Region:Global

Author(s):Rebecca

Product Code:KRAA2398

Pages:91

Published On:August 2025

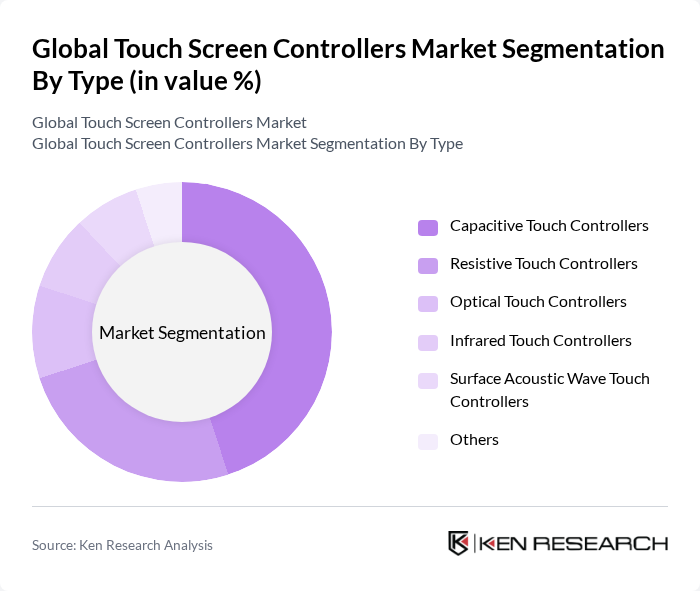

By Type:The market is segmented into various types of touch screen controllers, including capacitive, resistive, optical, infrared, surface acoustic wave, and others. Capacitive touch controllers dominate the market due to their widespread use in smartphones and tablets, driven by consumer preference for highly responsive and multi-touch capabilities. The increasing adoption of capacitive technology in automotive infotainment systems, industrial control panels, and interactive kiosks further solidifies its leading position .

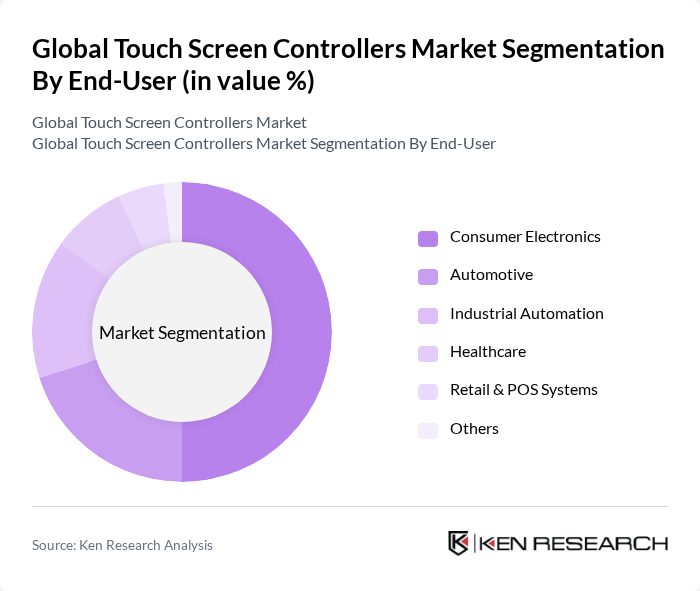

By End-User:The end-user segmentation includes consumer electronics, automotive, industrial automation, healthcare, retail & POS systems, and others. The consumer electronics segment holds the largest share, primarily due to the high demand for touch-enabled devices such as smartphones, tablets, laptops, and smart home appliances. The automotive sector is experiencing significant growth as manufacturers increasingly integrate touch screen technology into vehicles for infotainment, navigation, and climate control systems. Industrial automation and healthcare are also notable growth areas, driven by the adoption of touch interfaces in control panels and medical equipment .

The Global Touch Screen Controllers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Texas Instruments Incorporated, Microchip Technology Incorporated, Cypress Semiconductor Corporation (now part of Infineon Technologies AG), STMicroelectronics N.V., Analog Devices, Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Atmel Corporation (now part of Microchip Technology Incorporated), Broadcom Inc., onsemi (formerly ON Semiconductor Corporation), Infineon Technologies AG, Maxim Integrated Products, Inc. (now part of Analog Devices, Inc.), EETI (Egalax_Empia Technology Inc.), Himax Technologies, Inc., Synaptics Incorporated, Goodix Technology Inc., Elan Microelectronics Corporation, Melfas Inc., FocalTech Systems Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the touch screen controller market appears promising, driven by ongoing technological advancements and increasing integration with emerging technologies. As industries continue to embrace automation and smart devices, the demand for innovative touch solutions is expected to rise. Furthermore, the growing emphasis on user experience will likely lead to the development of more sophisticated touch interfaces, enhancing functionality and engagement across various applications, including healthcare and automotive sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Capacitive Touch Controllers Resistive Touch Controllers Optical Touch Controllers Infrared Touch Controllers Surface Acoustic Wave Touch Controllers Others |

| By End-User | Consumer Electronics Automotive Industrial Automation Healthcare Retail & POS Systems Others |

| By Application | Smartphones Tablets Wearables Laptops & PCs Kiosks ATMs Automotive Infotainment Systems Industrial Control Panels Medical Devices Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Multi-Touch Technology Single-Touch Technology Gesture Recognition Technology Haptic Feedback Technology Flexible/Foldable Display Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Touch Screen Controllers | 60 | Product Engineers, Automotive Designers |

| Consumer Electronics Touch Screens | 80 | R&D Managers, Product Development Leads |

| Industrial Touch Screen Applications | 50 | Operations Managers, Automation Specialists |

| Healthcare Touch Screen Devices | 40 | Medical Device Engineers, Compliance Officers |

| Smart Home Touch Screen Interfaces | 45 | IoT Developers, User Experience Designers |

The Global Touch Screen Controllers Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by the increasing demand for touch-enabled devices across various sectors, including consumer electronics, automotive, and healthcare.