Region:Global

Author(s):Geetanshi

Product Code:KRAB0087

Pages:99

Published On:August 2025

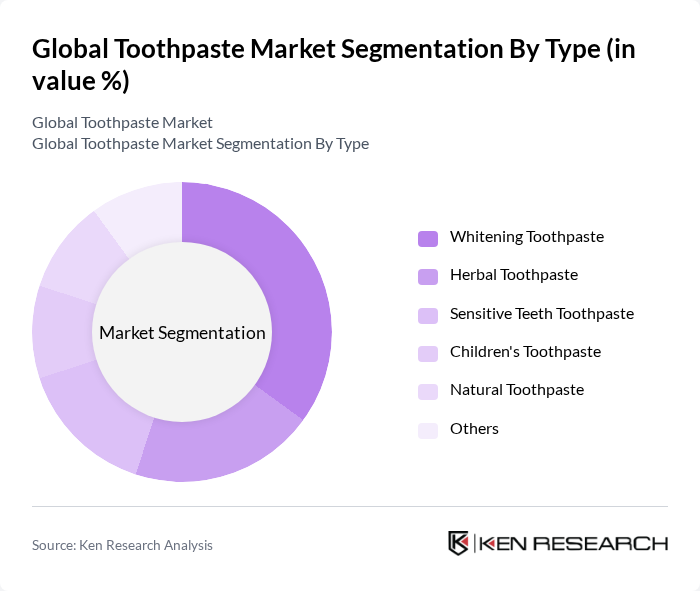

By Type:The market is segmented into various types of toothpaste, including Whitening Toothpaste, Herbal Toothpaste, Sensitive Teeth Toothpaste, Children's Toothpaste, Natural Toothpaste, and Others. Among these, Whitening Toothpaste is currently the leading sub-segment, driven by consumer demand for aesthetic appeal and the desire for brighter smiles. The trend towards self-care and personal grooming has significantly influenced purchasing decisions, making whitening products highly sought after. Herbal and natural toothpaste segments are also witnessing notable growth due to rising consumer preference for chemical-free and plant-based oral care products.

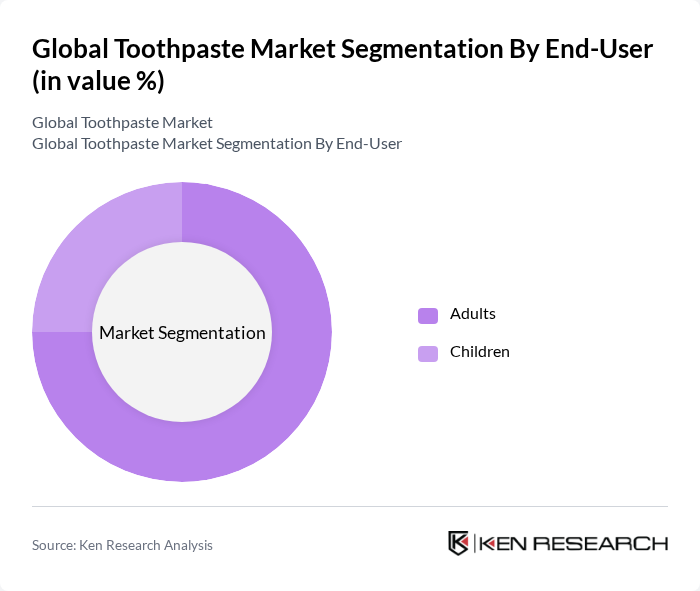

By End-User:The market is divided into two primary end-user segments: Adults and Children. The Adult segment dominates the market, primarily due to the higher purchasing power and the growing awareness of oral health among adults. Adults are increasingly opting for specialized toothpaste that addresses specific dental issues, such as sensitivity and whitening, which drives the demand in this segment. The children's segment is also expanding, supported by increased marketing of age-specific oral care products and growing parental awareness of early dental hygiene.

The Global Toothpaste Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Colgate-Palmolive Company, Unilever PLC, GSK plc (GlaxoSmithKline plc), Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Johnson & Johnson, Kao Corporation, Amway Corporation, Himalaya Drug Company, Colgate-Palmolive (India) Limited, Marico Limited, Dabur India Limited, Lion Corporation, Patanjali Ayurved Ltd., Tom's of Maine (Colgate-Palmolive), SNOW COSMETICS LLC, D.R. Harris & Co Ltd, Avon Products Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the toothpaste market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to invest in eco-friendly formulations and packaging solutions. Additionally, the integration of smart technology in oral care products, such as app-connected toothbrushes, is expected to enhance consumer engagement. These trends indicate a shift towards personalized oral care experiences, aligning with the growing demand for tailored health solutions in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Whitening Toothpaste Herbal Toothpaste Sensitive Teeth Toothpaste Children's Toothpaste Natural Toothpaste Others |

| By End-User | Adults Children |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Pharmaceutical & Drug Stores Online Retail |

| By Packaging Type | Tubes Pumps Sachets |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels |

| By Product Form | Paste Gel Powder |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Toothpaste | 120 | General Consumers, Dental Patients |

| Retail Insights on Toothpaste Sales | 60 | Store Managers, Category Buyers |

| Dental Professional Insights | 50 | Dentists, Dental Hygienists |

| Market Trends in Natural Toothpaste | 40 | Health-Conscious Consumers, Eco-Friendly Advocates |

| Brand Loyalty and Switching Behavior | 70 | Frequent Buyers, Brand Switchers |

The Global Toothpaste Market is valued at approximately USD 22 billion, driven by increasing consumer awareness of oral hygiene, rising disposable incomes, and the expansion of retail channels. This market is expected to grow further in the coming years.