Region:Global

Author(s):Dev

Product Code:KRAA3067

Pages:96

Published On:August 2025

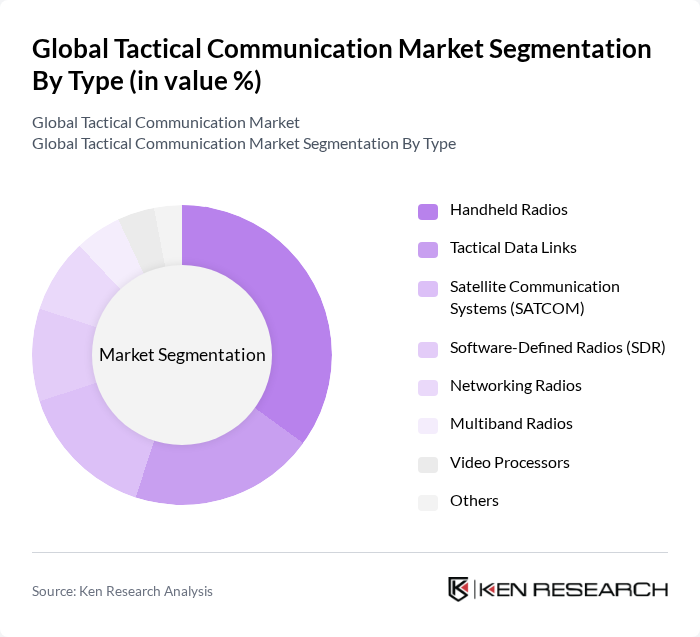

By Type:

The types of tactical communication systems include Handheld Radios, Tactical Data Links, Satellite Communication Systems (SATCOM), Software-Defined Radios (SDR), Networking Radios, Multiband Radios, Video Processors, and Others. Among these, Handheld Radios remain the most dominant segment due to their portability, reliability, and critical role in frontline operations. The demand for real-time, secure communication in military and emergency services continues to drive this segment. Tactical Data Links and SATCOM are also experiencing robust growth, propelled by the need for high-capacity, secure, and resilient communication channels in joint and network-centric operations .

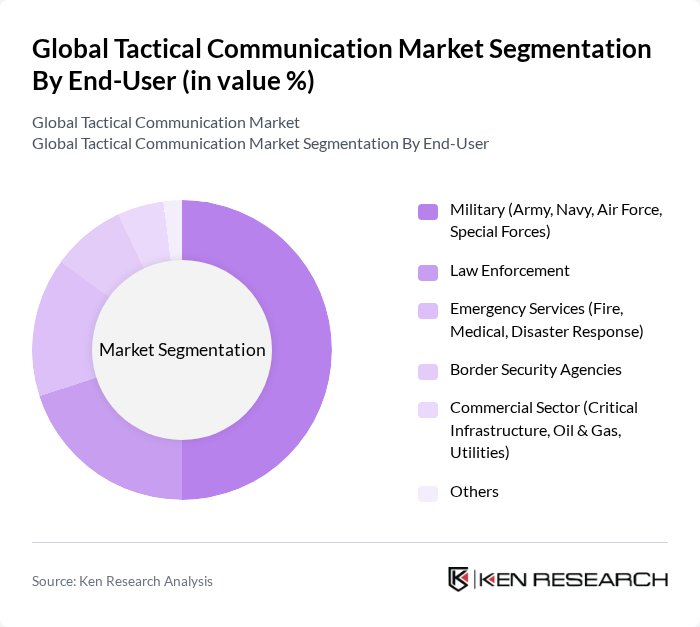

By End-User:

The end-users of tactical communication systems include Military (Army, Navy, Air Force, Special Forces), Law Enforcement, Emergency Services (Fire, Medical, Disaster Response), Border Security Agencies, and the Commercial Sector (Critical Infrastructure, Oil & Gas, Utilities). The Military segment holds the largest share, driven by ongoing modernization of armed forces, increased complexity of military operations, and the adoption of advanced network-centric communication solutions. Law Enforcement and Emergency Services are also significant users, with growing emphasis on secure, interoperable communication during critical incidents and disaster response .

The Global Tactical Communication Market is characterized by a dynamic mix of regional and international players. Leading participants such as L3Harris Technologies, Thales Group, Northrop Grumman Corporation, Raytheon Technologies (RTX Corporation), General Dynamics Corporation, Leonardo S.p.A., BAE Systems plc, Elbit Systems Ltd., Rohde & Schwarz GmbH & Co KG, Motorola Solutions, Inc., Saab AB, Cobham Limited, Rheinmetall AG, Collins Aerospace (an RTX business), Barrett Communications Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tactical communication market is poised for significant transformation, driven by technological innovations and evolving defense strategies. As military forces increasingly adopt cloud-based solutions and mobile communication systems, the demand for interoperability and real-time data sharing will intensify. Furthermore, the integration of artificial intelligence and machine learning into communication systems is expected to enhance operational efficiency, enabling forces to respond swiftly to emerging threats and challenges in a dynamic global landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Handheld Radios Tactical Data Links Satellite Communication Systems (SATCOM) Software-Defined Radios (SDR) Networking Radios Multiband Radios Video Processors Others |

| By End-User | Military (Army, Navy, Air Force, Special Forces) Law Enforcement Emergency Services (Fire, Medical, Disaster Response) Border Security Agencies Commercial Sector (Critical Infrastructure, Oil & Gas, Utilities) Others |

| By Application | Command and Control Situational Awareness Intelligence, Surveillance, and Reconnaissance (ISR) Training and Simulation Routine Operations Others |

| By Component | Hardware Software Services |

| By Platform | Ground Airborne Naval Space |

| By Technology | SATCOM VHF/UHF/L-Band HF Communication Data Link Others |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Tactical Communication Systems | 100 | Defense Procurement Officers, Military Communication Specialists |

| Public Safety Communication Solutions | 80 | Emergency Response Coordinators, Law Enforcement Officials |

| Commercial Tactical Communication Applications | 60 | Corporate Security Managers, Operations Directors |

| Research and Development in Communication Technologies | 50 | R&D Managers, Technology Innovators |

| Training and Simulation for Tactical Communication | 40 | Training Coordinators, Simulation Experts |

The Global Tactical Communication Market is valued at approximately USD 21.5 billion, driven by increased defense budgets, advancements in secure communication technologies, and the need for resilient communication systems in military and law enforcement operations.