Region:North America

Author(s):Rebecca

Product Code:KRAC9870

Pages:88

Published On:November 2025

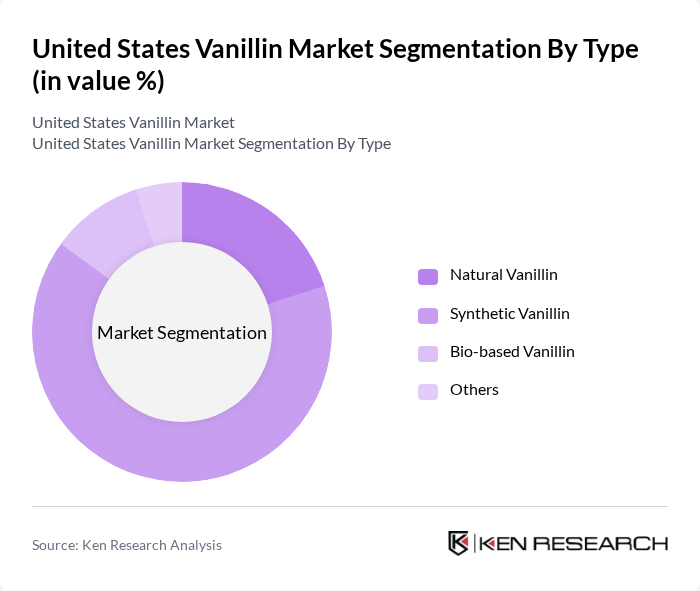

By Type:The vanillin market is segmented into four main types: Natural Vanillin, Synthetic Vanillin, Bio-based Vanillin, and Others.Natural Vanillinis extracted from vanilla beans,Synthetic Vanillinis produced through chemical synthesis (primarily guaiacol-based), andBio-based Vanillinis derived from renewable feedstocks such as lignin or ferulic acid. The Others category includes alternative and specialty vanillin derivatives.Synthetic Vanillincontinues to dominate the market due to its cost-effectiveness, consistent quality, and reliable supply, while natural and bio-based vanillin are gaining traction with the rise of clean-label and sustainable product trends .

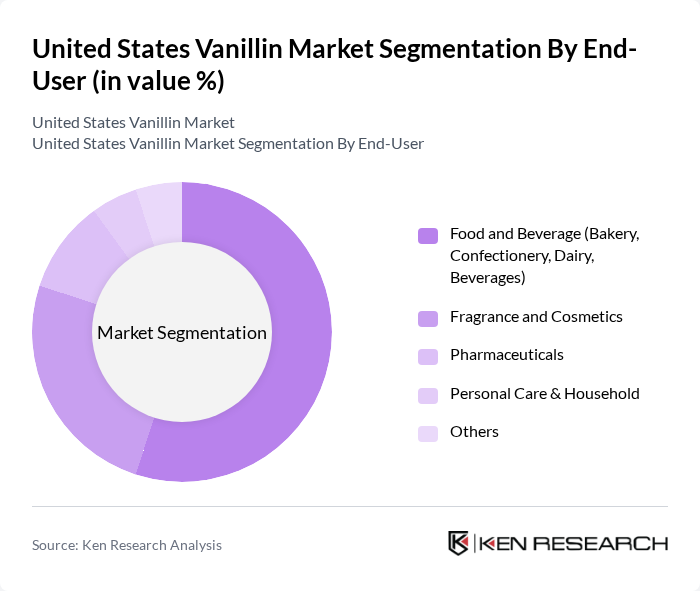

By End-User:The end-user segmentation of the vanillin market includes Food and Beverage (Bakery, Confectionery, Dairy, Beverages), Fragrance and Cosmetics, Pharmaceuticals, Personal Care & Household, and Others. TheFood and Beveragesector remains the largest consumer of vanillin, driven by the growing demand for flavoring agents in bakery, confectionery, dairy, and beverage applications. TheFragrance and Cosmeticsindustry is also a significant user, leveraging vanillin for its aromatic and stabilizing properties. Pharmaceutical and personal care applications are expanding as vanillin is increasingly used for masking flavors and as a functional ingredient in health and wellness products .

The United States Vanillin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solvay S.A., Merck KGaA, Givaudan SA, Firmenich SA, Symrise AG, International Flavors & Fragrances Inc. (IFF), Sensient Technologies Corporation, T. Hasegawa Co., Ltd., Camlin Fine Sciences Ltd., Advanced Biotech, Flavorchem Corporation, Borregaard ASA, Evolva Holding SA, A.M. Todd Company, Vigon International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. vanillin market appears promising, driven by increasing consumer demand for natural and organic products. As the food and beverage industry continues to evolve, manufacturers are likely to invest in innovative extraction techniques and sustainable sourcing practices. Additionally, the expansion of e-commerce platforms is expected to facilitate greater access to vanillin products, enhancing market reach. Overall, these trends indicate a robust growth trajectory for the vanillin market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Vanillin Synthetic Vanillin Bio-based Vanillin Others |

| By End-User | Food and Beverage (Bakery, Confectionery, Dairy, Beverages) Fragrance and Cosmetics Pharmaceuticals Personal Care & Household Others |

| By Application | Flavoring Agent Fragrance Component Food Preservative Dietary Supplements and Sports Nutrition Others |

| By Distribution Channel | Online Retail Offline Retail (Supermarkets, Specialty Stores) Direct Sales (B2B) Others |

| By Region | Northeast Midwest South West |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Flavor Technologists |

| Cosmetics and Personal Care Companies | 90 | Formulation Chemists, Brand Managers |

| Pharmaceutical Companies | 70 | Regulatory Affairs Specialists, R&D Directors |

| Flavor and Fragrance Suppliers | 60 | Sales Managers, Technical Support Staff |

| Research Institutions and Universities | 50 | Academic Researchers, Industry Analysts |

The United States Vanillin Market is valued at approximately USD 850 million, reflecting a significant growth trend driven by increasing demand for natural flavors in various industries, including food, beverages, fragrances, and cosmetics.