Region:Asia

Author(s):Shubham

Product Code:KRAA8534

Pages:90

Published On:November 2025

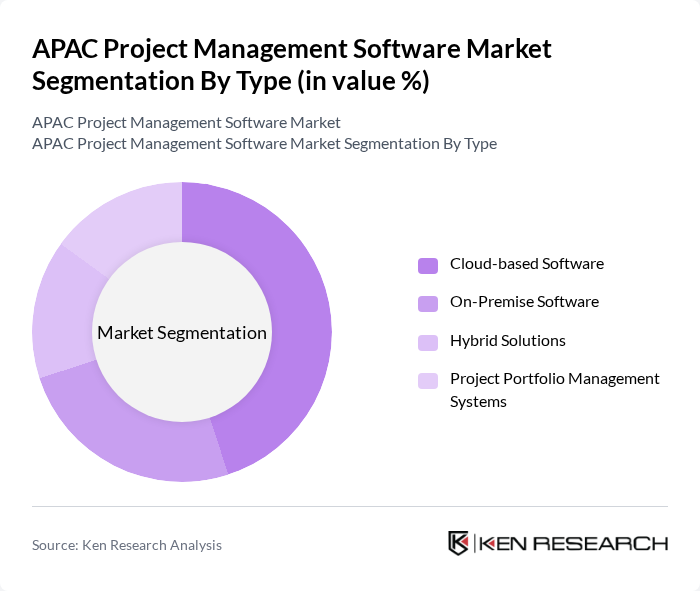

By Type:The market is segmented into various types of project management software, including Cloud-based Software, On-Premise Software, Hybrid Solutions, and Project Portfolio Management Systems. Each of these sub-segments caters to different user needs and preferences, with cloud-based solutions gaining significant traction due to their flexibility, scalability, and cost-effectiveness. Cloud deployments are preferred by both large enterprises and SMEs for ease of integration and remote accessibility .

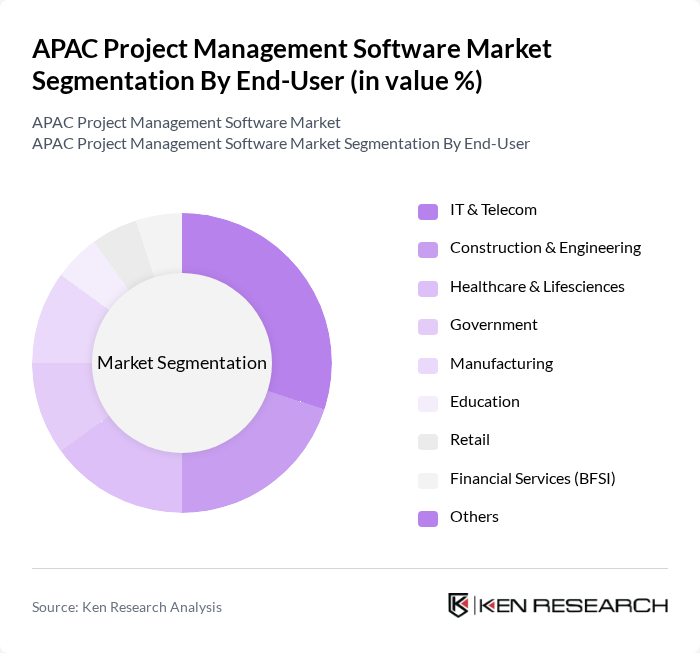

By End-User:The end-user segmentation includes various industries such as IT & Telecom, Construction & Engineering, Healthcare & Lifesciences, Government, Manufacturing, Education, Retail, Financial Services (BFSI), and Others. The IT & Telecom sector is particularly dominant due to the high demand for project management tools that facilitate agile methodologies, remote collaboration, and rapid deployment of technology projects. Construction & Engineering is another leading segment, leveraging project management software for large-scale infrastructure and compliance management .

The APAC Project Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft (Project, Planner), Atlassian (Jira, Confluence), Asana, Monday.com, Wrike (Citrix Systems), Smartsheet, Zoho Corporation (Zoho Projects), ClickUp, Basecamp, Teamwork.com, ProofHub, Scoro, Workfront (Adobe), SAP (SAP Project System, SAP Cloud ALM), Oracle (Oracle Primavera, Oracle Cloud Projects) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC project management software market is poised for transformative growth driven by technological advancements and evolving work dynamics. As organizations increasingly embrace cloud-based solutions, the demand for user-friendly interfaces and mobile accessibility will rise. Furthermore, the adoption of agile methodologies is expected to reshape project management practices, fostering a culture of flexibility and responsiveness. These trends will create a dynamic environment for innovation and collaboration, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Software On-Premise Software Hybrid Solutions Project Portfolio Management Systems |

| By End-User | IT & Telecom Construction & Engineering Healthcare & Lifesciences Government Manufacturing Education Retail Financial Services (BFSI) Others |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Deployment Model | SaaS (Software as a Service) On-Premise Hybrid |

| By Industry Vertical | IT & Telecom Construction & Engineering Healthcare & Lifesciences Government Manufacturing Retail Financial Services (BFSI) Others |

| By Geographic Presence | China Japan India South Korea Australia Southeast Asia Rest of APAC |

| By Pricing Model | Subscription-based One-time License Fee Freemium Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Management | 60 | Project Managers, Site Supervisors |

| IT Project Management Software | 50 | IT Managers, Software Developers |

| Consulting Firms' Software Usage | 40 | Consultants, Operations Managers |

| SME Adoption of Project Management Tools | 45 | Business Owners, Operations Directors |

| Government Project Management Practices | 40 | Public Sector Managers, Policy Advisors |

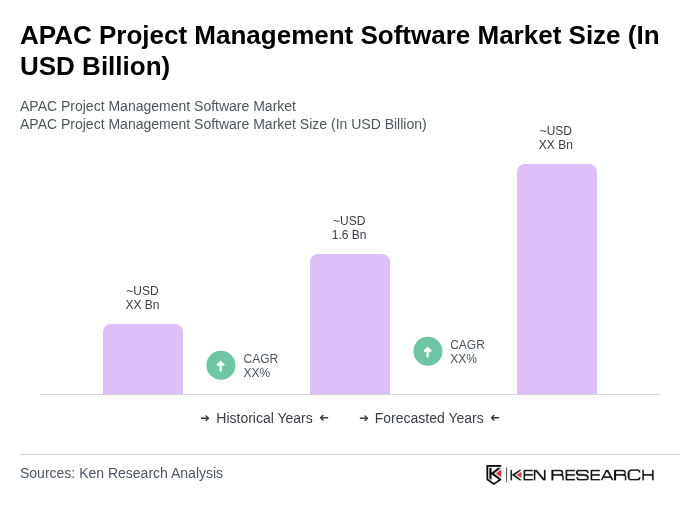

The APAC Project Management Software Market is valued at approximately USD 1.6 billion, driven by digital transformation initiatives, urbanization, and the need for efficient project management solutions to enhance productivity and collaboration among distributed teams.