Region:Global

Author(s):Rebecca

Product Code:KRAA1379

Pages:94

Published On:August 2025

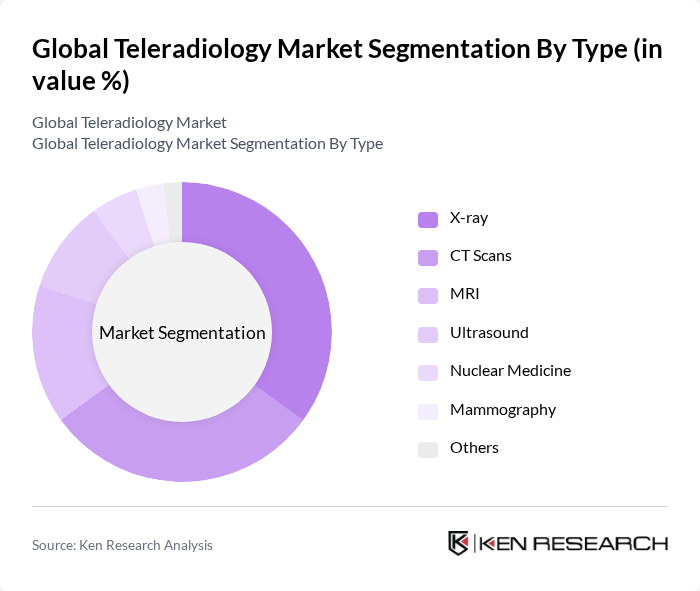

By Type:The teleradiology market is segmented into X-ray, CT Scans, MRI, Ultrasound, Nuclear Medicine, Mammography, and Others. Among these, X-ray and CT Scans are the most widely used modalities due to their quick turnaround times and effectiveness in diagnosing a broad range of conditions. The increasing prevalence of injuries and chronic diseases, such as cancer and cardiovascular disorders, has led to higher demand for these imaging techniques, making them dominant in the market.

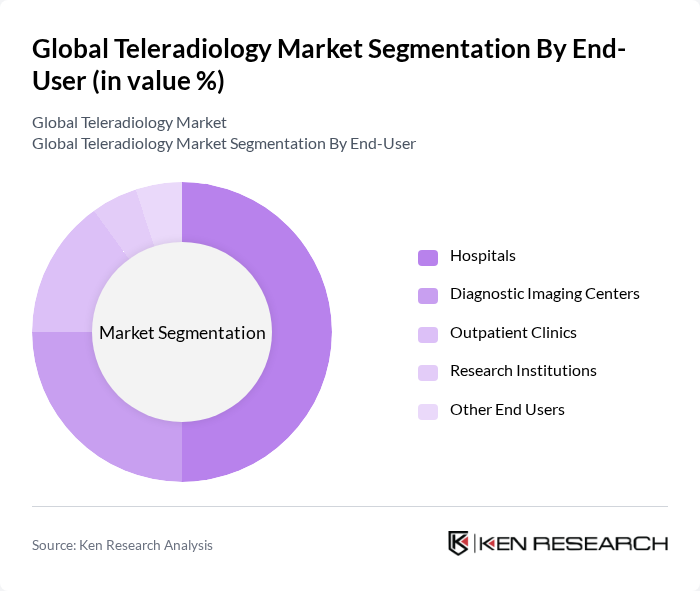

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Outpatient Clinics, Research Institutions, and Other End Users. Hospitals are the leading end-users of teleradiology services, driven by the need for efficient patient care and the ability to provide timely diagnoses. The increasing number of hospitals adopting telemedicine solutions to enhance their service offerings has solidified their position as the dominant segment in the market. Diagnostic imaging centers and outpatient clinics are also experiencing growth due to the rising demand for specialized imaging services and the need for rapid turnaround times.

The Global Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Radiology Partners, vRad (Virtual Radiologic), Teleradiology Solutions, NightHawk Radiology, StatRad, TeleRadiology, LLC, Imaging Advantage, Mednax Radiology Solutions, Siemens Healthineers, GE Healthcare, Philips Healthcare, Agfa HealthCare, Fujifilm Medical Systems, Canon Medical Systems, Carestream Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of teleradiology is poised for transformative growth, driven by technological advancements and increasing healthcare demands. As telehealth services expand, the integration of artificial intelligence in imaging will enhance diagnostic accuracy and efficiency. Additionally, the development of mobile teleradiology solutions will facilitate access to remote diagnostics, particularly in underserved regions. These trends indicate a robust evolution in healthcare delivery, emphasizing the importance of teleradiology in modern medical practices.

| Segment | Sub-Segments |

|---|---|

| By Type | X-ray CT Scans MRI Ultrasound Nuclear Medicine Mammography Others |

| By End-User | Hospitals Diagnostic Imaging Centers Outpatient Clinics Research Institutions Other End Users |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| By Application | Emergency Services Routine Diagnostics Teleconsultation Second Opinion Services |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Teleradiology Services | 100 | Radiologists, Hospital Administrators |

| Diagnostic Imaging Centers | 80 | Imaging Technologists, Center Managers |

| Telehealth Integration | 60 | Healthcare IT Managers, Telehealth Coordinators |

| Remote Patient Monitoring | 50 | Clinical Directors, Remote Care Specialists |

| Regulatory Compliance in Teleradiology | 40 | Compliance Officers, Legal Advisors in Healthcare |

The Global Teleradiology Market is valued at approximately USD 15.6 billion, reflecting significant growth driven by the increasing demand for remote diagnostic services and advancements in telecommunication technologies.