Region:Global

Author(s):Rebecca

Product Code:KRAC0228

Pages:93

Published On:August 2025

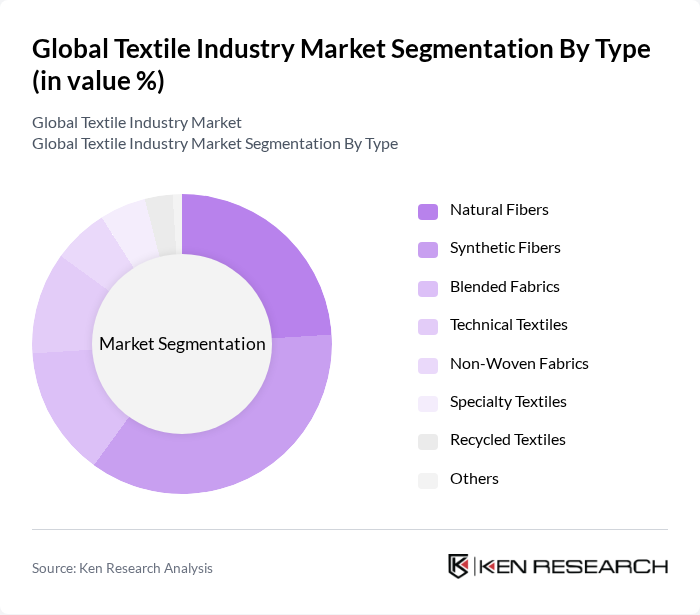

By Type:The textile industry is segmented into various types, including natural fibers, synthetic fibers, blended fabrics, technical textiles, non-woven fabrics, specialty textiles, recycled textiles, and others. Each of these segments plays a crucial role in meeting diverse consumer needs and preferences. Natural fibers are favored for their sustainability and biodegradability, while synthetic fibers are popular for their durability, versatility, and cost-effectiveness. Blended fabrics combine the properties of both natural and synthetic fibers, catering to a wide range of applications from fashion to industrial uses. Technical textiles and non-woven fabrics are increasingly used in automotive, medical, and construction sectors due to their specialized performance characteristics .

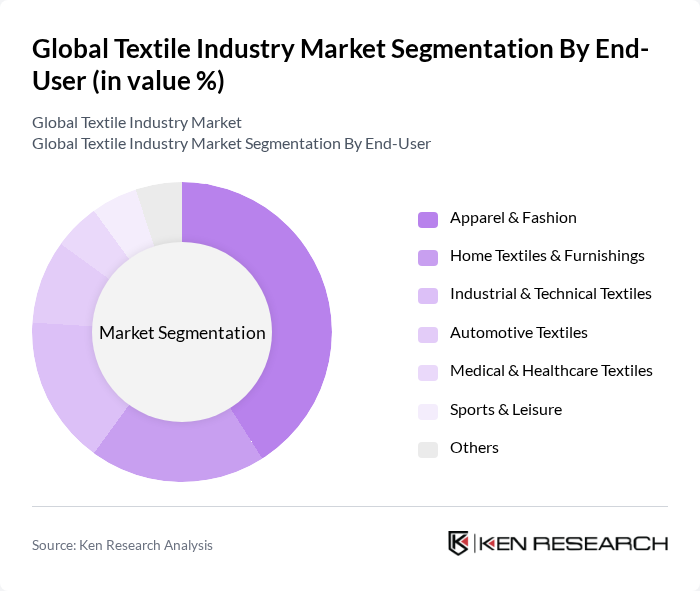

By End-User:The end-user segmentation of the textile industry includes apparel & fashion, home textiles & furnishings, industrial & technical textiles, automotive textiles, medical & healthcare textiles, sports & leisure, and others. The apparel and fashion segment is the largest, driven by fast fashion, influencer-led marketing, and rising disposable incomes in emerging markets. Home textiles are also significant, reflecting trends in interior design, urbanization, and increased consumer spending on home improvement. Industrial and technical textiles are gaining traction due to their applications in automotive, construction, and healthcare sectors, where demand for functional and high-performance materials is rising .

The Global Textile Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arvind Limited, Vardhman Textiles Limited, Welspun India Limited, Raymond Limited, Alok Industries Limited, Grasim Industries Limited, Aditya Birla Fashion & Retail Limited, Shahi Exports Private Limited, Trident Group, LNJ Bhilwara Group, JBF Industries Limited, KPR Mill Limited, Himatsingka Seide Limited, Indo Count Industries Limited, Century Textiles and Industries Limited, Toray Industries, Inc., Reliance Industries Limited (Textiles Division), Zhejiang Hengli Group Co., Ltd., Shandong Weiqiao Pioneering Group Co., Ltd., Far Eastern New Century Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the textile industry is poised for transformation, driven by sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, companies are increasingly adopting sustainable practices, which are expected to dominate the market landscape. Additionally, advancements in digital technologies will enhance operational efficiencies and customization capabilities. The rise of smart textiles and wearable technology will further redefine consumer engagement, creating new avenues for growth and innovation in the textile sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Fibers Synthetic Fibers Blended Fabrics Technical Textiles Non-Woven Fabrics Specialty Textiles Recycled Textiles Others |

| By End-User | Apparel & Fashion Home Textiles & Furnishings Industrial & Technical Textiles Automotive Textiles Medical & Healthcare Textiles Sports & Leisure Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales (B2B) Wholesale/Distributors Others |

| By Application | Fashion and Apparel Home Furnishings Technical/Industrial Applications Medical Applications Automotive Applications Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Cotton Polyester Wool Silk Nylon Viscose/Rayon Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Apparel Manufacturing Insights | 150 | Production Managers, Quality Control Supervisors |

| Home Textiles Market Trends | 100 | Product Managers, Retail Buyers |

| Technical Textiles Applications | 80 | R&D Engineers, Industry Analysts |

| Sustainable Textile Practices | 60 | Sustainability Managers, Compliance Officers |

| Fashion Retail Supply Chain | 90 | Supply Chain Managers, Merchandising Directors |

The Global Textile Industry Market is valued at approximately USD 1,980 billion, reflecting significant growth driven by consumer demand for sustainable products, the expansion of the fashion sector, and advancements in textile manufacturing technologies.