Region:Asia

Author(s):Dev

Product Code:KRAA8183

Pages:90

Published On:November 2025

By Type:The teleradiology market can be segmented into various types, including Diagnostic Teleradiology, Interventional Teleradiology, Emergency Teleradiology, and Subspecialty Teleradiology (e.g., Pediatric, Neuroradiology). Each of these segments plays a crucial role in addressing specific healthcare needs and enhancing the efficiency of radiological services. Diagnostic teleradiology is the most prevalent, supporting routine and complex imaging interpretation, while emergency and subspecialty teleradiology address urgent and specialized diagnostic requirements.

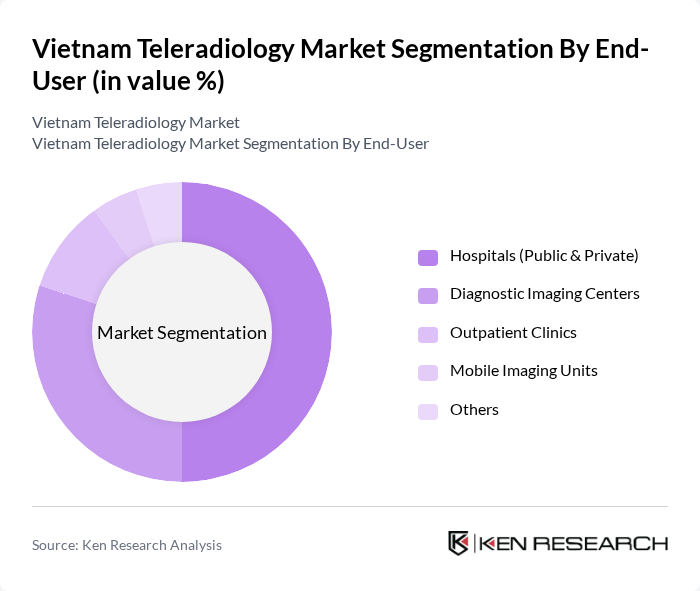

By End-User:The end-user segmentation includes Hospitals (Public & Private), Diagnostic Imaging Centers, Outpatient Clinics, Mobile Imaging Units, and Others. Each segment reflects the diverse applications of teleradiology services across different healthcare settings. Hospitals and diagnostic imaging centers account for the majority of teleradiology adoption, driven by the need for timely and accurate diagnostics, while mobile units and outpatient clinics expand access to underserved populations.

The Vietnam Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Solutions (Viettel Group), FPT Digital Healthcare (FPT Corporation), VinBrain (Vingroup), Medlatec Group, Hanoi Medical University Hospital, Ho Chi Minh City University of Medicine and Pharmacy Hospital, B?nh vi?n ?a khoa Qu?c t? Vinmec, B?nh vi?n Ch? R?y, B?nh vi?n ??i h?c Y D??c TP.HCM, B?nh vi?n Nhân Dân 115, B?nh vi?n ?a khoa t?nh Bình D??ng, B?nh vi?n ?a khoa t?nh ??ng Nai, B?nh vi?n ?a khoa t?nh Khánh Hòa, B?nh vi?n ?a khoa t?nh Th?a Thiên Hu?, Telemedicine Center, Ministry of Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the teleradiology market in Vietnam appears promising, driven by technological advancements and increasing healthcare investments. As the government continues to prioritize digital health initiatives, the integration of artificial intelligence in diagnostic processes is expected to enhance efficiency and accuracy. Furthermore, the expansion of telemedicine services will likely facilitate greater access to radiology consultations, particularly in underserved regions, thereby improving overall healthcare delivery and patient satisfaction across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Teleradiology Interventional Teleradiology Emergency Teleradiology Subspecialty Teleradiology (e.g., Pediatric, Neuroradiology) |

| By End-User | Hospitals (Public & Private) Diagnostic Imaging Centers Outpatient Clinics Mobile Imaging Units Others |

| By Application | Oncology Neurology Orthopedics Cardiology Pulmonology Others |

| By Technology | Cloud-based Teleradiology Web-based Teleradiology Mobile Teleradiology AI-enabled Teleradiology Others |

| By Service Model | Remote Radiology Reporting Services Teleradiology Software Solutions PACS (Picture Archiving and Communication System) Integration Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 100 | Radiologists, Department Heads |

| Teleradiology Service Providers | 60 | Business Development Managers, Technical Leads |

| Healthcare IT Solutions | 50 | IT Managers, System Administrators |

| Patient Experience with Teleradiology | 70 | Patients, Caregivers |

| Government Health Policy Makers | 40 | Health Policy Analysts, Program Directors |

The Vietnam Teleradiology Market is valued at approximately USD 15 million, reflecting a significant growth driven by the increasing demand for remote healthcare services and advancements in imaging technologies.