Region:Global

Author(s):Dev

Product Code:KRAA8222

Pages:90

Published On:November 2025

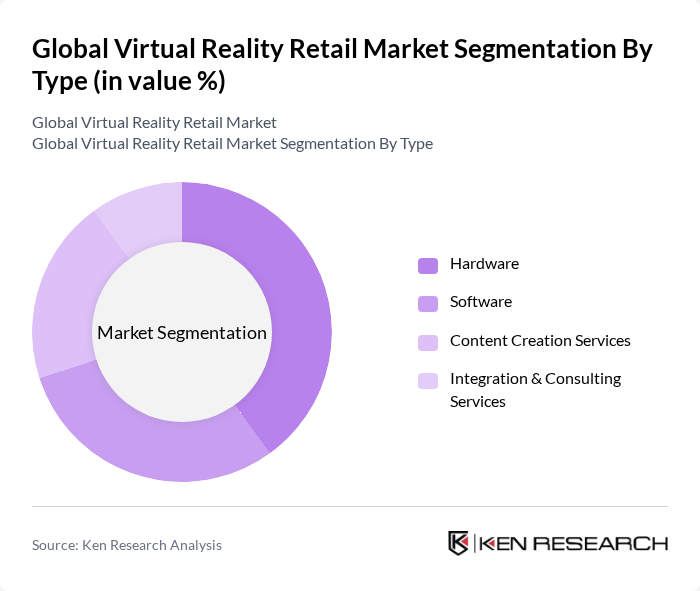

By Type:The market is segmented into Hardware, Software, Content Creation Services, and Integration & Consulting Services. Each of these subsegments plays a vital role in the overall market dynamics, with hardware and software being the most significant contributors. Hardware remains the largest segment, driven by demand for VR headsets and accessories, while software and content creation are increasingly important for delivering engaging and interactive retail experiences .

The Hardware subsegment is currently dominating the market due to the increasing demand for VR headsets and devices that enhance the shopping experience. As retailers invest in high-quality VR hardware to create immersive environments, consumer interest in VR shopping continues to grow. The trend towards experiential retailing, where customers seek unique and engaging shopping experiences, has further solidified the importance of hardware in this market. Software solutions are also critical, but hardware remains the primary driver of market growth .

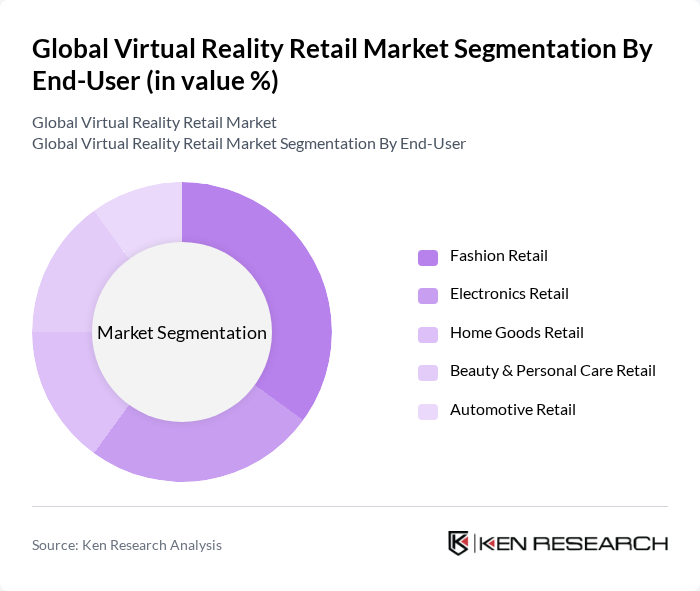

By End-User:The market is segmented into Fashion Retail, Electronics Retail, Home Goods Retail, Beauty & Personal Care Retail, and Automotive Retail. Each end-user segment has unique requirements and applications for VR technology. Fashion and electronics retail are the most prominent, leveraging VR for virtual try-ons, product visualization, and interactive showrooms .

The Fashion Retail segment is leading the market, driven by the need for innovative ways to showcase products and enhance customer engagement. Retailers are increasingly using VR to allow customers to try on clothes virtually, which not only improves the shopping experience but also reduces return rates. The Electronics Retail segment follows closely, as consumers seek to experience products in a virtual environment before making a purchase. The immersive nature of VR is particularly appealing in fashion, where visual appeal is paramount .

The Global Virtual Reality Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc. (Oculus), HTC Corporation, Sony Interactive Entertainment, Samsung Electronics, Microsoft Corporation, Unity Technologies, NVIDIA Corporation, Google LLC, PTC Inc., Shopify Inc., Alibaba Group, Amazon.com, Inc., Snap Inc., Roblox Corporation, VIVEPORT (HTC), Marxent Labs LLC, WorldViz, Wevr, Magic Leap, Firsthand Technology Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the virtual reality retail market appears promising, driven by technological advancements and changing consumer preferences. As VR technology becomes more accessible and affordable, retailers are likely to invest in immersive experiences that enhance customer engagement. Additionally, the integration of AI and machine learning into VR platforms will enable personalized shopping experiences, further attracting consumers. Retailers that embrace these innovations will likely gain a competitive edge in the evolving retail landscape, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software Content Creation Services Integration & Consulting Services |

| By End-User | Fashion Retail Electronics Retail Home Goods Retail Beauty & Personal Care Retail Automotive Retail |

| By Customer Experience | Virtual Showrooms Interactive Product Demos Virtual Try-Ons Virtual Store Navigation Social Shopping Experiences |

| By Distribution Channel | Online Retail Physical Stores Mobile Applications Omnichannel Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Standalone VR Tethered VR Mobile VR Web-Based VR |

| By Payment Method | Credit/Debit Cards Digital Wallets Buy Now Pay Later (BNPL) Cryptocurrency |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer VR Shopping Experience | 120 | Frequent Online Shoppers, VR Users |

| Retail Executive Insights | 60 | Heads of Retail Operations, Technology Leads, Marketing Managers |

| VR Technology Providers | 50 | Product Managers, Business Development Executives |

| Market Analysts and Researchers | 40 | Industry Analysts, Academic Researchers |

| Consumer Behavior Specialists | 40 | Behavioral Scientists, UX Researchers |

The Global Virtual Reality Retail Market is valued at approximately USD 4 billion, reflecting significant growth driven by the increasing adoption of VR technologies in retail, enhancing customer engagement and immersive shopping experiences.