Global Telecom Operations Management Market Overview

- The Global Telecom Operations Management Market is valued at USD 73 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing demand for efficient network management solutions, rapid adoption of cloud-based OSS/BSS platforms, the rise of digital transformation initiatives, and the need for enhanced customer experience in the telecom sector. The market is witnessing a shift towards automation, AI-driven analytics, and zero-touch operations, which are essential for managing complex telecom environments and supporting 5G network rollouts.

- Key players in this market include the United States, China, and Germany, which dominate due to their advanced telecommunications infrastructure, significant investments in next-generation technologies, and a high number of telecom service providers. The presence of major multinational companies and a robust regulatory framework further enhance their competitive edge in the global market.

- In 2023, the European Union implemented the Digital Markets Act (Regulation (EU) 2022/1925), issued by the European Parliament and Council. This regulation mandates that telecom operators provide transparent pricing and service quality information to consumers, promote fair competition, and ensure interoperability of digital services, thereby enhancing consumer trust and fostering a more competitive environment in the telecom sector.

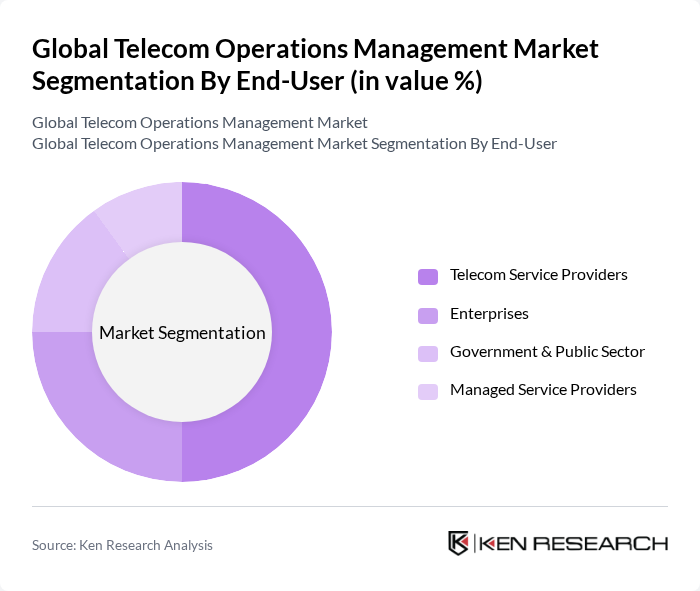

Global Telecom Operations Management Market Segmentation

By Type:The market is segmented into Network Management Solutions, Service Assurance Solutions, Revenue Management Solutions, Workforce Management Solutions, Inventory Management Solutions, Customer & Product Management Solutions, Service Fulfillment & Assurance Solutions, and Billing & OSS/BSS Solutions. Among these,Network Management Solutionsare leading due to the increasing complexity of telecom networks, the proliferation of multi-vendor environments, and the need for real-time monitoring, automation, and predictive maintenance to support 5G and IoT deployments.

By End-User:The end-user segmentation includes Telecom Service Providers, Enterprises, Government & Public Sector, and Managed Service Providers.Telecom Service Providersdominate this segment as they are the primary users of telecom operations management solutions, driven by the need to enhance service delivery, operational efficiency, and support for new digital services and business models.

Global Telecom Operations Management Market Competitive Landscape

The Global Telecom Operations Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ericsson, Nokia, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Amdocs Limited, CSG International, Inc., Netcracker Technology Corporation, ZTE Corporation, Oracle Corporation, Comarch S.A., Tata Consultancy Services Limited, Infosys Limited, Wipro Limited, Accenture plc, Capgemini SE, IBM Corporation, Hewlett Packard Enterprise Development LP, NEC Corporation, SAP SE, ServiceNow, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Telecom Operations Management Market Industry Analysis

Growth Drivers

- Increasing Demand for Network Optimization:The global telecom sector is witnessing a surge in demand for network optimization, driven by the need for enhanced service quality. In future, telecom operators are expected to invest approximately $50 billion in network optimization technologies, as they aim to reduce latency and improve bandwidth utilization. This investment is crucial, given that 70% of telecom companies report that network performance directly impacts customer satisfaction and retention rates, highlighting the importance of optimized operations.

- Rise in Cloud-Based Telecom Solutions:The shift towards cloud-based telecom solutions is reshaping the industry landscape. By future, the global market for cloud telecom services is projected to reach $30 billion, reflecting a compound annual growth rate (CAGR) of 15%. This growth is fueled by the increasing adoption of Software as a Service (SaaS) models, which allow telecom operators to enhance scalability and reduce operational costs. As a result, 60% of telecom firms are expected to migrate to cloud platforms, improving service delivery and operational efficiency.

- Expansion of IoT and Connected Devices:The proliferation of Internet of Things (IoT) devices is a significant growth driver for telecom operations management. In future, the number of connected devices is anticipated to exceed 30 billion globally, creating a demand for robust telecom infrastructure. This expansion is projected to generate an additional $20 billion in revenue for telecom operators, as they invest in managing the increased data traffic and connectivity requirements. Consequently, telecom companies are prioritizing IoT solutions to capitalize on this burgeoning market.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing telecom operators is the high initial investment required for advanced operations management systems. In future, the average cost for implementing new telecom technologies is estimated at $10 million per operator. This financial burden can deter smaller companies from upgrading their systems, leading to a competitive disadvantage. As a result, 40% of smaller telecom firms may struggle to keep pace with larger competitors who can afford these investments.

- Data Security Concerns:Data security remains a critical challenge in the telecom industry, particularly as cyber threats become more sophisticated. In future, it is projected that telecom companies will face an increase in data breaches, with costs associated with these breaches potentially reaching $5 billion. This growing concern compels operators to invest heavily in cybersecurity measures, diverting funds from other operational improvements. Consequently, 55% of telecom firms report that data security issues hinder their ability to innovate and expand services.

Global Telecom Operations Management Market Future Outlook

The future of telecom operations management is poised for transformative changes driven by technological advancements and evolving consumer expectations. As automation becomes increasingly integrated into operations, telecom companies are expected to enhance efficiency and reduce costs significantly. Additionally, the focus on customer experience will lead to the development of personalized services, fostering customer loyalty. With the ongoing rollout of 5G networks, operators will have the opportunity to leverage new capabilities, driving innovation and expanding service offerings in the coming years.

Market Opportunities

- Adoption of AI and Machine Learning:The integration of artificial intelligence (AI) and machine learning presents a significant opportunity for telecom operators. By future, investments in AI technologies are expected to exceed $15 billion, enabling companies to enhance predictive analytics and automate customer service. This shift can lead to improved operational efficiency and reduced costs, positioning telecom firms to better meet customer demands and streamline processes.

- Expansion into Emerging Markets:Emerging markets represent a lucrative opportunity for telecom operators seeking growth. In future, the telecom sector in regions such as Africa and Southeast Asia is projected to grow by $25 billion, driven by increasing mobile penetration and demand for connectivity. By strategically entering these markets, telecom companies can tap into new customer bases and diversify their revenue streams, enhancing overall market resilience.