Region:Global

Author(s):Shubham

Product Code:KRAD5469

Pages:87

Published On:December 2025

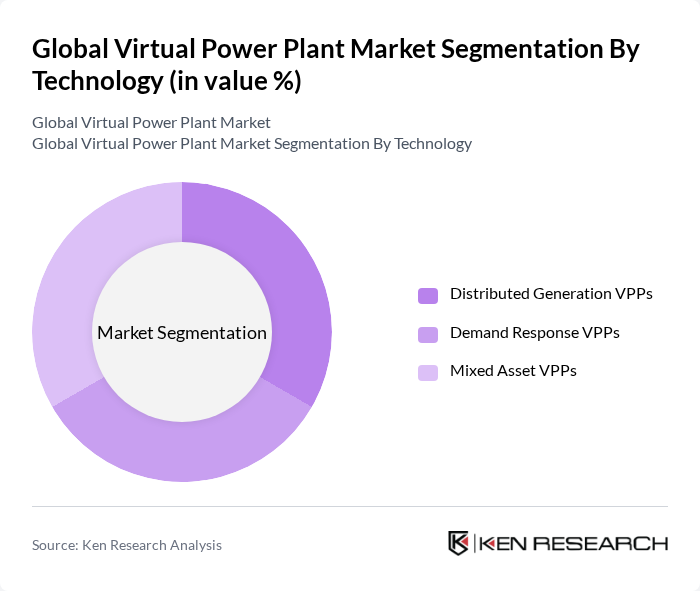

By Technology:The technology segment of the market includes Distributed Generation, Demand Response, and Mixed Asset VPPs. Distributed Generation VPPs, aggregating resources such as solar PV, small wind, CHP, and battery storage, are gaining traction due to their ability to utilize local energy resources effectively and support congestion management and voltage control at the distribution level. Demand Response VPPs are increasingly popular as they help manage energy consumption during peak periods and provide flexible capacity and frequency regulation services by curtailing or shifting loads in residential, commercial, and industrial sites. Mixed Asset VPPs combine various resources, including generation, storage, and controllable loads, on a single platform to optimize performance across multiple markets, maximize revenue stacking, and improve overall system resilience.

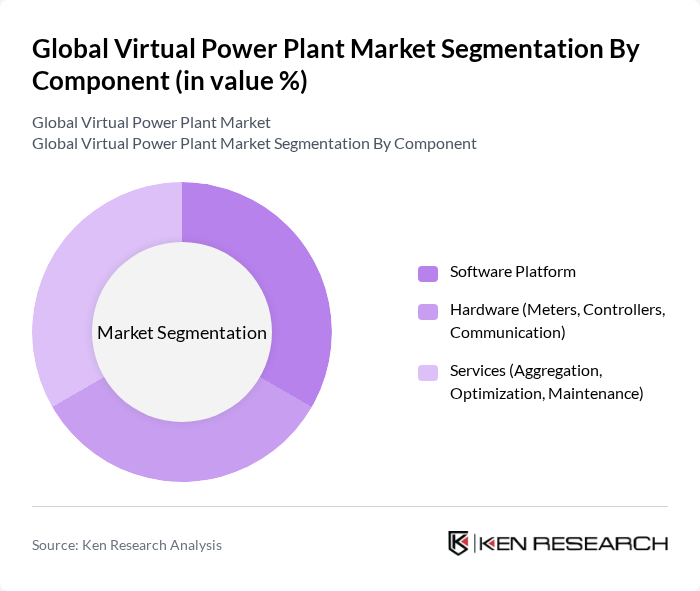

By Component:The component segment encompasses Software Platforms, Hardware, and Services. Software Platforms are crucial for managing and optimizing energy resources, providing real-time monitoring, forecasting, dispatch optimization, and market bidding functionalities that underpin most commercial VPP offerings. Hardware includes essential devices like meters, controllers, communication gateways, inverters, and battery management systems that enable secure connectivity and control of distributed energy resources. Services such as aggregation, optimization, portfolio management, and ongoing maintenance are vital for ensuring the effective operation of virtual power plants and for monetizing flexibility in energy, capacity, and ancillary service markets.

The Global Virtual Power Plant Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, Enel X S.r.l. (Enel Group), NextEra Energy, Inc., ENGIE SA, Tesla, Inc., General Electric Company, ABB Ltd., E.ON SE, RWE AG, Vattenfall AB, Ørsted A/S, AutoGrid Systems, Inc. (Schneider Electric), Next Kraftwerke GmbH, Centrica plc (Centrica Business Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the virtual power plant market appears promising, driven by increasing investments in renewable energy and technological advancements. As governments worldwide implement stricter emission reduction targets, the demand for decentralized energy solutions will likely rise. Additionally, the integration of smart grid technologies will facilitate more efficient energy distribution, enhancing the operational capabilities of virtual power plants. This evolving landscape presents significant opportunities for innovation and collaboration among stakeholders in the energy sector.

| Segment | Sub-Segments |

|---|---|

| By Technology (Distributed Generation, Demand Response, Mixed Asset) | Distributed Generation VPPs Demand Response VPPs Mixed Asset VPPs |

| By Component (Software Platform, Hardware, Services) | Software Platform Hardware (Meters, Controllers, Communication) Services (Aggregation, Optimization, Maintenance) |

| By End-User (Residential, Commercial, Industrial, Utility) | Residential Commercial Industrial Utility / Grid Operator |

| By Power Source (Solar PV, Wind, Battery Energy Storage, CHP & Other DERs) | Solar Photovoltaic (PV) Wind Battery Energy Storage Systems (BESS) Combined Heat and Power (CHP) & Other DERs |

| By Application (Peak Shaving, Frequency Regulation, Energy Trading, Backup & Resilience) | Peak Shaving & Load Management Frequency Regulation & Ancillary Services Energy Trading & Arbitrage Backup Power & Resilience |

| By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies Implementing VPPs | 100 | Energy Managers, Operations Directors |

| Renewable Energy Project Developers | 80 | Project Managers, Business Development Leads |

| Energy Storage Solution Providers | 70 | Technical Directors, Product Managers |

| Regulatory Bodies and Policy Makers | 50 | Policy Analysts, Regulatory Affairs Managers |

| Research Institutions Focused on Energy | 60 | Research Scientists, Energy Economists |

The Global Virtual Power Plant Market is valued at approximately USD 6.3 billion, reflecting a significant growth trajectory driven by the integration of renewable energy sources and advancements in energy management technologies.