Region:Global

Author(s):Rebecca

Product Code:KRAA2432

Pages:96

Published On:August 2025

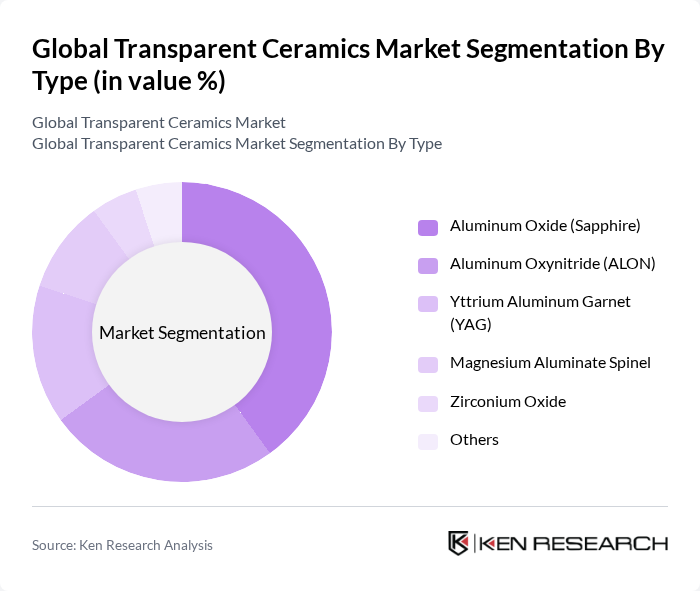

By Type:The market is segmented into various types of transparent ceramics, including Aluminum Oxide (Sapphire), Aluminum Oxynitride (ALON), Yttrium Aluminum Garnet (YAG), Magnesium Aluminate Spinel, Zirconium Oxide, and Others. Among these, Aluminum Oxide (Sapphire) is the leading subsegment due to its exceptional hardness, optical properties, and chemical stability, making it ideal for applications in electronics, defense, and optoelectronics. The demand for high-performance and miniaturized components in these sectors continues to drive the growth of this subsegment .

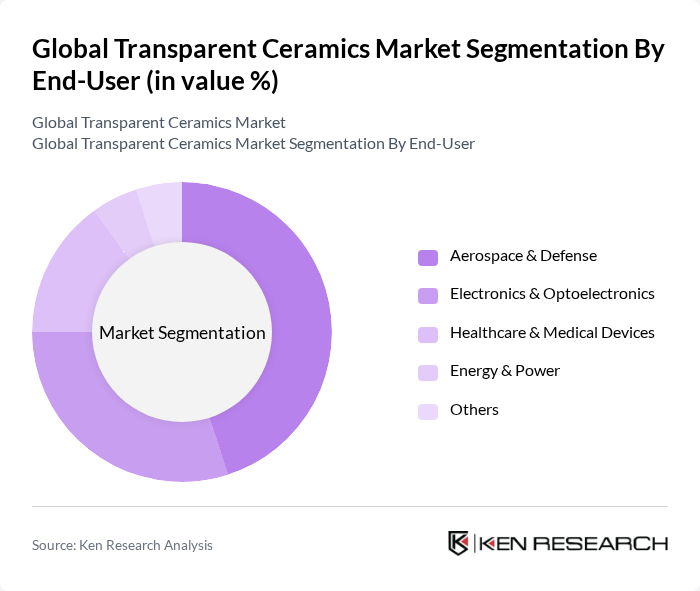

By End-User:The end-user segmentation includes Aerospace & Defense, Electronics & Optoelectronics, Healthcare & Medical Devices, Energy & Power, and Others. The Aerospace & Defense sector is the dominant segment, driven by the increasing need for lightweight, durable, and high-performance materials in military and aerospace applications. Transparent ceramics are widely used in protective armor, sensor windows, and advanced optical systems. The Electronics & Optoelectronics segment is also significant, with demand fueled by the adoption of transparent ceramics in displays, lasers, and semiconductor equipment. The Healthcare & Medical Devices sector is expanding due to the use of transparent ceramics in medical imaging and diagnostic devices .

The Global Transparent Ceramics Market is characterized by a dynamic mix of regional and international players. Leading participants such as CoorsTek, Inc., SCHOTT AG, II-VI Incorporated (now Coherent Corp.), CeramTec GmbH, Surmet Corporation, Kyocera Corporation, Morgan Advanced Materials plc, Saint-Gobain S.A., Nippon Electric Glass Co., Ltd., AGC Inc., Aremco Products, Inc., Advanced Ceramic Materials, H.C. Starck GmbH, Rauschert Steinbach GmbH, TOSOH Corporation, Heraeus Holding GmbH, Jiangsu Lida Optoelectronics Co., Ltd., Shanghai Nanyang Special Ceramics Co., Ltd., Mach 1 Inc., Sapphire Technology Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transparent ceramics market appears promising, driven by technological advancements and increasing applications across various sectors. As industries prioritize lightweight and durable materials, the demand for transparent ceramics is expected to rise significantly. Furthermore, the ongoing focus on sustainability and environmental compliance will likely encourage innovations in production processes, enhancing the market's growth potential. Companies that invest in research and development will be well-positioned to capitalize on emerging trends and meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Aluminum Oxide (Sapphire) Aluminum Oxynitride (ALON) Yttrium Aluminum Garnet (YAG) Magnesium Aluminate Spinel Zirconium Oxide Others |

| By End-User | Aerospace & Defense Electronics & Optoelectronics Healthcare & Medical Devices Energy & Power Others |

| By Application | Transparent Armor & Ballistic Protection Optical Components (Lenses, Windows, Domes) Lighting & LED Substrates Laser Systems Sensors & Imaging Systems Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Rest of APAC) Rest of World (Latin America, Middle East & Africa) |

| By Price Range | Low Medium High |

| By Product Form | Sheets & Plates Rods & Tubes Custom Shapes & Components Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 100 | Materials Engineers, Aerospace Product Managers |

| Defense Sector Utilization | 80 | Procurement Officers, Defense Technology Specialists |

| Optical Components Manufacturing | 90 | Optics Engineers, Production Supervisors |

| Consumer Electronics Integration | 60 | Product Development Managers, Supply Chain Analysts |

| Medical Device Applications | 50 | Regulatory Affairs Managers, Biomedical Engineers |

The Global Transparent Ceramics Market is valued at approximately USD 510 million, driven by increasing demand for advanced materials in sectors such as aerospace, defense, electronics, and healthcare, highlighting its significance in high-performance applications.