Region:Global

Author(s):Shubham

Product Code:KRAC0574

Pages:94

Published On:August 2025

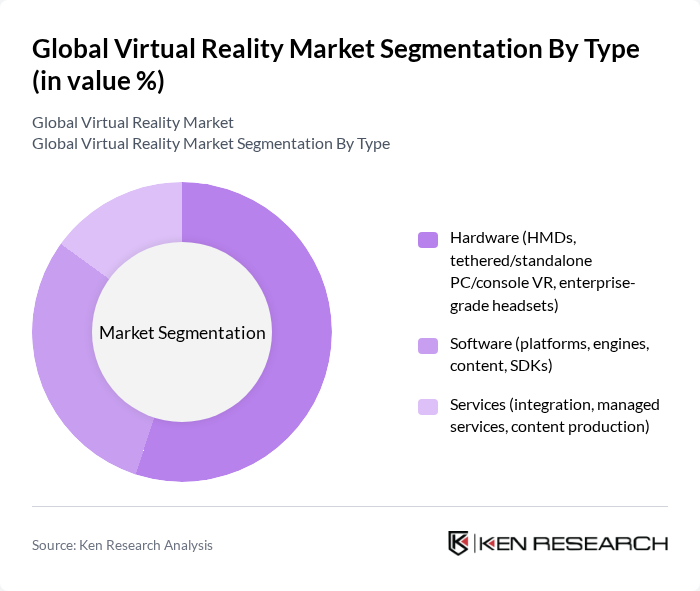

By Type:The market is segmented into Hardware, Software, and Services. Hardware includes head-mounted displays (HMDs), tethered/standalone PC/console VR, and enterprise-grade headsets. Software encompasses platforms, engines, content, and SDKs, while Services cover integration, managed services, and content production. The hardware segment is currently leading the market due to demand for standalone headsets and console/PC-tethered devices, supported by falling component costs and broader content ecosystems.

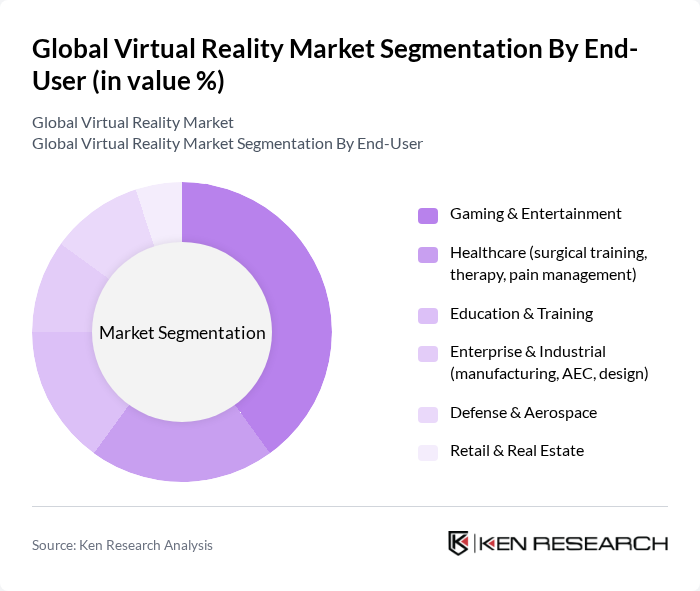

By End-User:The end-user segmentation includes Gaming & Entertainment, Healthcare, Education & Training, Enterprise & Industrial, Defense & Aerospace, and Retail & Real Estate. The Gaming & Entertainment sector is the most significant contributor to the market, supported by strong consumer headset sales and premium content libraries; enterprise adoption continues in simulation, design, training, and clinical applications.

The Global Virtual Reality Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc. (Oculus), Sony Interactive Entertainment (PlayStation VR), HTC Corporation (VIVE), Valve Corporation (SteamVR, Index), Samsung Electronics Co., Ltd., Microsoft Corporation (Mixed Reality, HoloLens ecosystem), Pico Interactive (ByteDance), HP Inc. (Reverb series), Varjo Technologies Oy, Pimax Innovation, Inc., Qualcomm Technologies, Inc. (Snapdragon XR platforms), NVIDIA Corporation (RTX, CloudXR), Unity Technologies, Epic Games, Inc. (Unreal Engine), EON Reality, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the VR market appears promising, driven by technological advancements and increasing applications across various sectors. As companies continue to innovate, the integration of VR with AI and machine learning is expected to enhance user experiences significantly. Furthermore, the expansion of VR into sectors like education and healthcare will likely create new revenue streams. With ongoing investments and a growing user base, the market is poised for substantial growth, fostering a vibrant ecosystem for both developers and consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware (HMDs, tethered/standalone PC/console VR, enterprise-grade headsets) Software (platforms, engines, content, SDKs) Services (integration, managed services, content production) |

| By End-User | Gaming & Entertainment Healthcare (surgical training, therapy, pain management) Education & Training Enterprise & Industrial (manufacturing, AEC, design) Defense & Aerospace Retail & Real Estate |

| By Application | Training & Simulation Gaming Virtual Collaboration & Remote Assistance Virtual Prototyping & Design Visualization Marketing & Immersive Experiences |

| By Distribution Channel | Online Retail & Brand Stores Offline Retail & Specialist Stores Direct Enterprise Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range (Headsets) | Entry/Budget (<$300) Mid-Range ($300–$700) Premium (>$700) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gaming Industry Adoption | 150 | Game Developers, Marketing Managers |

| Healthcare Training Programs | 100 | Medical Educators, Training Coordinators |

| Corporate Training Solutions | 80 | HR Managers, Learning & Development Specialists |

| VR Hardware Manufacturing | 70 | Product Managers, Supply Chain Analysts |

| Consumer VR Experiences | 90 | End-users, Tech Enthusiasts |

The Global Virtual Reality Market is valued at approximately USD 44.0 billion, driven by increased headset adoption, expanding enterprise applications, and a robust pipeline of gaming content. This valuation is based on a comprehensive five-year historical analysis.