Middle East Immersive Technology Market Overview

- The Middle East Immersive Technology Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in technology, increasing demand for immersive experiences in various sectors, and the rising adoption of augmented and virtual reality solutions across industries such as education, healthcare, and entertainment.

- Key players in this market include the United Arab Emirates, Saudi Arabia, and Qatar. These countries dominate the market due to their significant investments in technology infrastructure, government support for innovation, and a growing consumer base that is increasingly engaged with immersive technologies.

- In 2023, the UAE government launched a comprehensive strategy to promote the use of immersive technologies in education and training. This initiative includes funding of USD 200 million to develop AR and VR applications aimed at enhancing learning experiences and improving workforce skills in various sectors.

Middle East Immersive Technology Market Segmentation

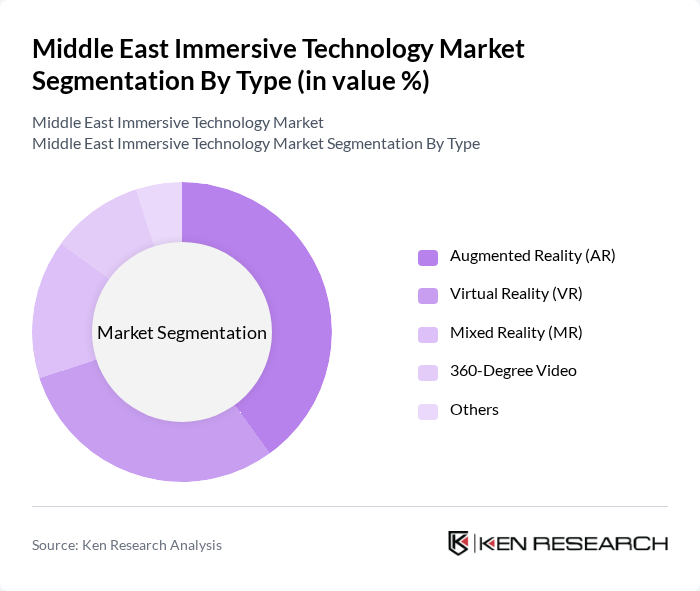

By Type:The immersive technology market is segmented into various types, including Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), 360-Degree Video, and Others. Among these, Augmented Reality (AR) is currently the leading sub-segment, driven by its applications in retail, education, and marketing. The increasing integration of AR in mobile applications and the growing demand for interactive experiences are key factors contributing to its dominance.

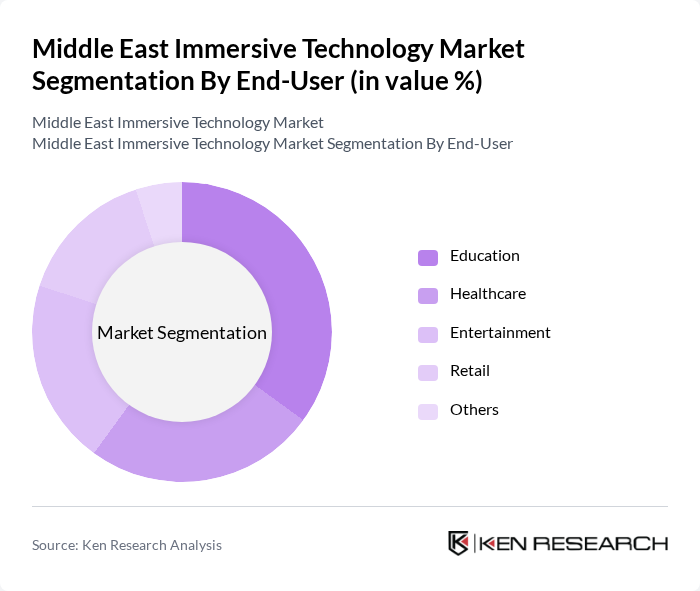

By End-User:The market is also segmented by end-user, which includes Education, Healthcare, Entertainment, Retail, and Others. The Education sector is the most significant contributor, as institutions increasingly adopt immersive technologies for enhanced learning experiences. The demand for interactive and engaging educational tools is driving growth in this segment, making it a leader in the immersive technology landscape.

