Global Transportation Industry Market Overview

- The Global Transportation Industry Market is valued at USD 8 trillion, based on a five-year historical analysis. This growth is primarily driven by increasing globalization, urbanization, and rapid advancements in digitalization, automation, and sustainability initiatives that have enhanced logistics and supply chain efficiency. The surge in e-commerce, the proliferation of on-demand mobility services, and heightened consumer demand for faster, more flexible delivery options have also significantly contributed to the market's expansion.

- Key players in this market include the United States, China, and Germany, which dominate due to their robust infrastructure, technological innovation, and substantial investments in transportation networks. The United States benefits from an extensive road and rail system and strong private consumption, China leads in rail and air transport capacity and infrastructure expansion, and Germany is recognized for its efficient logistics, automotive industry leadership, and advanced freight management.

- The Mobility Package (Regulation (EU) 2020/1055, Regulation (EU) 2020/1054, and Regulation (EU) 2020/1056), issued by the European Parliament and the Council in 2020, was fully implemented in 2023. This regulatory framework aims to enhance efficiency and sustainability in the European transportation sector by introducing mandatory rest periods, stricter cabotage rules, and digital tachographs for heavy-duty vehicles, as well as measures to reduce emissions and promote alternative fuels.

Global Transportation Industry Market Segmentation

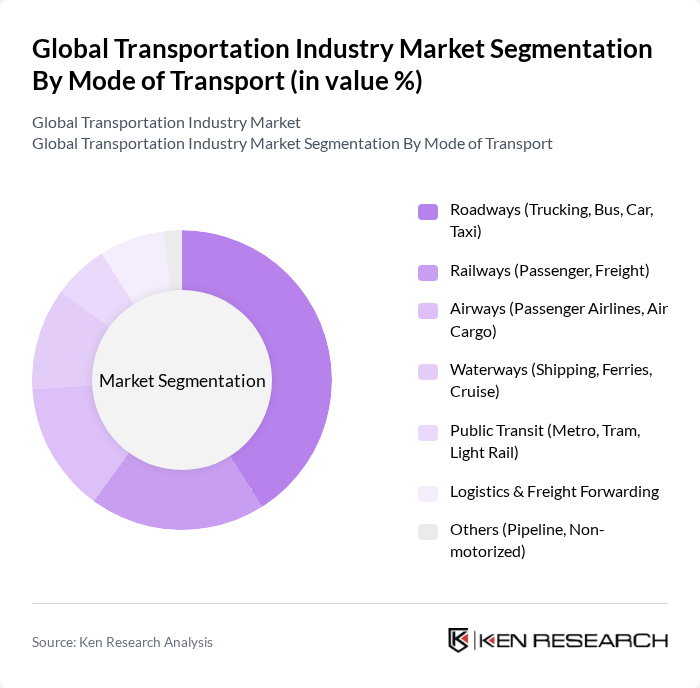

By Mode of Transport:The transportation market is segmented into roadways, railways, airways, waterways, public transit, logistics & freight forwarding, and others. Each mode serves distinct purposes and caters to different consumer needs. Roadways and logistics remain dominant due to their flexibility, last-mile connectivity, and critical role in both passenger and freight movement. The rise of courier, parcel delivery, and intermodal solutions is also reshaping modal dynamics.

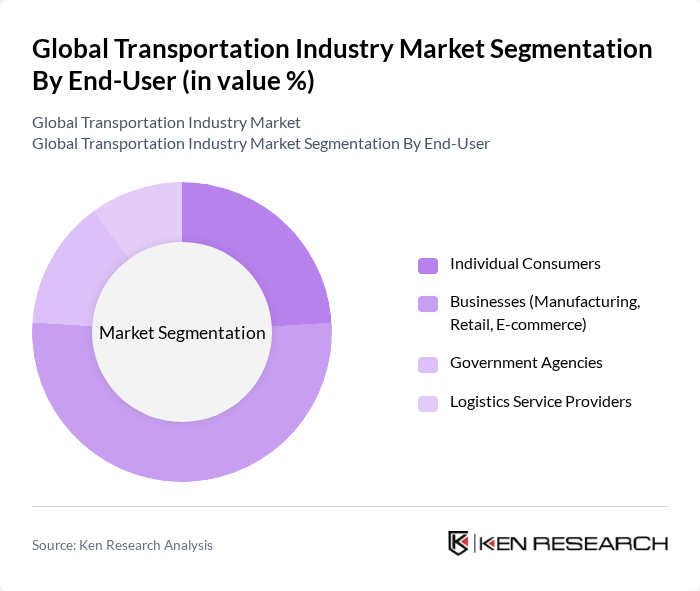

By End-User:The end-user segmentation includes individual consumers, businesses (manufacturing, retail, e-commerce), government agencies, and logistics service providers. Demand from businesses—especially e-commerce, manufacturing, and retail—continues to surge, driving significant growth in logistics, freight, and last-mile delivery services.

