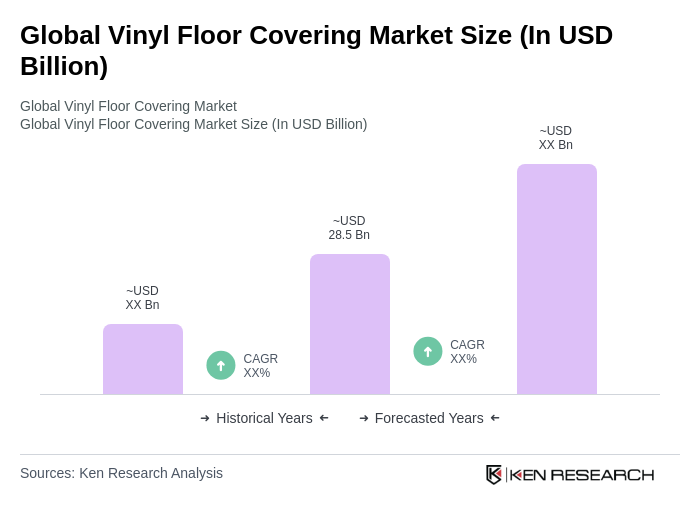

Global Vinyl Floor Covering Market Overview

- The Global Vinyl Floor Covering Market is valued at USD 28.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for durable, cost-effective, and aesthetically pleasing flooring solutions in both residential and commercial sectors. The rise in construction activities, coupled with the growing trend of home renovations, has significantly contributed to the market's expansion .

- Key players in this market include the United States, Germany, and China, which dominate due to their robust construction industries and high consumer spending on home improvement. The presence of leading manufacturers and a strong distribution network in these regions further enhances their market position, making them pivotal in shaping global trends in vinyl flooring .

- In 2023, the U.S. government implemented regulations aimed at reducing the environmental impact of flooring materials. This includes stricter guidelines on the use of phthalates in vinyl flooring products, as mandated by the “Phthalates Action Plan” under the U.S. Environmental Protection Agency (EPA) and the Consumer Product Safety Improvement Act (CPSIA) enforced by the U.S. Consumer Product Safety Commission. These regulations promote the adoption of safer alternatives and encourage manufacturers to invest in sustainable practices, thereby enhancing the overall market landscape.

