Region:Asia

Author(s):Dev

Product Code:KRAD1666

Pages:90

Published On:November 2025

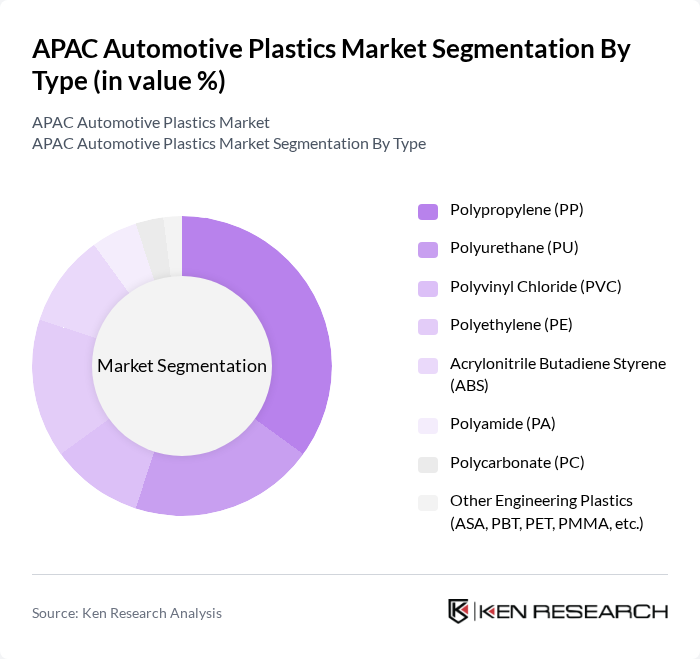

By Type:The market is segmented into various types of plastics used in automotive applications. The primary types include Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Polyethylene (PE), Acrylonitrile Butadiene Styrene (ABS), Polyamide (PA), Polycarbonate (PC), and Other Engineering Plastics (ASA, PBT, PET, PMMA, etc.). Among these, Polypropylene (PP) is the most widely used due to its excellent balance of properties, including lightweight, chemical resistance, and cost-effectiveness, making it ideal for various automotive components. Polyurethane (PU) is valued for its versatility and cushioning properties, supporting its use in seating and interior components. Polyvinyl Chloride (PVC) and Polyethylene (PE) are also prominent for their durability and flexibility in automotive interiors and exteriors .

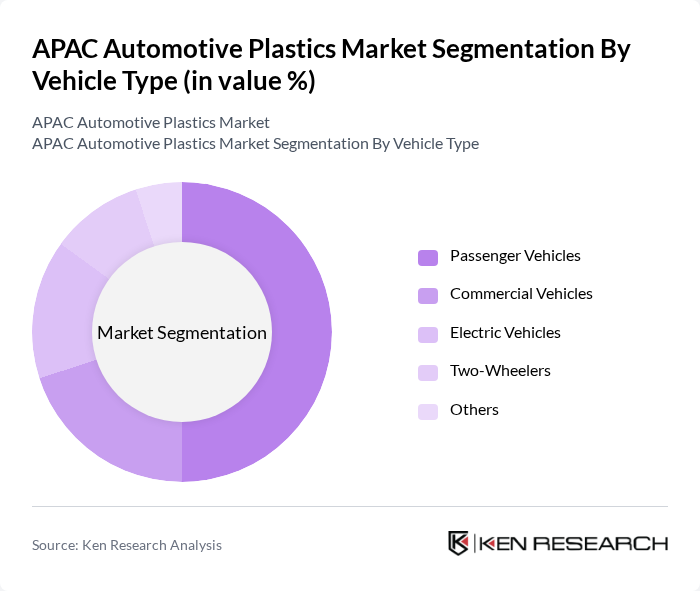

By Vehicle Type:The segmentation by vehicle type includes Passenger Vehicles, Commercial Vehicles, Electric Vehicles, Two-Wheelers, and Others. The Passenger Vehicles segment dominates the market due to high demand for personal transportation, increasing production of lightweight vehicles, and the adoption of advanced plastic materials for improved fuel efficiency and design aesthetics. Electric Vehicles are rapidly gaining share, driven by government incentives and the need for specialized plastics in battery housings and thermal management systems .

The APAC Automotive Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Covestro AG, SABIC, LG Chem Ltd., Mitsubishi Engineering-Plastics Corporation, Solvay S.A., Toray Industries, Inc., DSM Engineering Materials (formerly DSM Engineering Plastics), Celanese Corporation, Borealis AG, Eastman Chemical Company, Teijin Limited, Asahi Kasei Corporation, INEOS Group contribute to innovation, geographic expansion, and service delivery in this space.

The APAC automotive plastics market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As electric vehicle adoption accelerates, manufacturers are increasingly integrating sustainable materials into their production processes. Additionally, the focus on recycling and circular economy initiatives is expected to reshape the market landscape, encouraging innovation in material sourcing and waste management. These trends will likely foster a more resilient and environmentally responsible automotive plastics industry in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Polypropylene (PP) Polyurethane (PU) Polyvinyl Chloride (PVC) Polyethylene (PE) Acrylonitrile Butadiene Styrene (ABS) Polyamide (PA) Polycarbonate (PC) Other Engineering Plastics (ASA, PBT, PET, PMMA, etc.) |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Electric Vehicles Two-Wheelers Others |

| By Region | China India Japan South Korea ASEAN Rest of Asia-Pacific |

| By Application | Interior Components Exterior Components Under-the-Hood Components Electrical Components Other Applications (Instrument Panel, Door Systems, etc.) |

| By Manufacturing Process | Injection Molding Blow Molding Thermoforming Others |

| By Material Source | Virgin Materials Recycled Materials Others |

| By Policy Support | Subsidies for sustainable materials Tax incentives for manufacturers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 100 | Product Development Managers, R&D Engineers |

| Plastic Suppliers | 70 | Sales Directors, Product Managers |

| Automotive Aftermarket | 50 | Procurement Officers, Supply Chain Managers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

| Research Institutions | 40 | Material Scientists, Automotive Researchers |

The APAC Automotive Plastics Market is valued at approximately USD 23.7 billion, driven by the increasing demand for lightweight materials in vehicle manufacturing, which enhances fuel efficiency and reduces emissions.