Region:Global

Author(s):Dev

Product Code:KRAC0536

Pages:93

Published On:August 2025

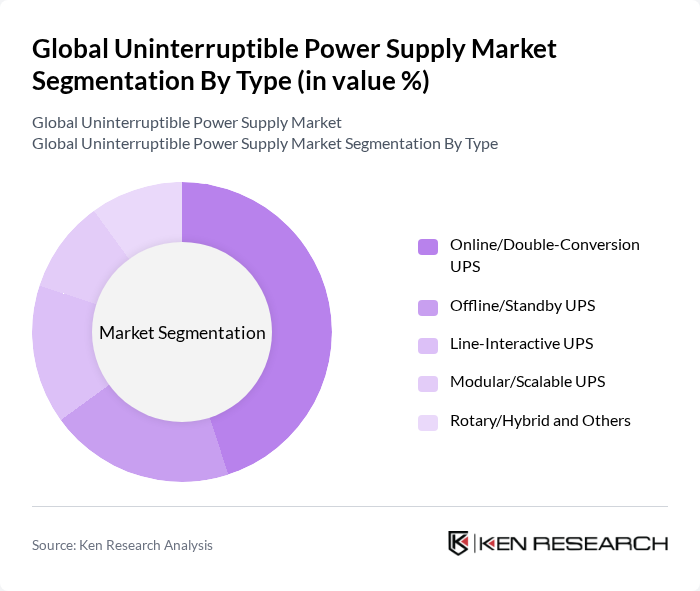

By Type:The market is segmented into various types of uninterruptible power supplies, including Online/Double-Conversion UPS, Offline/Standby UPS, Line-Interactive UPS, Modular/Scalable UPS, and Rotary/Hybrid and Others. Among these, Online/Double-Conversion UPS is the most dominant segment due to its ability to provide continuous power without any interruption, making it ideal for critical applications such as data centers and healthcare facilities. The demand for high reliability and power quality drives the preference for this type of UPS.

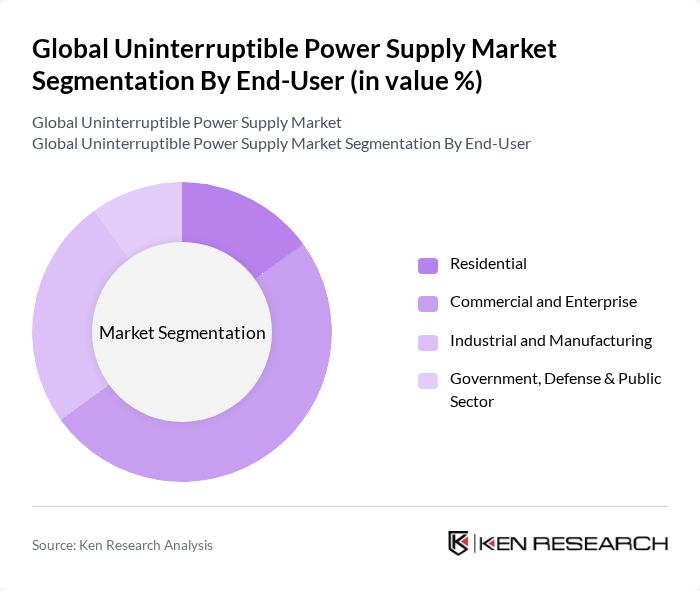

By End-User:The end-user segmentation includes Residential, Commercial and Enterprise, Industrial and Manufacturing, and Government, Defense & Public Sector. The Commercial and Enterprise segment leads the market, driven by the increasing reliance on technology and the need for uninterrupted power supply in businesses. The growing number of data centers and the expansion of IT infrastructure in urban areas further bolster the demand for UPS systems in this segment.

The Global Uninterruptible Power Supply Market is characterized by a dynamic mix of regional and international players. Leading participants such as APC by Schneider Electric, Eaton Corporation plc, Vertiv Holdings Co, Tripp Lite (a brand of Eaton), CyberPower Systems, Inc., Riello UPS S.p.A., Delta Electronics, Inc., Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions Corporation, Huawei Technologies Co., Ltd. (UPS & Power), Kehua Data Co., Ltd. (Kehua Tech), Legrand Group (Socomec brand), AEG Power Solutions, Fuji Electric Co., Ltd., Schneider Electric SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the uninterruptible power supply market appears promising, driven by technological advancements and increasing energy demands. The integration of smart technologies and IoT in UPS systems is expected to enhance efficiency and reliability. Additionally, as industries prioritize sustainability, eco-friendly UPS solutions will gain traction. The focus on energy efficiency and renewable energy integration will further propel market growth, creating a robust landscape for UPS providers in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Online/Double-Conversion UPS Offline/Standby UPS Line-Interactive UPS Modular/Scalable UPS Rotary/Hybrid and Others |

| By End-User | Residential Commercial and Enterprise Industrial and Manufacturing Government, Defense & Public Sector |

| By Application | Data Centers Telecommunications Healthcare and Medical Facilities Industrial Automation and Process Control BFSI, Retail, Education and Others |

| By Component | Batteries (VRLA, Lithium-ion, NiCd) Power Electronics (Rectifiers, Inverters) Control/Monitoring & Management Software Services (Installation, Maintenance) and Others |

| By Sales Channel | Direct Sales Indirect/Distributor Sales Online/E-commerce System Integrators and Others |

| By Capacity Rating | Below 10 kVA –100 kVA –500 kVA –1,000 kVA Above 1,000 kVA |

| By Battery Technology | Valve-Regulated Lead Acid (VRLA) Lithium-ion Nickel-Cadmium (NiCd) and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Data Center UPS Solutions | 120 | Data Center Managers, IT Infrastructure Directors |

| Healthcare Power Backup Systems | 100 | Facility Managers, Biomedical Engineers |

| Telecommunications UPS Applications | 80 | Network Operations Managers, Telecom Engineers |

| Industrial UPS Installations | 70 | Plant Managers, Electrical Engineers |

| Commercial UPS Systems | 90 | Building Managers, Energy Efficiency Consultants |

The Global Uninterruptible Power Supply Market is valued at approximately USD 11.5 billion, driven by the increasing demand for reliable power supply solutions across various sectors, including IT, healthcare, and manufacturing, as well as the rising frequency of power outages.