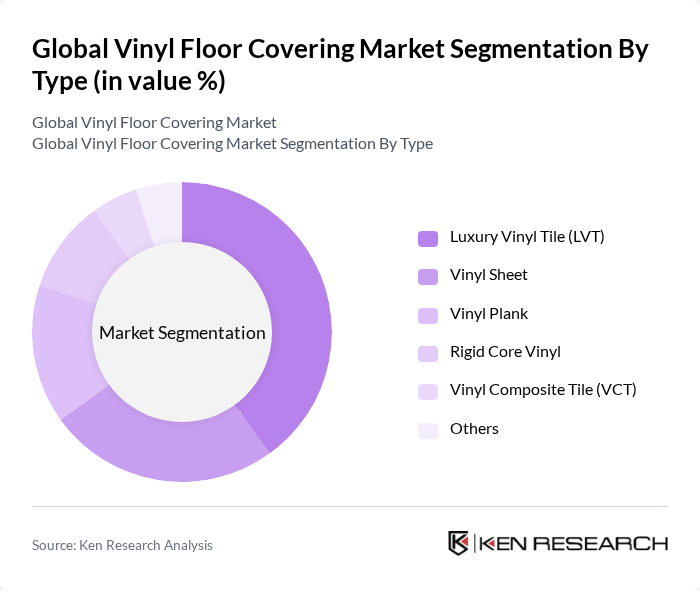

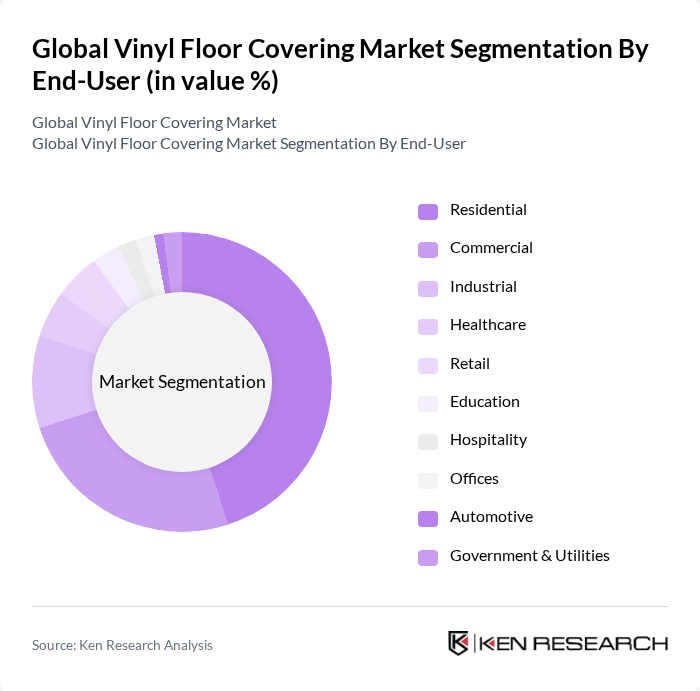

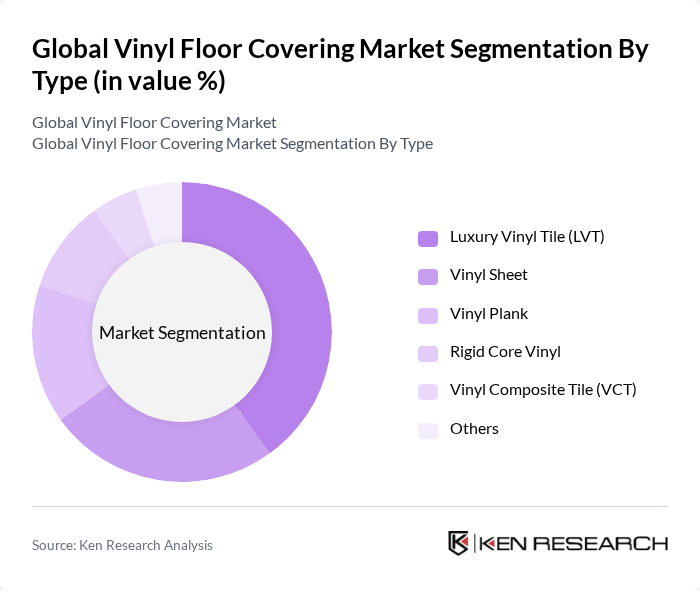

Global Vinyl Floor Covering Market Segmentation

By Type:The market is segmented into various types, including Luxury Vinyl Tile (LVT), Vinyl Sheet, Vinyl Plank, Rigid Core Vinyl, Vinyl Composite Tile (VCT), and Others. Among these, Luxury Vinyl Tile (LVT) has emerged as the dominant segment due to its versatility, aesthetic appeal, and ease of installation. Consumers increasingly prefer LVT for both residential and commercial applications, driven by its ability to mimic natural materials while offering superior durability and water resistance. The market is also witnessing increased demand for rigid core vinyl products, which offer enhanced stability and waterproof features, aligning with the latest technological advancements in the industry .

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Healthcare, Retail, Education, Hospitality, Offices, Automotive, and Government & Utilities. The Residential segment leads the market, driven by increasing home renovation projects and consumer preference for stylish yet affordable flooring options. The growing trend of DIY home improvement projects, along with rising investments in residential construction, has also bolstered demand in this segment, making it a key driver of market growth .

Global Vinyl Floor Covering Market Competitive Landscape

The Global Vinyl Floor Covering Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mohawk Industries, Inc., Shaw Industries Group, Inc., Armstrong Flooring, Inc., Tarkett S.A., Gerflor Group, Forbo International SA, Mannington Mills, Inc., Beaulieu International Group, Interface, Inc., LG Hausys, Ltd., IVC Group, Polyflor Ltd., Daltile Corporation, Roppe Holding Company, Novalis Innovative Flooring, Karndean Designflooring, Milliken & Company, Congoleum Corporation, Responsive Industries Ltd., CFL Flooring contribute to innovation, geographic expansion, and service delivery in this space.

Global Vinyl Floor Covering Market Industry Analysis

Growth Drivers

- Increasing Demand for Durable Flooring Solutions:The global demand for durable flooring solutions is projected to reach 1.7 billion square meters in future, driven by the need for long-lasting materials in residential and commercial spaces. The construction sector's growth, particularly in urban areas, is a significant contributor, with investments in infrastructure expected to exceed $1.2 trillion globally. This trend highlights the increasing preference for vinyl flooring due to its resilience and low maintenance requirements, making it a favored choice among builders and homeowners alike.

- Rising Popularity of Eco-Friendly Products:The eco-friendly flooring segment is anticipated to grow significantly, with the market for sustainable materials projected to reach $350 million in future. This growth is fueled by consumer awareness regarding environmental issues and the demand for products that minimize ecological impact. Vinyl flooring manufacturers are increasingly adopting sustainable practices, such as using recycled materials and reducing harmful emissions, aligning with the global shift towards greener building solutions and meeting regulatory standards.

- Growth in the Construction and Renovation Sector:The construction and renovation sector is expected to see a 6% increase in activity, with global spending projected to reach $11 trillion in future. This surge is driven by urbanization and the need for modernized infrastructure. Vinyl flooring, known for its versatility and cost-effectiveness, is becoming a preferred choice in both new constructions and renovation projects, as it offers a wide range of designs and finishes that cater to diverse consumer preferences.

Market Challenges

- Fluctuating Raw Material Prices:The vinyl flooring industry faces challenges due to fluctuating prices of raw materials, particularly PVC and additives, which can vary significantly based on global oil prices. In future, PVC prices surged by 12%, impacting production costs and profit margins for manufacturers. This volatility can lead to increased prices for consumers, potentially dampening demand and affecting overall market growth in the coming years.

- Intense Competition from Alternative Flooring Options:The vinyl flooring market is experiencing intense competition from alternative flooring solutions such as laminate, hardwood, and ceramic tiles. In future, the market share of laminate flooring increased by 8%, posing a significant challenge to vinyl products. This competition is driven by consumer preferences for aesthetics and perceived value, necessitating vinyl manufacturers to innovate and differentiate their offerings to maintain market share.

Global Vinyl Floor Covering Market Future Outlook

The future of the vinyl flooring market appears promising, with a strong emphasis on sustainability and technological integration. As consumers increasingly prioritize eco-friendly products, manufacturers are likely to invest in sustainable practices and materials. Additionally, the integration of smart technology into flooring solutions is expected to enhance functionality and appeal. These trends will likely drive innovation and create new market segments, positioning vinyl flooring as a leading choice in the evolving construction landscape.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia-Pacific and Africa, present significant growth opportunities for vinyl flooring. With urbanization rates projected to exceed 55% in future in these regions, the demand for affordable and durable flooring solutions is expected to rise, creating a lucrative market for manufacturers looking to expand their footprint.

- Innovations in Product Design and Functionality:Innovations in product design, such as enhanced durability and aesthetic appeal, are key opportunities for growth. The introduction of waterproof and scratch-resistant vinyl products is expected to attract a broader consumer base, particularly in high-traffic areas. This focus on functionality and design will likely drive sales and enhance market competitiveness.