Region:Asia

Author(s):Rebecca

Product Code:KRAD1538

Pages:86

Published On:November 2025

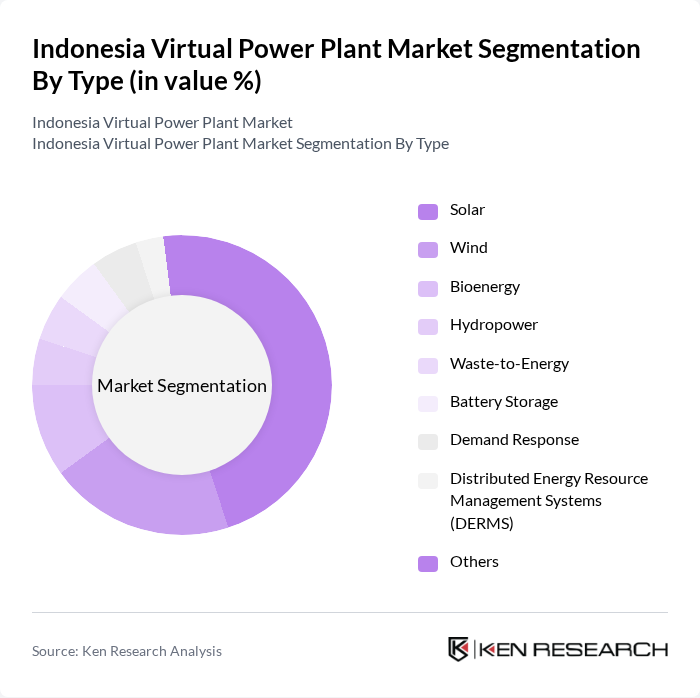

By Type:The market is segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Battery Storage, Demand Response, Distributed Energy Resource Management Systems, and Others. Among these, solar energy is the most dominant segment due to its abundant availability and decreasing costs of solar technology. The increasing adoption of solar panels in residential and commercial sectors is driving this segment's growth, as consumers seek sustainable energy solutions and cost savings on electricity bills. The integration of demand response and battery storage is also accelerating, driven by the need for flexible grid management and enhanced energy reliability.

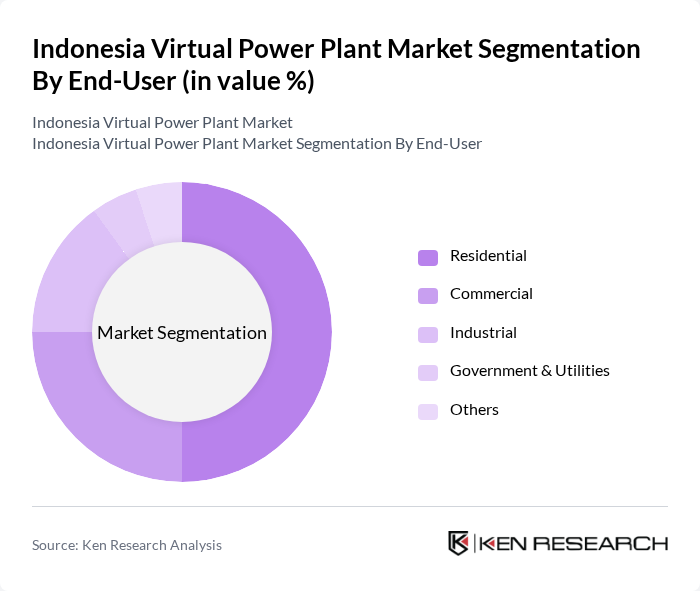

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, Government & Utilities, and Others. The residential segment is currently leading the market, driven by the increasing adoption of solar energy systems among homeowners. This trend is fueled by rising electricity costs and a growing awareness of environmental sustainability, prompting consumers to invest in renewable energy solutions for their homes. Utilities and industrial users are also expanding their participation, leveraging virtual power plant platforms for grid stability and operational cost savings.

The Indonesia Virtual Power Plant Market is characterized by a dynamic mix of regional and international players. Leading participants such as PLN (Perusahaan Listrik Negara), Adaro Energy Indonesia Tbk, PT Pertamina (Persero), Vena Energy, TotalEnergies (Total Eren), Enel Green Power, JinkoSolar Holding Co., Ltd., Siemens Gamesa Renewable Energy, GE Vernova (formerly GE Renewable Energy), Trina Solar Co., Ltd., Canadian Solar Inc., EDP Renewables, ACWA Power, Sembcorp Industries, PT Indonesia Power, PT Medco Power Indonesia, PT Cirebon Electric Power contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia virtual power plant market appears promising, driven by increasing investments in renewable energy and supportive government policies. As the country aims for a23 percentrenewable energy share, the integration of smart grid technologies and energy storage solutions will become critical. Furthermore, the growing emphasis on sustainability and carbon neutrality will likely accelerate the adoption of VPPs, positioning them as a vital component of Indonesia's energy transition strategy.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Battery Storage, Demand Response, Distributed Energy Resource Management Systems) | Solar Wind Bioenergy Hydropower Waste-to-Energy Battery Storage Demand Response Distributed Energy Resource Management Systems (DERMS) Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Commercial Industrial Government & Utilities Others |

| By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali) | Java Sumatra Kalimantan Sulawesi Bali |

| By Technology (Photovoltaic, CSP, Onshore/Offshore Wind, Biomass Gasification, Battery Energy Storage, Smart Meters & IoT Platforms) | Photovoltaic CSP Onshore Wind Offshore Wind Biomass Gasification Battery Energy Storage Smart Meters & IoT Platforms Others |

| By Application (Grid-Connected, Off-Grid, Rooftop Installations, Utility-Scale Projects, Virtual Energy Trading) | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Virtual Energy Trading Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes) | Domestic FDI PPP Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, RECs, Net Metering, Feed-in Tariffs) | Subsidies Tax Exemptions RECs Net Metering Feed-in Tariffs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Energy Policy Makers | 50 | Regulatory Officials, Energy Policy Analysts |

| Virtual Power Plant Operators | 40 | Project Managers, Operations Directors |

| Technology Providers in Energy Sector | 40 | Product Managers, Technical Leads |

| Energy Aggregators and Traders | 40 | Market Analysts, Trading Managers |

| Renewable Energy Consultants | 40 | Consultants, Industry Experts |

The Indonesia Virtual Power Plant market is valued at approximately USD 1.9 billion, reflecting significant growth driven by the demand for renewable energy, government initiatives, and advancements in smart grid technologies.