Global Transportation Industry Market Competitive Landscape

The Global Transportation Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL International GmbH, FedEx Corporation, UPS (United Parcel Service, Inc.), Maersk Line (A.P. Moller - Maersk Group), DB Schenker, SNCF Logistics, XPO Logistics, Inc., Kuehne + Nagel International AG, C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., Yang Ming Marine Transport Corporation, Hapag-Lloyd AG, China COSCO Shipping Corporation, TCDD Ta??mac?l?k A.?., American Airlines Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Transportation Industry Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization is a significant driver of the transportation industry, with the United Nations projecting that in future, approximately 56% of the global population will reside in urban areas, up from about 55% in recent years. This shift necessitates enhanced transportation infrastructure, leading to increased demand for public transit systems, road networks, and logistics services. In cities like Tokyo and New York, urban mobility solutions are being prioritized, resulting in investments exceeding $100 billion in infrastructure improvements to accommodate growing populations.

- Technological Advancements:The transportation sector is experiencing rapid technological advancements, particularly in automation and data analytics. In future, global investment in transportation technology is expected to reach $200 billion, driven by innovations such as AI, IoT, and blockchain. These technologies enhance operational efficiency, reduce costs, and improve safety. For instance, AI-driven traffic management systems in cities like Los Angeles have reportedly reduced congestion by 20%, showcasing the transformative impact of technology on urban transportation.

- Rising E-commerce Demand:The surge in e-commerce, projected to reach $6.4 trillion in sales by future, is significantly impacting the transportation industry. This growth is driving demand for efficient logistics and last-mile delivery solutions. Companies like Amazon are investing heavily in their logistics networks, with plans to add over 100 fulfillment centers globally. This shift is creating a need for innovative transportation solutions, including drone deliveries and automated warehouses, to meet consumer expectations for rapid delivery times.

Market Challenges

- Regulatory Compliance Issues:The transportation industry faces stringent regulatory compliance challenges, particularly regarding safety and environmental standards. In future, the global cost of compliance is estimated to exceed $50 billion, as companies must adhere to various regulations, including emissions standards and safety protocols. Non-compliance can result in hefty fines and operational disruptions, making it crucial for companies to invest in compliance management systems to navigate this complex landscape effectively.

- High Operational Costs:High operational costs remain a significant challenge for the transportation industry, with fuel prices projected to average $3.50 per gallon in future. Additionally, labor costs are rising, with the average salary for truck drivers in the U.S. reaching $50,000 annually. These factors contribute to an overall increase in logistics costs, which can account for up to 10% of a company's revenue. Companies must find ways to optimize operations and reduce costs to maintain profitability in this competitive environment.

Global Transportation Industry Market Future Outlook

The future of the transportation industry is poised for transformative changes driven by technological advancements and evolving consumer preferences. As urbanization continues to rise, cities will increasingly adopt smart transportation solutions, integrating AI and IoT to enhance efficiency. Additionally, the shift towards sustainability will drive investments in electric vehicles and green logistics. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves for growth in a rapidly changing market landscape.

Market Opportunities

- Expansion of Electric Vehicles:The electric vehicle (EV) market is projected to grow significantly, with sales expected to reach 10 million units by future. This growth presents opportunities for transportation companies to invest in EV infrastructure, including charging stations and fleet electrification, reducing operational costs and enhancing sustainability efforts.

- Growth in Smart Transportation Solutions:The demand for smart transportation solutions is on the rise, with investments in smart city initiatives projected to exceed $300 billion by future. This trend offers opportunities for companies to develop innovative technologies that improve traffic management, enhance public transit systems, and optimize logistics operations, ultimately leading to more efficient urban mobility.