Region:Global

Author(s):Dev

Product Code:KRAA2197

Pages:86

Published On:August 2025

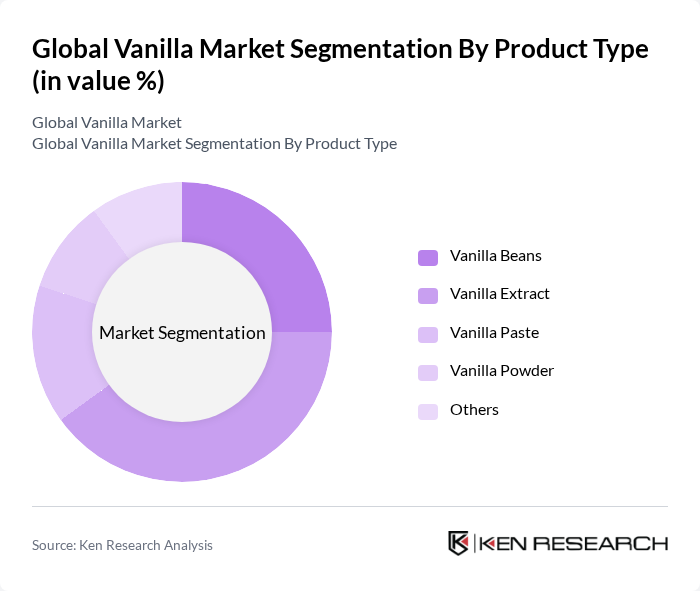

By Product Type:The product type segmentation includes vanilla beans, vanilla extract, vanilla paste, vanilla powder, and other forms. Vanilla extract remains the most popular due to its versatility and ease of use in culinary and industrial applications. Vanilla beans are in high demand among gourmet chefs and artisanal producers for their robust flavor profile and premium positioning. Vanilla paste and powder are increasingly favored for their convenience and ability to deliver concentrated flavor in processed foods and beverages.

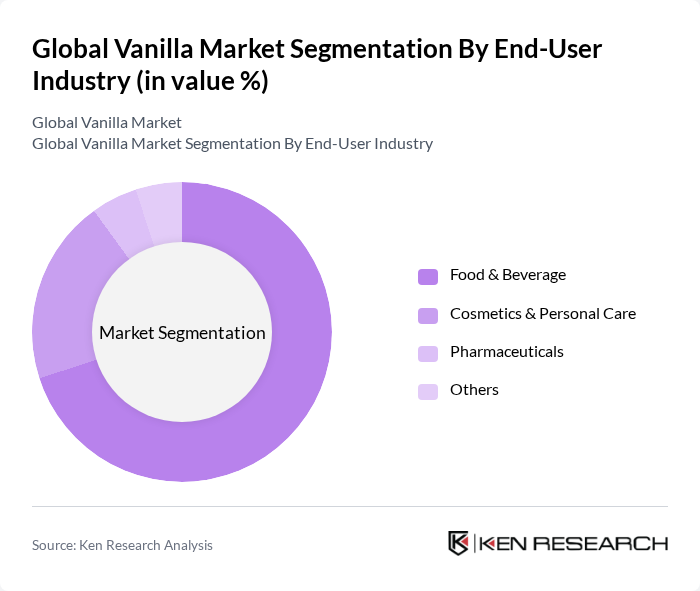

By End-User Industry:The end-user industry segmentation includes food & beverage, cosmetics & personal care, pharmaceuticals, and others. The food & beverage sector is the largest consumer, accounting for the majority of vanilla usage due to the increasing preference for natural flavors in processed foods, bakery, dairy, and beverages. The cosmetics and personal care industry is experiencing notable growth in vanilla demand, driven by its appealing scent and perceived skin benefits, while pharmaceutical applications leverage vanilla for its antioxidant and anti-inflammatory properties.

The Global Vanilla Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nielsen-Massey Vanillas, Inc., McCormick & Company, Inc., Symrise AG, Aust & Hachmann (Canada) Ltd., Heilala Vanilla Ltd., Lochhead Manufacturing Company, Sambavanilla SARL, Frontier Co-op, T. Hasegawa Co., Ltd., D. G. A. Vanille, Vanilla Food Company, Blue Pacific Flavors, Inc., The Vanilla Company, Tavanipupu Vanilla, Eurovanille SAS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the vanilla market appears promising, driven by increasing consumer demand for natural and organic products. As health consciousness continues to rise, manufacturers are likely to innovate with vanilla-based offerings, particularly in health and wellness sectors. Additionally, the expansion of e-commerce platforms will facilitate broader access to vanilla products, enhancing market reach. Sustainable sourcing practices will also gain traction, aligning with consumer preferences for ethically produced goods, thereby shaping the market landscape positively.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Vanilla Beans Vanilla Extract Vanilla Paste Vanilla Powder Others |

| By End-User Industry | Food & Beverage Cosmetics & Personal Care Pharmaceuticals Others |

| By Application | Bakery & Confectionery Dairy & Frozen Desserts Beverages Fragrances Others |

| By Distribution Channel | Online Stores Supermarkets/Hypermarkets Specialty Stores Foodservice Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vanilla Farmers | 100 | Smallholder Farmers, Cooperative Leaders |

| Importers and Distributors | 60 | Supply Chain Managers, Procurement Managers |

| Food and Beverage Manufacturers | 50 | Product Development Managers, Quality Assurance Managers |

| Cosmetics Industry Stakeholders | 40 | Formulation Chemists, Brand Managers |

| Regulatory Bodies and Trade Associations | 40 | Policy Makers, Industry Analysts |

The Global Vanilla Market is valued at approximately USD 3.2 billion, driven by increasing demand for natural flavors in food, beverages, and cosmetics, as well as a trend towards clean label ingredients and sustainably sourced products.