Region:Global

Author(s):Dev

Product Code:KRAA1603

Pages:94

Published On:August 2025

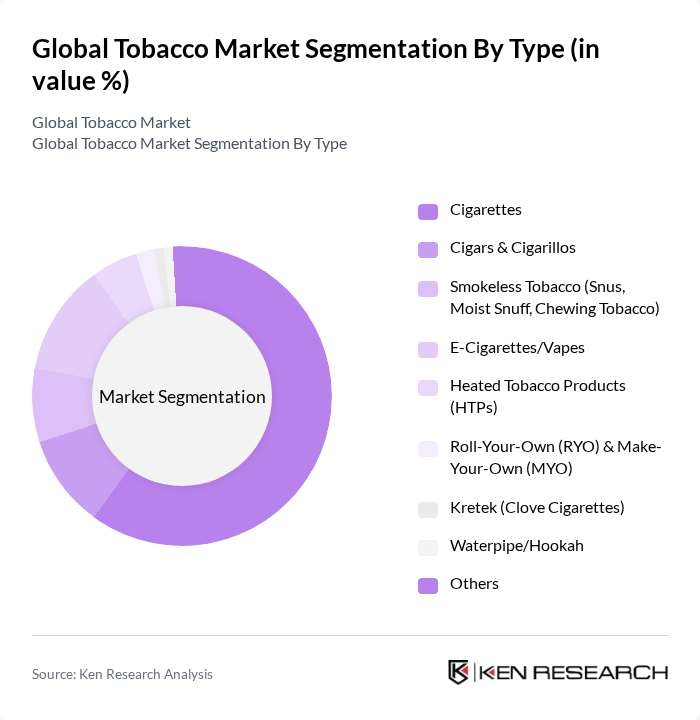

By Type:The tobacco market is segmented into various types, including cigarettes, cigars, smokeless tobacco, e-cigarettes, heated tobacco products, roll-your-own, kretek, waterpipe, and others. Among these, cigarettes remain the dominant segment due to their widespread consumption and established market presence. However, the rise of e-cigarettes and heated tobacco products is reshaping consumer preferences, particularly among younger demographics seeking alternatives to traditional smoking.

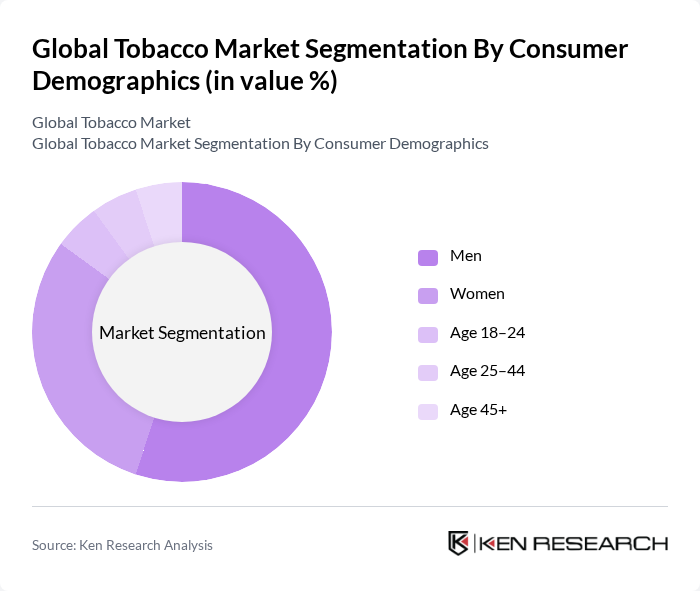

By Consumer Demographics:The tobacco market is segmented by consumer demographics, including men, women, and various age groups. Men represent the largest consumer segment, driven by traditional smoking habits and cultural acceptance; globally, tobacco use prevalence has historically been higher among men than women. There is a growing trend of experimentation and use among younger age groups with e?cigarettes and other alternative products in several markets, indicating a shift in consumer behavior and product mix.

The Global Tobacco Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philip Morris International Inc. (PMI), British American Tobacco p.l.c. (BAT), Japan Tobacco Inc. (JT Group), Imperial Brands PLC, Altria Group, Inc., China National Tobacco Corporation, Reynolds American Inc. (a subsidiary of BAT), Scandinavian Tobacco Group A/S, Swedish Match AB (a subsidiary of Philip Morris International), ITC Limited, KT&G Corporation, Universal Corporation, PT Djarum, Godfrey Phillips India Ltd., Habanos, S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tobacco market is poised for transformation, driven by evolving consumer preferences and regulatory landscapes. As health-conscious trends continue to rise, companies are likely to invest in reduced-risk products and innovative alternatives. Additionally, the expansion into untapped markets will provide new growth avenues, particularly in regions with increasing disposable incomes. The integration of digital marketing strategies will also play a crucial role in reaching younger demographics, ensuring sustained engagement and brand loyalty in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Cigarettes Cigars & Cigarillos Smokeless Tobacco (Snus, Moist Snuff, Chewing Tobacco) E-Cigarettes/Vapes Heated Tobacco Products (HTPs) Roll-Your-Own (RYO) & Make-Your-Own (MYO) Kretek (Clove Cigarettes) Waterpipe/Hookah Others |

| By Consumer Demographics | Men Women Age 18–24 Age 25–44 Age 45+ |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience/Grocery Stores Tobacco/Smoke Shops Online Retail Others |

| By Product Category | Premium Mass/Mid-Range Value |

| By Packaging Type | Soft Packs Hard Packs Tins/Cans Pods/Cartridges (for E-Cigarettes/HTPs) |

| By Price Range | Low Price Mid Price High Price |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cigarette Consumption Patterns | 150 | Adult Smokers, Retail Store Owners |

| Smokeless Tobacco Usage | 100 | Smokeless Tobacco Users, Health Professionals |

| Tobacco Regulatory Impact | 80 | Policymakers, Public Health Officials |

| Market Trends in E-Cigarettes | 120 | Vape Shop Owners, E-Cigarette Users |

| Consumer Attitudes Towards Tobacco | 90 | General Public, Health Advocates |

The Global Tobacco Market is valued at approximately USD 965 billion, reflecting a significant market size driven by the demand for traditional tobacco products and the growing popularity of alternatives like e-cigarettes and heated tobacco products.