Region:Global

Author(s):Shubham

Product Code:KRAA2698

Pages:97

Published On:August 2025

By Type:The market is segmented into various types of collaboration tools that cater to different needs and functionalities. The subsegments include Video Conferencing Tools, Instant Messaging Platforms, Project Management Software, Document Collaboration Tools, Virtual Whiteboards, Team Management Applications, Workflow Automation Tools, File Sharing & Storage Solutions, and Others. Each of these tools serves a unique purpose in enhancing team collaboration and productivity. Cloud integration, AI-driven automation, and cross-platform compatibility are increasingly standard across these categories, reflecting evolving user expectations and enterprise requirements .

TheVideo Conferencing Toolssegment is currently dominating the market due to the increasing reliance on virtual meetings and remote communication. The COVID-19 pandemic significantly accelerated the adoption of video conferencing solutions, as organizations sought to maintain connectivity and collaboration among remote teams. This segment has seen a surge in user engagement, with platforms offering features such as screen sharing, recording, AI-powered transcription, and integration with other collaboration tools, making them essential for modern workplaces .

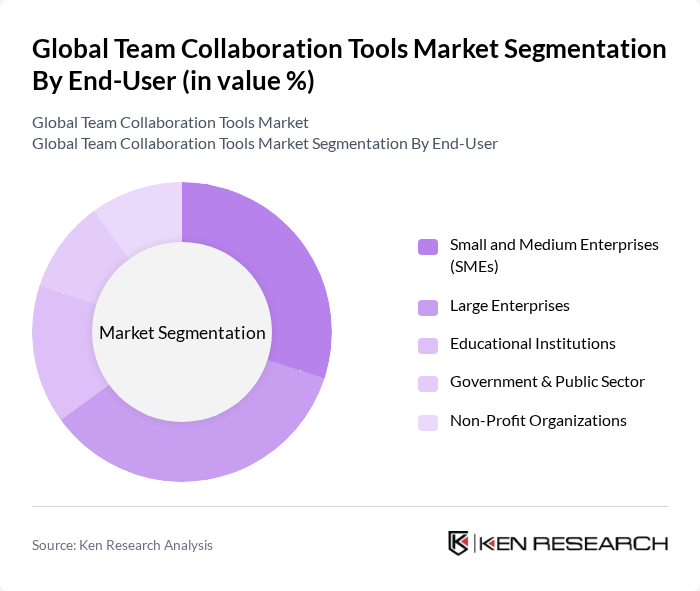

By End-User:The market is segmented based on end-users, which include Small and Medium Enterprises (SMEs), Large Enterprises, Educational Institutions, Government & Public Sector, and Non-Profit Organizations. Each end-user segment has unique requirements and preferences for collaboration tools, influencing their adoption rates and market dynamics. SMEs are increasingly adopting cloud-based and scalable solutions, while large enterprises demand advanced integrations and security features .

TheLarge Enterprisessegment leads the market due to their extensive resources and need for comprehensive collaboration solutions that can support large teams and complex projects. These organizations often require advanced features, integrations, and security measures, driving their preference for robust collaboration tools. Additionally, the shift towards digital transformation in large enterprises has further accelerated the adoption of these tools, making them a critical component of their operational strategy .

The Global Team Collaboration Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation (Teams, SharePoint, Yammer), Slack Technologies, Inc. (A Salesforce Company), Zoom Video Communications, Inc., Atlassian Corporation Plc (Confluence, Jira, Trello), Cisco Systems, Inc. (Webex), Google LLC (Google Workspace, Google Chat, Google Meet), Asana, Inc., Monday.com Ltd., Basecamp, LLC, Wrike, Inc. (A Citrix Company), Flock FZ-LLC, ClickUp, Notion Labs, Inc., TeamViewer AG, Smartsheet Inc., Zoho Corporation (Zoho Cliq, Zoho Projects), IceWarp Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of team collaboration tools is poised for significant evolution, driven by technological advancements and changing workplace dynamics. As organizations increasingly embrace hybrid work models, the demand for mobile and cloud-based solutions will intensify. Furthermore, the integration of AI-driven features is expected to enhance user experience, enabling smarter collaboration. Companies will also focus on analytics capabilities to measure productivity and engagement, ensuring that collaboration tools align with organizational goals and foster effective teamwork.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Conferencing Tools Instant Messaging Platforms Project Management Software Document Collaboration Tools Virtual Whiteboards Team Management Applications Workflow Automation Tools File Sharing & Storage Solutions Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Educational Institutions Government & Public Sector Non-Profit Organizations |

| By Industry | Information Technology (IT) & Telecom Healthcare & Life Sciences Banking, Financial Services & Insurance (BFSI) Retail & E-commerce Manufacturing Education Government Others |

| By Deployment Mode | Cloud-Based On-Premises Hybrid |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Model Pay-As-You-Go |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By User Size | Individual Users Small Teams Large Teams Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Collaboration Tools | 100 | IT Directors, Collaboration Tool Administrators |

| Small Business Communication Solutions | 60 | Small Business Owners, Operations Managers |

| Remote Work Platforms | 50 | HR Managers, Team Leaders |

| Project Management Tools | 40 | Project Managers, Product Owners |

| Video Conferencing Solutions | 45 | Event Coordinators, IT Support Staff |

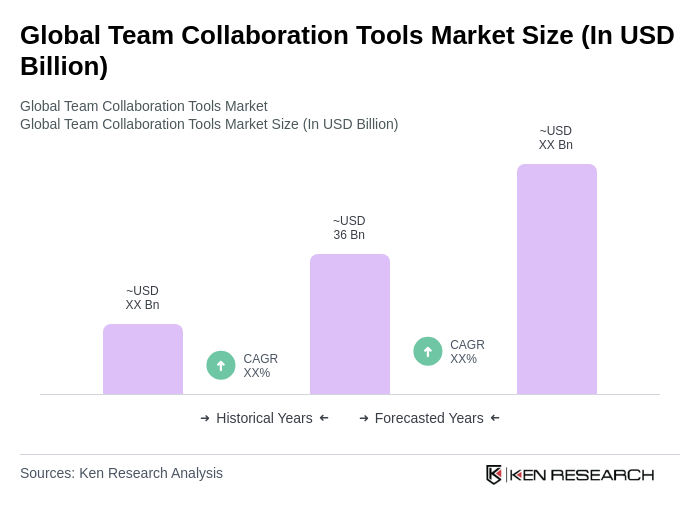

The Global Team Collaboration Tools Market is valued at approximately USD 36 billion, reflecting significant growth driven by the increasing demand for remote and hybrid work solutions, enhanced communication needs, and digital transformation initiatives across various industries.