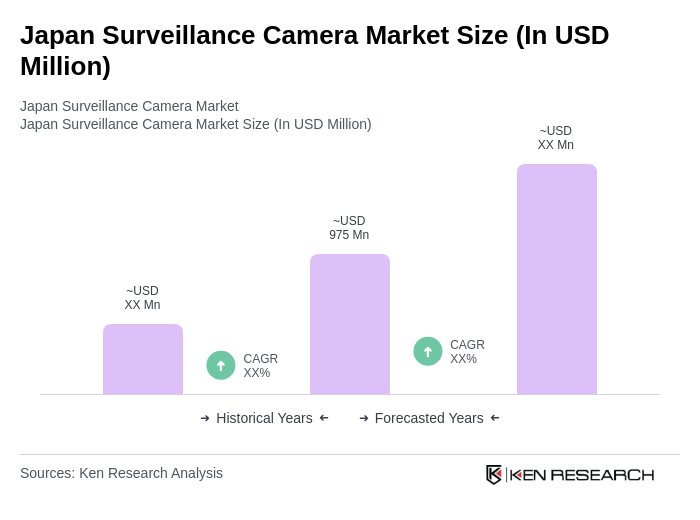

The Japan Surveillance Camera Market is valued at approximately USD 975 million, reflecting a significant growth driven by increasing security concerns, technological advancements, and smart city initiatives.