Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2009

Pages:86

Published On:August 2025

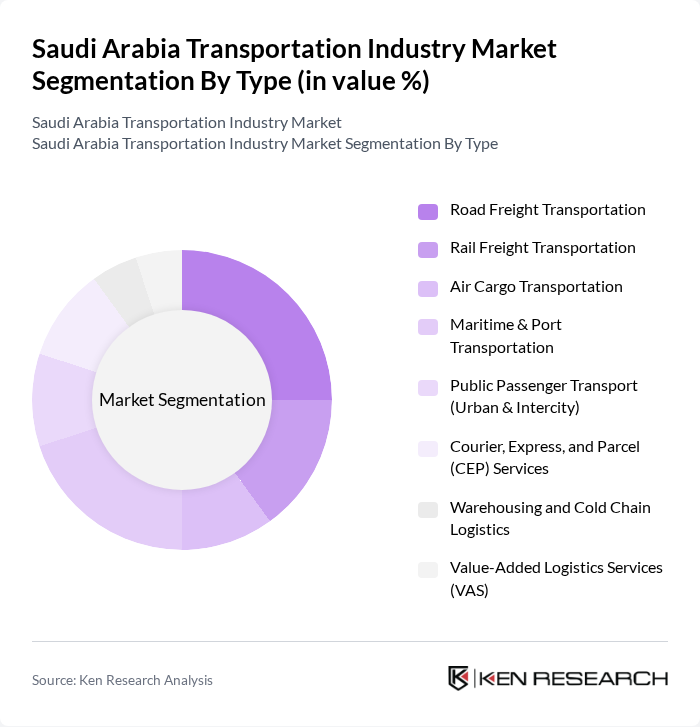

By Type:The transportation industry in Saudi Arabia can be segmented into various types, includingroad freight transportation, rail freight transportation, air cargo transportation, maritime and port transportation, public passenger transport (urban and intercity), courier, express, and parcel (CEP) services, warehousing and cold chain logistics, and value-added logistics services (VAS). Each of these segments plays a vital role in the overall market, catering to different logistical needs and consumer demands.

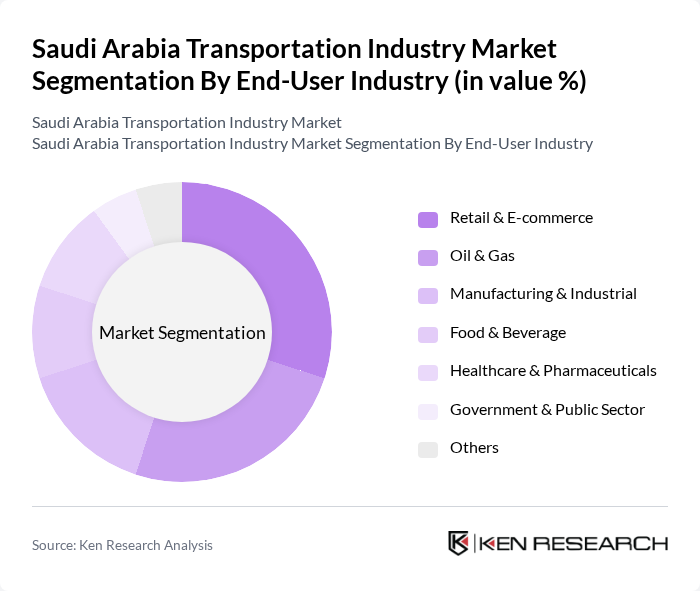

By End-User Industry:The transportation market in Saudi Arabia is also segmented by end-user industries, which includeretail and e-commerce, oil and gas, manufacturing and industrial, food and beverage, healthcare and pharmaceuticals, government and public sector, and others. Each industry has unique transportation needs, influencing the demand for specific logistics services.

The Saudi Arabia Transportation Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Airlines (Saudia), Saudi Public Transport Company (SAPTCO), Saudi Railway Company (SAR), National Shipping Company of Saudi Arabia (Bahri), Almajdouie Logistics, Abdul Latif Jameel Transport Services, Nesma Holding Co. Ltd., Al Bassami International Group, Agility Logistics Saudi Arabia, Aramex Saudi Arabia, Al-Jazira Equipment & Transport, Hala Supply Chain Services, Al-Rajhi Transport, Al-Suwaidi Group, Al-Tamimi Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi transportation industry is poised for significant transformation, driven by technological advancements and government initiatives. The integration of smart transportation solutions, such as AI and IoT, will enhance operational efficiency and safety. Furthermore, the shift towards electric vehicles is expected to gain momentum, supported by government incentives. As urbanization continues, the expansion of public transport systems will play a crucial role in addressing congestion and improving mobility, ultimately fostering sustainable economic growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Transportation Rail Freight Transportation Air Cargo Transportation Maritime & Port Transportation Public Passenger Transport (Urban & Intercity) Courier, Express, and Parcel (CEP) Services Warehousing and Cold Chain Logistics Value-Added Logistics Services (VAS) |

| By End-User Industry | Retail & E-commerce Oil & Gas Manufacturing & Industrial Food & Beverage Healthcare & Pharmaceuticals Government & Public Sector Others |

| By Application | Passenger Mobility Cargo & Freight Movement Last-Mile Delivery |

| By Distribution Mode | Direct Contracts Third-Party Logistics (3PL) Providers Online Logistics Platforms |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Services | 60 | Transport Authority Officials, Public Transit Managers |

| Logistics and Freight Services | 70 | Logistics Managers, Supply Chain Executives |

| Air Cargo Operations | 40 | Airline Operations Managers, Cargo Handlers |

| Maritime Transport Sector | 40 | Port Authorities, Shipping Company Executives |

| Infrastructure Development Projects | 40 | Project Managers, Civil Engineers in Transportation |

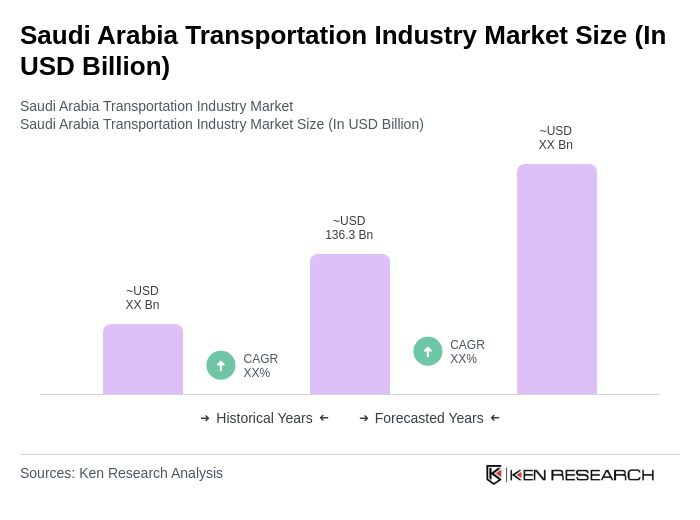

The Saudi Arabia Transportation Industry Market is valued at approximately USD 136.3 billion, driven by strategic investments in infrastructure, urbanization, and the demand for efficient logistics and transportation services as part of the Vision 2030 initiatives.