Region:Middle East

Author(s):Dev

Product Code:KRAC2064

Pages:89

Published On:October 2025

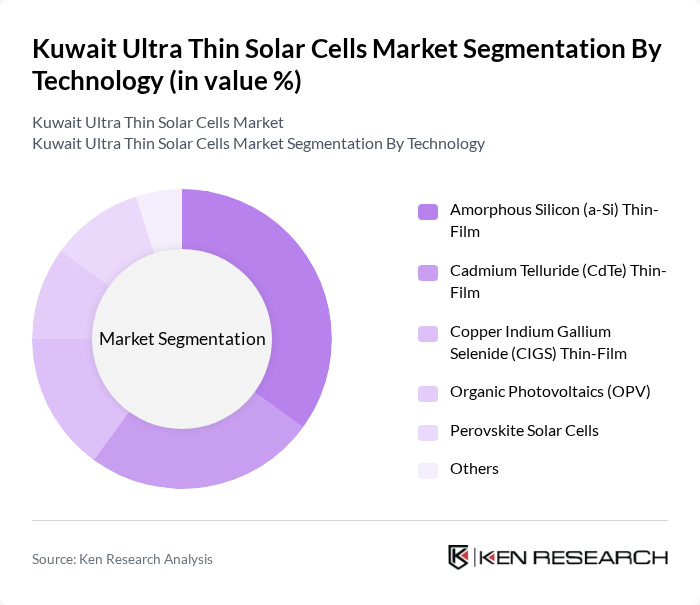

By Technology:The technology segment includes Amorphous Silicon (a-Si) Thin-Film, Cadmium Telluride (CdTe) Thin-Film, Copper Indium Gallium Selenide (CIGS) Thin-Film, Organic Photovoltaics (OPV), Perovskite Solar Cells, and Others. Globally, perovskite solar cells are gaining significant traction due to their high efficiency and potential for low-cost manufacturing, though thin-film technologies like CdTe and CIGS remain important for specific applications . The claim that a-Si Thin-Film leads the Kuwait market is plausible given its historical use in building-integrated photovoltaics, but no Kuwait-specific technology share data is available in the cited sources. The global trend shows perovskite and advanced thin-film technologies as key growth areas, driven by material science innovations and the demand for flexible, lightweight solutions .

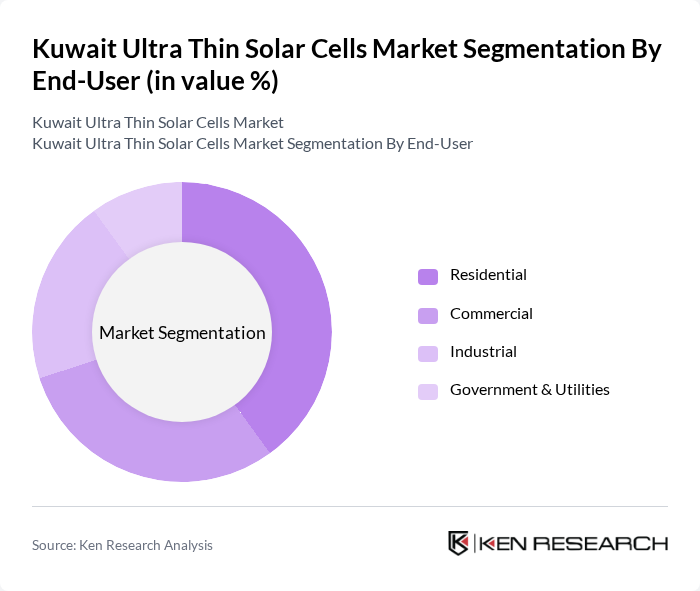

By End-User:The end-user segment includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is highlighted as a significant contributor, driven by consumer awareness and government incentives. However, in the broader Middle East context, commercial and utility-scale projects are also major drivers, especially as countries invest in large-scale renewable energy infrastructure to meet national targets . The trend towards decentralized and mobile energy systems in the region supports growth across all segments, with particular relevance for off-grid and portable applications where ultra-thin solar cells excel .

The Kuwait Ultra Thin Solar Cells Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, Inc., Oxford PV, Greatcell Solar Limited, Exeger Operations AB, SunPower Corporation, Canadian Solar Inc., JinkoSolar Holding Co., Ltd., Trina Solar Limited, LONGi Green Energy Technology Co., Ltd., JA Solar Technology Co., Ltd., REC Group, Q CELLS, Peccell Technologies, Inc., Merck KGaA, Kuwait National Petroleum Company (KNPC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait ultra-thin solar cells market appears promising, driven by increasing investments in renewable energy and technological advancements. As the government continues to implement supportive policies and incentives, the market is expected to witness significant growth. Additionally, the integration of smart technologies and off-grid solutions will likely enhance the appeal of solar energy, making it a viable option for both urban and rural areas, thus expanding its reach and adoption.

| Segment | Sub-Segments |

|---|---|

| By Technology | Amorphous Silicon (a-Si) Thin-Film Cadmium Telluride (CdTe) Thin-Film Copper Indium Gallium Selenide (CIGS) Thin-Film Organic Photovoltaics (OPV) Perovskite Solar Cells Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Building-Integrated Photovoltaics (BIPV) Portable & Wearable Devices Off-Grid Power Solutions Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 120 | Homeowners, Property Managers |

| Commercial Solar Solutions | 100 | Facility Managers, Business Owners |

| Government Renewable Energy Initiatives | 80 | Policy Makers, Energy Regulators |

| Research and Development in Solar Technology | 60 | R&D Managers, Technical Experts |

| Investment in Solar Projects | 70 | Investors, Financial Analysts |

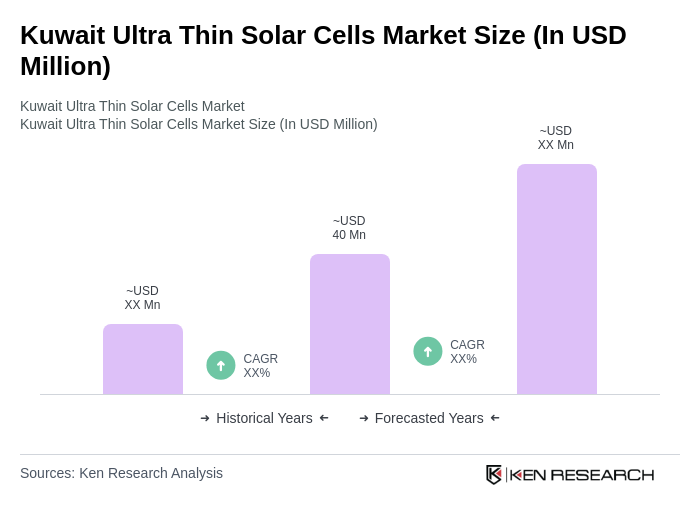

The Kuwait Ultra Thin Solar Cells Market is valued at approximately USD 40 million, reflecting a growing interest in renewable energy solutions and advancements in solar technology. This market is still in its early stages compared to larger global solar markets.