Region:Middle East

Author(s):Dev

Product Code:KRAC3489

Pages:88

Published On:October 2025

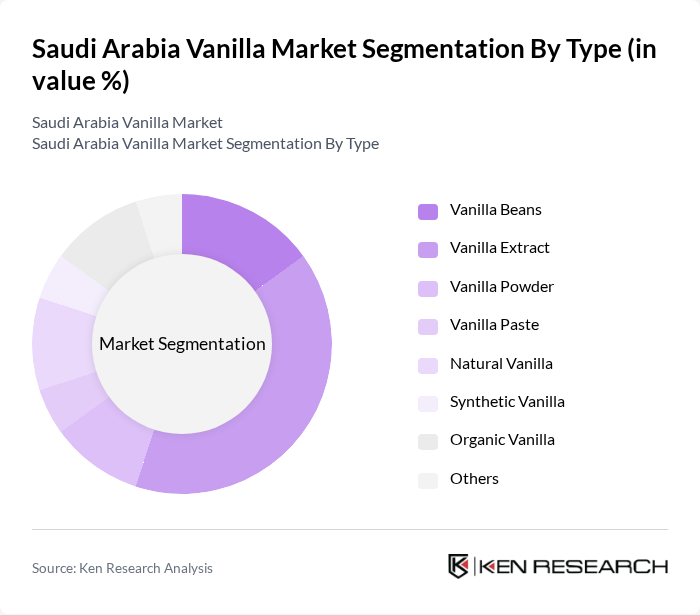

By Type:The market is segmented into various types of vanilla products, including Vanilla Beans, Vanilla Extract, Vanilla Powder, Vanilla Paste, Natural Vanilla, Synthetic Vanilla, Organic Vanilla, and Others. Among these, Vanilla Extract is the most popular due to its versatility and ease of use in various culinary applications. The growing trend towards natural and organic products has also led to an increase in the demand for Organic Vanilla, which is gaining traction among health-conscious consumers.

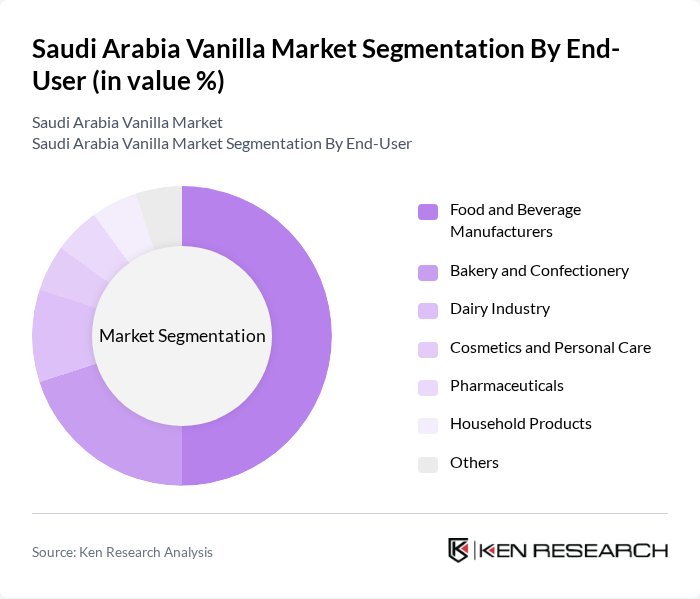

By End-User:The end-user segmentation includes Food and Beverage Manufacturers, Bakery and Confectionery, Dairy Industry, Cosmetics and Personal Care, Pharmaceuticals, Household Products, and Others. The Food and Beverage Manufacturers segment holds the largest share, driven by the increasing incorporation of vanilla in various food products, including ice creams, desserts, and beverages. The Bakery and Confectionery segment is also significant, as vanilla is a staple flavoring agent in baked goods.

The Saudi Arabia Vanilla Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nielsen-Massey Vanillas, Inc., McCormick & Company, Inc., Aust & Hachmann (Canada) Ltd., Symrise AG, Givaudan SA, Firmenich SA, Kerry Group plc, Sensient Technologies Corporation, Slofoodgroup LLC, Vanilla Food Company (Saudi Arabia), Evolva Holding SA, Heilala Vanilla, Sambavanam Spices, Advanced Biotech, Dr. Oetker GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia vanilla market is poised for growth, driven by increasing consumer demand for natural flavors and health-conscious products. Innovations in extraction techniques and a shift towards organic vanilla are expected to enhance product offerings. Additionally, the expansion of e-commerce platforms will facilitate greater access to vanilla products. As the market evolves, collaboration with local farmers and investment in sustainable practices will be crucial for long-term success and resilience against supply chain challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Vanilla Beans Vanilla Extract Vanilla Powder Vanilla Paste Natural Vanilla Synthetic Vanilla Organic Vanilla Others |

| By End-User | Food and Beverage Manufacturers Bakery and Confectionery Dairy Industry Cosmetics and Personal Care Pharmaceuticals Household Products Others |

| By Sales Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Food Service Providers Direct Sales Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Wholesalers Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Application | Baking Confectionery Beverages Dairy Products Personal Care & Cosmetics Pharmaceuticals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vanilla Producers | 60 | Farm Owners, Agricultural Managers |

| Distributors and Wholesalers | 50 | Supply Chain Managers, Sales Directors |

| Food and Beverage Manufacturers | 45 | Product Development Managers, Procurement Officers |

| Retail Sector Insights | 55 | Category Managers, Store Owners |

| Consumer Preferences | 80 | End Consumers, Food Enthusiasts |

The Saudi Arabia Vanilla Market is valued at approximately USD 4 million, reflecting a growing demand for natural flavors in the food and beverage industry, as well as a trend towards organic and natural products among consumers.