Middle East Immersive Technology Market Competitive Landscape

The Middle East Immersive Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as HTC Corporation, Oculus (Meta Platforms, Inc.), Magic Leap, Inc., Sony Interactive Entertainment, Samsung Electronics, Microsoft Corporation, Unity Technologies, PTC Inc., VIVEPORT, Varjo Technologies, Niantic, Inc., Autodesk, Inc., Epic Games, Inc., Snap Inc., Google LLC contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Immersive Technology Market Industry Analysis

Growth Drivers

- Increasing Demand for AR/VR Applications:The Middle East has witnessed a surge in demand for augmented reality (AR) and virtual reality (VR) applications, driven by a projected increase in smartphone penetration, expected to reach 90% in the future. The gaming industry alone is anticipated to generate revenues of approximately $1.8 billion in the future, reflecting a growing consumer interest in immersive experiences. This trend is further supported by the region's young population, with over 50% under the age of 30, eager for innovative digital solutions.

- Government Initiatives Promoting Digital Transformation:Governments across the Middle East are actively investing in digital transformation initiatives, with the UAE allocating $2 billion towards technology development in the future. These initiatives aim to enhance the region's technological infrastructure, fostering an environment conducive to the growth of immersive technologies. For instance, Saudi Arabia's Vision 2030 plan emphasizes the importance of digital innovation, which is expected to drive significant advancements in AR and VR applications across various sectors.

- Rising Investment in Entertainment and Gaming Sectors:The entertainment and gaming sectors in the Middle East are experiencing unprecedented growth, with investments projected to exceed $4 billion in the future. This influx of capital is fueling the development of immersive experiences, including theme parks and gaming arenas that leverage AR and VR technologies. The region's increasing focus on diversifying its economy away from oil dependency is further propelling investments in these sectors, creating a robust market for immersive technology solutions.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to the adoption of immersive technologies in the Middle East is the high initial investment required for hardware and software development. For instance, the cost of advanced VR headsets can exceed $1,200, which poses a challenge for small and medium enterprises (SMEs) looking to integrate these technologies. This financial hurdle can limit market entry and slow down the overall growth of the immersive technology sector in the region.

- Limited Awareness and Understanding of Technology:Despite the potential of immersive technologies, there remains a significant gap in awareness and understanding among businesses and consumers in the Middle East. A recent survey indicated that over 65% of businesses are unfamiliar with the applications of AR and VR, hindering their adoption. This lack of knowledge can lead to skepticism regarding the return on investment, further stalling the growth of the immersive technology market in the region.

Middle East Immersive Technology Market Future Outlook

The future of the Middle East immersive technology market appears promising, driven by ongoing advancements in technology and increasing consumer acceptance. As 5G networks expand, they will enhance the quality and accessibility of immersive experiences, making them more appealing to users. Additionally, the integration of artificial intelligence with immersive technologies is expected to create innovative applications across various sectors, including healthcare and education, further propelling market growth and adoption in the future.

Market Opportunities

- Growth in E-commerce and Virtual Shopping Experiences:The rise of e-commerce in the Middle East, projected to reach $30 billion in the future, presents significant opportunities for immersive technologies. Retailers can leverage AR and VR to create virtual shopping experiences, allowing consumers to visualize products in their environment, thereby enhancing customer engagement and satisfaction.

- Development of Immersive Tourism Experiences:The tourism sector in the Middle East is set to grow, with visitor numbers expected to reach 120 million in the future. This growth opens avenues for immersive tourism experiences, such as virtual tours and AR-enhanced attractions, which can enrich visitor experiences and drive higher engagement in the region's cultural and historical sites.