Region:Global

Author(s):Shubham

Product Code:KRAD6671

Pages:96

Published On:December 2025

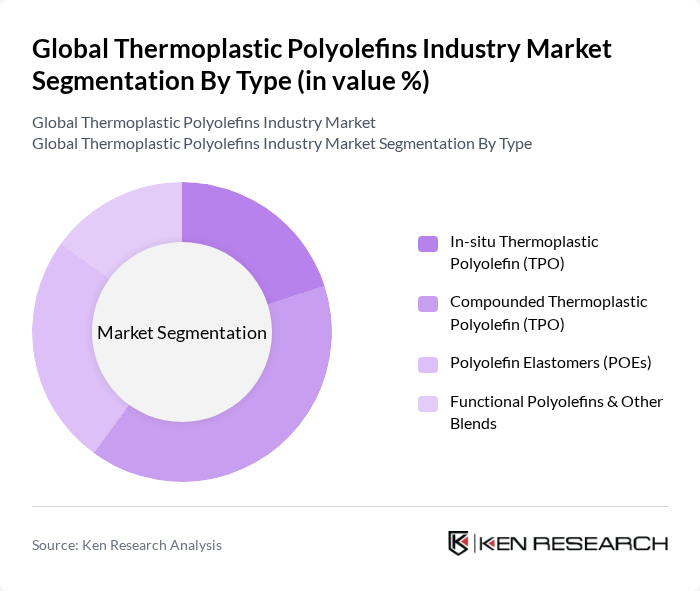

By Type:The thermoplastic polyolefins market is segmented into four main types: In-situ Thermoplastic Polyolefin (TPO), Compounded Thermoplastic Polyolefin (TPO), Polyolefin Elastomers (POEs), and Functional Polyolefins & Other Blends. This aligns with industry analyses that distinguish between in-situ TPO (reactor-made) and compounded TPO grades, with compounded TPO typically representing the larger share. Among these, Compounded Thermoplastic Polyolefin (TPO) is the leading subsegment due to its versatility, tunable stiffness–impact balance, good paintability, and superior performance in automotive exterior and interior applications such as bumpers, body panels, and instrument panels. The increasing demand for lightweight and durable materials in the automotive sector, driven by fuel-efficiency and emissions norms, as well as the replacement of PVC and rubber in roofing membranes and geomembranes, is further accelerating the growth of this subsegment.

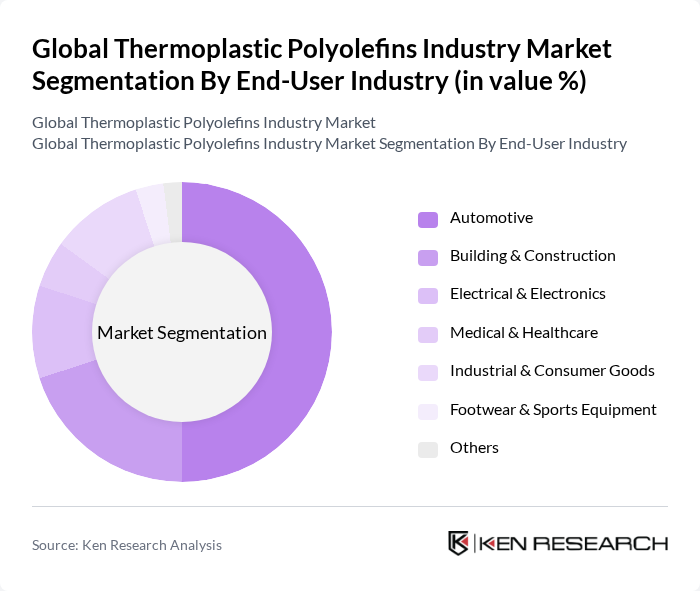

By End-User Industry:The end-user industries for thermoplastic polyolefins include Automotive, Building & Construction, Electrical & Electronics, Medical & Healthcare, Industrial & Consumer Goods, Footwear & Sports Equipment, and Others. Industry research consistently identifies Automotive as the dominant end-use sector for thermoplastic polyolefins, given their extensive use in bumpers, body kits, dashboards, trim, and under-the-hood components to reduce vehicle weight while maintaining impact resistance and durability. The increasing need for lightweight materials that enhance fuel efficiency and reduce emissions, combined with stringent efficiency regulations and the rapid growth of electric vehicles (which require lightweight components to extend driving range), is further propelling demand for thermoplastic polyolefins in this sector. Beyond automotive, TPO roofing membranes and waterproofing systems are driving adoption in Building & Construction, while flexible and soft-touch formulations are gaining use in consumer goods and certain medical applications such as device housings and tubing components.

The Global Thermoplastic Polyolefins Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as LyondellBasell Industries Holdings N.V., ExxonMobil Chemical Company, SABIC (Saudi Basic Industries Corporation), INEOS Olefins & Polymers, Braskem S.A., Borealis AG, Dow Inc., Mitsui Chemicals, Inc., Sumitomo Chemical Co., Ltd., Hanwha Solutions Corporation, LG Chem Ltd., Mitsui Plastics, Inc., S&E Specialty Polymers (A Celanese Company), RTP Company, Noble Polymers, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermoplastic polyolefins market appears promising, driven by technological advancements and a shift towards sustainable materials. As industries increasingly prioritize eco-friendly solutions, TPOs are likely to see expanded applications across various sectors. Additionally, the rise of e-commerce is expected to boost demand for TPOs in packaging, enhancing their market presence. Companies that invest in innovation and sustainability will be well-positioned to capitalize on these emerging trends and navigate the evolving regulatory landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | In-situ Thermoplastic Polyolefin (TPO) Compounded Thermoplastic Polyolefin (TPO) Polyolefin Elastomers (POEs) Functional Polyolefins & Other Blends |

| By End-User Industry | Automotive Building & Construction Electrical & Electronics Medical & Healthcare Industrial & Consumer Goods Footwear & Sports Equipment Others |

| By Application | Automotive Exterior & Interior Components Roofing Membranes Wire & Cable Insulation Film & Sheet Medical Device Housings & Components Industrial Products & Structural Plastics Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Form | Pellets & Granules Sheets & Membranes Films Molded & Extruded Parts Others |

| By Processing Method | Injection Molding Extrusion Blow Molding Thermoforming Others |

| By Distribution Channel | Direct Sales (Producers to OEMs) Distributors & Compounders Online & E-commerce Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Packaging Solutions | 80 | Packaging Designers, Supply Chain Managers |

| Construction Materials | 70 | Project Managers, Material Suppliers |

| Consumer Goods Manufacturing | 90 | Operations Managers, Quality Assurance Specialists |

| Research & Development Insights | 60 | R&D Directors, Innovation Managers |

The Global Thermoplastic Polyolefins Industry Market is valued at approximately USD 4.6 billion, reflecting a significant growth trend driven by the demand for lightweight materials in sectors like automotive and construction.