Global Ceramic Tile Market Overview

- The Global Ceramic Tile Market is valued at USD 194 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing preference for aesthetic and durable flooring solutions. The market has seen a surge in demand for ceramic tiles in residential and commercial sectors, particularly in developing regions where construction activities are on the rise. Recent trends highlight the adoption of digitally printed tiles, sustainable materials, and innovative surface finishes, enabling greater customization and design flexibility for both new construction and renovation projects .

- Key players in this market include countries like China, Italy, and Spain, which dominate due to their advanced manufacturing capabilities and established distribution networks. China, in particular, is a leading producer and exporter of ceramic tiles, benefiting from its vast resources and cost-effective production methods. Italy and Spain are renowned for their high-quality designs and craftsmanship, making them preferred choices in premium segments. The Asia Pacific region, led by China, continues to drive global production and export volumes, while European manufacturers focus on premium and sustainable offerings .

- In 2023, the European Union implemented Commission Regulation (EU) 2023/1545, issued by the European Commission, which sets binding requirements for energy efficiency and waste management in ceramic tile manufacturing. This regulation mandates manufacturers to reduce energy consumption, implement advanced waste recycling systems, and increase the use of recycled raw materials in production. The initiative aims to enhance sustainability in the construction industry and reduce the sector’s carbon footprint .

Global Ceramic Tile Market Segmentation

By Type:The ceramic tile market can be segmented into various types, including Glazed Ceramic Tiles, Porcelain Tiles, Terracotta Tiles, Mosaic Tiles, Vitrified Tiles, Stoneware Tiles, Roof Tiles, Ceiling Tiles, Backsplash Tiles, Countertop Tiles, and Others. Each type serves different aesthetic and functional purposes, catering to diverse consumer preferences and applications. Glazed and porcelain tiles are most widely used due to their durability, low maintenance, and broad design options. Vitrified and mosaic tiles are increasingly popular in both residential and commercial spaces for their enhanced performance and decorative appeal .

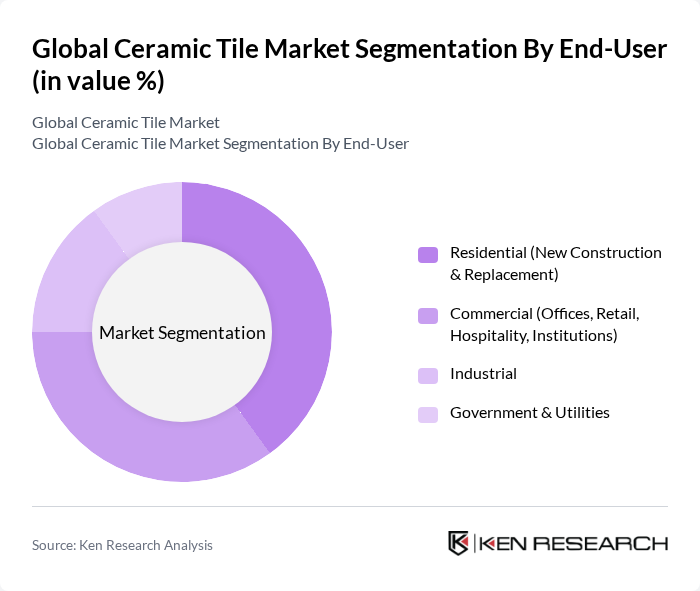

By End-User:The market can also be segmented based on end-users, which include Residential (New Construction & Replacement), Commercial (Offices, Retail, Hospitality, Institutions), Industrial, and Government & Utilities. Each segment has unique requirements and preferences, influencing the types of ceramic tiles used. Residential demand is driven by home renovation and new housing projects, while commercial and institutional segments prioritize durability, hygiene, and design versatility .

Global Ceramic Tile Market Competitive Landscape

The Global Ceramic Tile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mohawk Industries, Inc., RAK Ceramics PJSC, Grupo Lamosa, S.A.B. de C.V., Porcelanosa Grupo, Daltile (a division of Mohawk Industries), Marazzi Group S.r.l., Crossville, Inc., Ceramiche Atlas Concorde S.p.A., Siam Cement Group (SCG Ceramics), Kajaria Ceramics Ltd., Johnson Tiles (H&R Johnson India), VitrA (Eczac?ba?? Group), Interceramic, Inc., Florida Tile, Inc., Emser Tile LLC contribute to innovation, geographic expansion, and service delivery in this space.

Global Ceramic Tile Market Industry Analysis

Growth Drivers

- Increasing Demand for Aesthetic Flooring Solutions:The global ceramic tile market is experiencing a surge in demand for aesthetic flooring solutions, driven by a projected increase in residential construction, which is expected to reach 1.6 million new homes in future. This trend is supported by a growing consumer preference for visually appealing interiors, with 75% of homeowners prioritizing aesthetics in their flooring choices. The rise in disposable income, estimated to grow by 4.2% in future, further fuels this demand.

- Growth in the Construction Industry:The construction industry is anticipated to grow significantly, with global spending projected to reach $15 trillion in future. This growth is primarily driven by urbanization, particularly in developing regions, where urban populations are expected to increase by 1.3 billion in future. Consequently, the demand for ceramic tiles in both residential and commercial projects is expected to rise, as they are favored for their durability and aesthetic appeal.

- Rising Consumer Preference for Eco-Friendly Materials:There is a notable shift towards eco-friendly materials in the construction sector, with 65% of consumers indicating a preference for sustainable products. The global market for green building materials is projected to reach $600 billion in future, with ceramic tiles being a key component due to their recyclability and low environmental impact. This trend is further supported by government initiatives promoting sustainable construction practices, enhancing the appeal of eco-friendly ceramic tiles.

Market Challenges

- Fluctuating Raw Material Prices:The ceramic tile industry faces significant challenges due to fluctuating raw material prices, particularly for clay and natural minerals, which have seen price increases of up to 18% in the past period. This volatility can lead to unpredictable production costs, impacting profit margins for manufacturers. Additionally, the reliance on global supply chains makes the industry vulnerable to geopolitical tensions and trade disputes, further exacerbating these challenges.

- Intense Competition Among Manufacturers:The ceramic tile market is characterized by intense competition, with over 1,200 manufacturers globally. This saturation leads to price wars, driving down profit margins. In future, it is estimated that the top five manufacturers will account for only 30% of the market share, indicating a fragmented landscape. This competitive pressure compels companies to innovate continuously, which can strain resources and impact overall market stability.

Global Ceramic Tile Market Future Outlook

The future of the ceramic tile market appears promising, driven by technological advancements and evolving consumer preferences. The integration of smart technology in tiles, such as temperature regulation and energy efficiency, is expected to gain traction. Additionally, the increasing focus on sustainable production practices will likely shape the industry, as manufacturers adopt eco-friendly materials and processes. As urbanization continues, the demand for innovative and aesthetically pleasing ceramic tiles will remain strong, fostering growth opportunities in emerging markets.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for ceramic tile manufacturers. With urbanization rates projected to exceed 55% in these regions in future, the demand for construction materials, including ceramic tiles, is expected to rise sharply. This expansion can lead to increased sales and market penetration for companies willing to invest in these developing economies.

- Development of Smart Tiles:The development of smart tiles, which incorporate technology for enhanced functionality, represents a lucrative opportunity. As the Internet of Things (IoT) continues to grow, the demand for smart home solutions is expected to increase, with the smart home market projected to reach $150 billion in future. Manufacturers that innovate in this space can capture a significant share of the market, appealing to tech-savvy consumers.