Region:Global

Author(s):Dev

Product Code:KRAC1937

Pages:91

Published On:October 2025

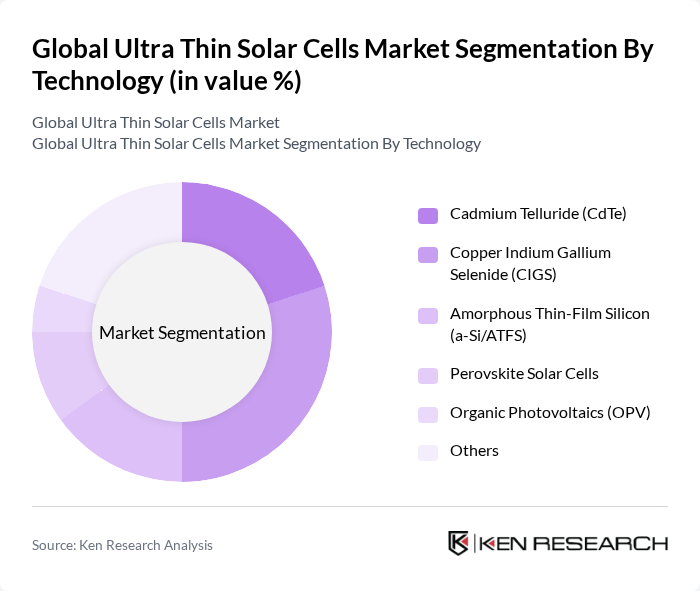

By Technology:The technology segment of the ultra-thin solar cells market includes Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Thin-Film Silicon (a-Si/ATFS), Perovskite Solar Cells, Organic Photovoltaics (OPV), and others. CIGS technology is gaining traction due to its high efficiency, flexibility, and suitability for integration into curved and lightweight applications. The demand for flexible and portable solar solutions is driving the growth of this segment, while perovskite and organic photovoltaics are emerging as promising alternatives due to ongoing improvements in efficiency and manufacturing scalability .

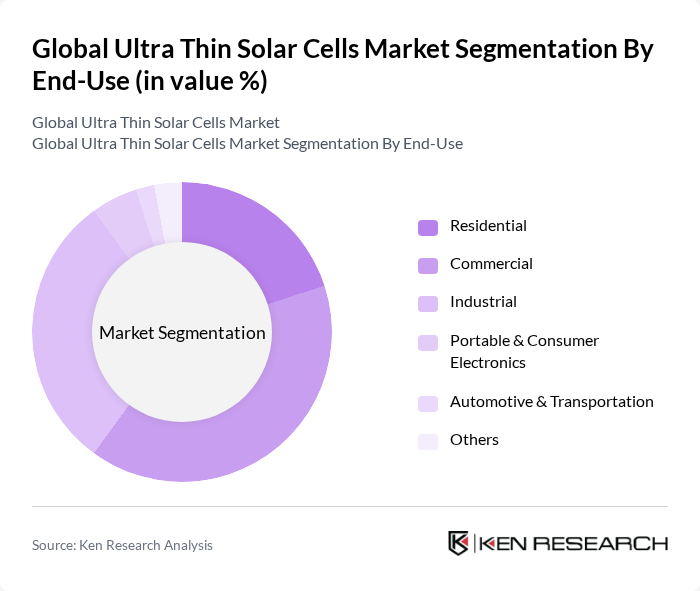

By End-Use:The end-use segment encompasses applications including Residential, Commercial, Industrial, Portable & Consumer Electronics, Automotive & Transportation, and others. The commercial segment currently holds the largest share, driven by the adoption of ultra-thin solar cells in building-integrated photovoltaics and architectural applications. The industrial sector follows, with significant use in remote power generation and specialized equipment. The residential segment, while smaller, is experiencing rapid growth due to increased consumer awareness and the availability of aesthetically integrated solutions for homes. Portable electronics and automotive applications are also expanding, fueled by the need for lightweight, flexible energy sources .

The Global Ultra Thin Solar Cells Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, Inc., SunPower Corporation, JinkoSolar Holding Co., Ltd., Canadian Solar Inc., Trina Solar Limited, Hanwha Q CELLS Co., Ltd., LONGi Green Energy Technology Co., Ltd., JA Solar Technology Co., Ltd., REC Group, Yingli Green Energy Holding Company Limited, GCL-Poly Energy Holdings Limited, Sharp Corporation, Kaneka Corporation, Solar Frontier K.K., MiaSolé contribute to innovation, geographic expansion, and service delivery in this space.

The future of ultra-thin solar cells appears promising, driven by increasing investments in renewable energy and technological advancements. By future, the integration of smart technologies and energy management systems is expected to enhance the efficiency and appeal of solar solutions. Additionally, as environmental regulations tighten globally, the demand for sustainable energy solutions will likely rise, further propelling the adoption of ultra-thin solar cells in various sectors, including residential, commercial, and industrial applications.

| Segment | Sub-Segments |

|---|---|

| By Technology | Cadmium Telluride (CdTe) Copper Indium Gallium Selenide (CIGS) Amorphous Thin-Film Silicon (a-Si/ATFS) Perovskite Solar Cells Organic Photovoltaics (OPV) Others |

| By End-Use | Residential Commercial Industrial Portable & Consumer Electronics Automotive & Transportation Others |

| By Application | Building-Integrated Photovoltaics (BIPV) Rooftop Installations Off-Grid Power Systems Utility-Scale Projects Wearables & IoT Devices Aerospace & Defense Others |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Panel Users | 120 | Homeowners, Energy Managers |

| Commercial Solar Installations | 90 | Facility Managers, Sustainability Officers |

| Solar Technology Manufacturers | 60 | Product Development Managers, Engineers |

| Government Energy Policy Makers | 50 | Policy Analysts, Regulatory Affairs Managers |

| Research Institutions and Academia | 40 | Researchers, Professors in Renewable Energy |

The Global Ultra Thin Solar Cells Market is valued at approximately USD 20 million, driven by the increasing demand for renewable energy and advancements in solar cell technologies, particularly in consumer electronics and building-integrated photovoltaics.