Region:Global

Author(s):Geetanshi

Product Code:KRAD0055

Pages:82

Published On:August 2025

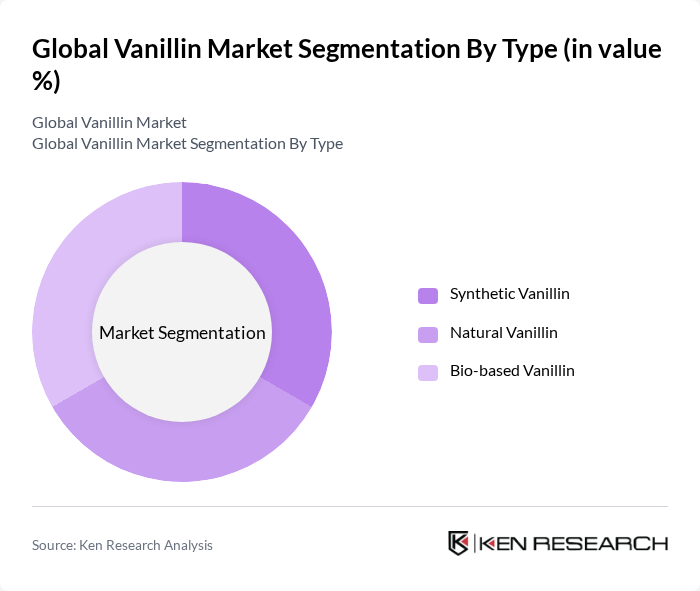

By Type:The vanillin market is segmented into three main types: Synthetic Vanillin, Natural Vanillin, and Bio-based Vanillin. Synthetic Vanillin remains the most widely used due to its cost-effectiveness and ease of production. However, Natural Vanillin is gaining market share as consumers increasingly prefer natural ingredients in food and personal care products. Bio-based Vanillin, produced from renewable resources, is emerging as a sustainable alternative, appealing to environmentally conscious consumers.

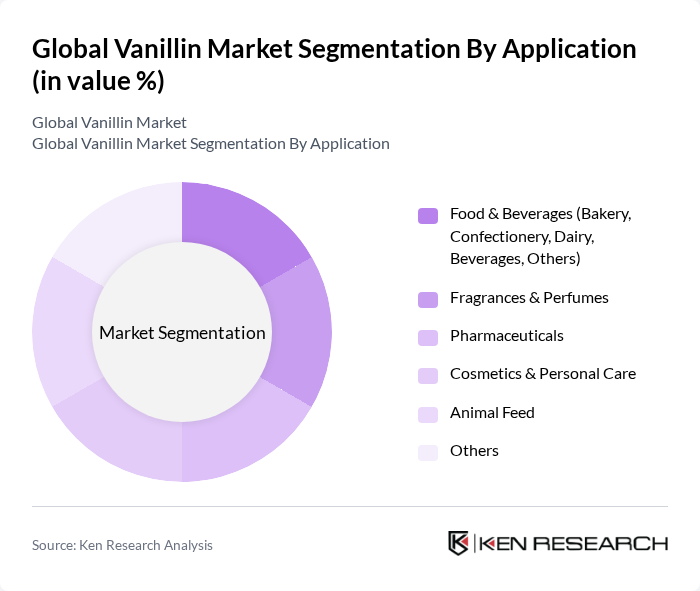

By Application:Vanillin is used across Food & Beverages, Fragrances & Perfumes, Pharmaceuticals, Cosmetics & Personal Care, Animal Feed, and other sectors. The Food & Beverages segment holds the largest share, driven by vanillin’s extensive use in bakery, confectionery, dairy, and beverage products. The Fragrances & Perfumes segment is also significant, as vanillin is a key ingredient in many fragrance formulations, enhancing scent profiles.

The Global Vanillin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solvay S.A., Jiaxing Zhonghua Chemical Co., Ltd., Borregaard AS, Camlin Fine Sciences Ltd., Merck KGaA, International Flavors & Fragrances Inc., Givaudan SA, Symrise AG, Firmenich SA, Mane SA, Robertet SA, Advanced Biotech, PROVA SAS, Prinova Group LLC, Sensient Technologies Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the vanillin market appears promising, driven by the increasing consumer preference for natural products and sustainable sourcing practices. As the demand for clean-label food and beverage options continues to rise, companies are likely to invest in innovative extraction methods to enhance product quality. Additionally, the expansion of e-commerce platforms is expected to facilitate greater accessibility for consumers, allowing for a broader distribution of vanillin products. This evolving landscape presents significant opportunities for growth and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Vanillin Natural Vanillin Bio-based Vanillin |

| By Application | Food & Beverages (Bakery, Confectionery, Dairy, Beverages, Others) Fragrances & Perfumes Pharmaceuticals Cosmetics & Personal Care Animal Feed Others |

| By End-User | Food & Beverage Industry Flavor & Fragrance Manufacturers Pharmaceutical Companies Cosmetic & Personal Care Industry Others |

| By Distribution Channel | Direct Sales (B2B) Distributors/Wholesalers Online Retail Offline Retail |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Southeast Asia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Medium Price High Price |

| By Packaging Type | Bulk Packaging Retail Packaging Industrial Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Fragrance and Cosmetic Companies | 80 | Fragrance Chemists, Brand Managers |

| Flavoring Agents Distributors | 60 | Sales Directors, Supply Chain Managers |

| Research Institutions and Universities | 50 | Academic Researchers, Industry Analysts |

| Regulatory Bodies and Trade Associations | 40 | Policy Makers, Industry Advocates |

The Global Vanillin Market is valued at approximately USD 670 million, driven by increasing demand for natural flavors in the food and beverage industry, as well as its applications in fragrances and cosmetics.